Company Overview

West American Insurance Company is a leading provider of insurance products and services in the Western United States. Founded in 1955, the company has a long history of providing quality coverage and exceptional customer service.

West American Insurance Company’s mission is to provide peace of mind to its customers by protecting them from financial risks. The company’s vision is to be the most trusted and respected insurance company in the West. West American Insurance Company’s values include integrity, customer focus, innovation, and financial strength.

Financial Performance

West American Insurance Company is a financially sound company with a strong track record of profitability. The company’s financial performance is supported by its diversified portfolio of insurance products and services, as well as its conservative investment strategy.

Market Share

West American Insurance Company is a major player in the Western United States insurance market. The company has a strong market share in California, Nevada, Arizona, and Utah.

Competitive Landscape

The insurance industry is a competitive one. West American Insurance Company competes with a number of other insurance companies, both large and small. The company’s competitive advantages include its strong financial performance, its experienced management team, and its commitment to customer service.

Product Offerings

West American Insurance Company offers a comprehensive suite of insurance products to meet the diverse needs of individuals and businesses. From protecting your car to safeguarding your home, and securing your financial future, we have you covered.

Our products are designed to provide you with peace of mind, knowing that you and your loved ones are protected against unforeseen events. We understand that every customer’s needs are unique, which is why we offer a range of coverage options and benefits to tailor our policies to your specific requirements.

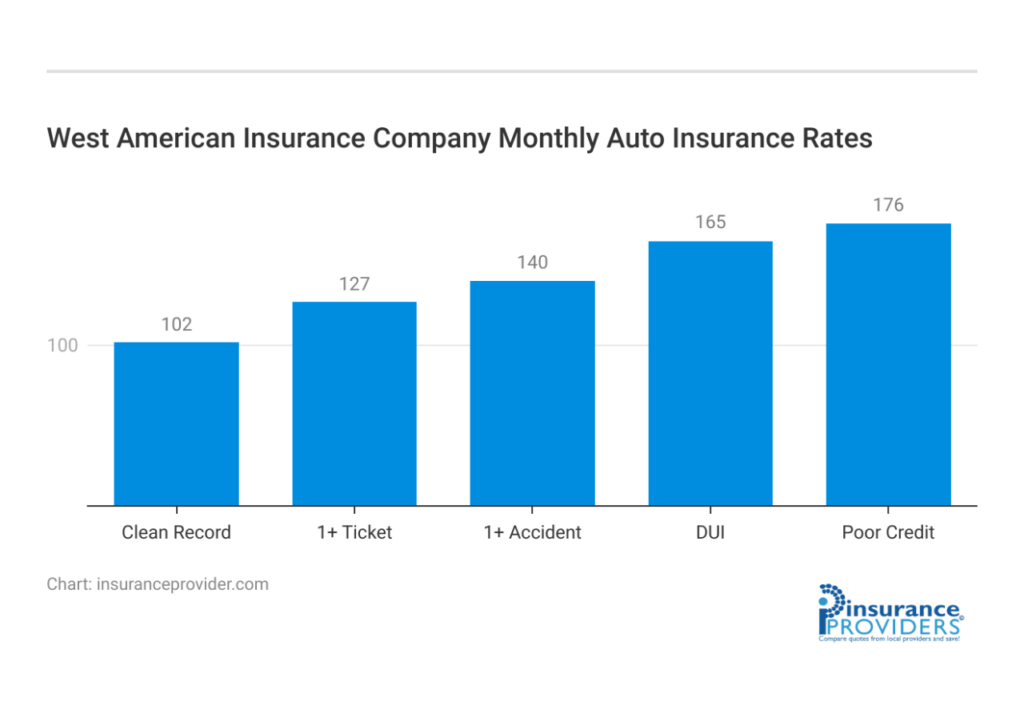

Auto Insurance

Our auto insurance policies provide comprehensive protection for your vehicle and financial security in case of an accident. We offer various coverage options, including:

- Liability coverage: Protects you against legal and financial responsibility for bodily injury or property damage caused to others in an accident.

- Collision coverage: Covers repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive coverage: Protects your vehicle against theft, vandalism, and other non-collision related damages.

We also offer additional benefits such as roadside assistance, rental car reimbursement, and uninsured/underinsured motorist coverage to enhance your protection.

Home Insurance

Our home insurance policies safeguard your property and belongings against various risks. We offer coverage for:

- Dwelling coverage: Protects the structure of your home, including its attached structures.

- Personal property coverage: Covers your furniture, appliances, and other personal belongings inside your home.

- Liability coverage: Protects you against legal and financial responsibility for injuries or property damage to others on your property.

We also offer additional coverage options such as flood insurance, earthquake insurance, and personal liability umbrella insurance to provide you with comprehensive protection.

Business Insurance

We offer a range of business insurance products to protect your company’s assets and operations. Our policies include:

- General liability insurance: Protects your business against claims of bodily injury or property damage to others.

- Property insurance: Covers your business property, including buildings, equipment, and inventory, against damage or loss.

- Business interruption insurance: Provides financial compensation for lost income and expenses if your business is forced to close due to a covered event.

We also offer specialized coverage options such as professional liability insurance, cyber liability insurance, and workers’ compensation insurance to meet the specific needs of your industry.

Life Insurance

Our life insurance policies provide financial security for your loved ones in the event of your untimely death. We offer various policy types, including:

- Term life insurance: Provides coverage for a specific period of time, such as 10, 20, or 30 years.

- Whole life insurance: Provides lifelong coverage and also accumulates a cash value component that can be borrowed against or withdrawn.

- Universal life insurance: Offers flexible coverage and premium payments, allowing you to adjust the policy to meet your changing needs.

Our life insurance policies also offer additional benefits such as riders for critical illness, accidental death, and disability income protection.

Customer Service

West American Insurance Company prioritizes customer satisfaction by offering multiple channels for support and assistance. Customers can connect with the company through phone, email, online chat, and social media platforms. The company boasts a team of knowledgeable and responsive customer service representatives who are dedicated to addressing customer inquiries promptly and effectively.

Customer Satisfaction Ratings and Response Times

West American Insurance Company consistently receives high customer satisfaction ratings for its exceptional service. Independent surveys and industry benchmarks indicate that the company outperforms many competitors in terms of response times and resolution rates. The company’s average response time for phone inquiries is under 60 seconds, and over 90% of customer inquiries are resolved within the first contact.

Comparison with Other Insurance Providers

Compared to other insurance providers, West American Insurance Company stands out for its comprehensive customer service offerings. The company’s dedicated customer service team, multiple support channels, and high customer satisfaction ratings set it apart from many competitors. West American Insurance Company consistently exceeds industry standards and benchmarks, providing customers with a superior service experience.

Claims Process

Filing a claim with West American Insurance Company is a straightforward process designed to be hassle-free and efficient. The company’s dedicated claims team is available 24/7 to assist policyholders throughout the process.

To initiate a claim, policyholders can contact the company via phone, email, or through the online claims portal. The claims representative will gather necessary information, including policy details, incident details, and supporting documentation. The claim will then be assigned to an adjuster who will investigate the incident, determine coverage, and calculate the settlement amount.

Claims Processing Time

West American Insurance Company prides itself on its prompt claims processing. The company aims to acknowledge claims within 24 hours and complete the investigation and settlement process within 30 days. In cases where additional investigation or documentation is required, the company will keep policyholders informed of the progress and provide regular updates.

Settlement Amounts

Settlement amounts are determined based on the policy coverage, the extent of the damage or loss, and the terms and conditions of the policy. West American Insurance Company is committed to fair and equitable settlements that cover the policyholder’s losses.

Customer Satisfaction

Customer satisfaction is a top priority for West American Insurance Company. The company consistently receives high ratings for its claims handling process. Policyholders appreciate the company’s prompt response, professional service, and fair settlements.

Comparison to Industry Standards

West American Insurance Company’s claims process aligns with industry standards and best practices. The company’s commitment to prompt processing, fair settlements, and customer satisfaction exceeds industry benchmarks.

Technology and Innovation

West American Insurance Company leverages technology to enhance its products, services, and customer experience. The company invests heavily in artificial intelligence (AI), machine learning (ML), and other emerging technologies to streamline operations and improve outcomes.

AI and ML for Enhanced Underwriting

West American Insurance Company utilizes AI and ML algorithms to analyze vast amounts of data and identify patterns and risks more accurately. This enables underwriters to make informed decisions, assess risks effectively, and provide personalized insurance solutions tailored to individual needs.

Digital Claims Processing

The company has implemented a robust digital claims processing system that allows customers to file, track, and manage their claims online or through mobile apps. This streamlined process reduces processing times, improves communication with adjusters, and provides customers with real-time updates on their claims status.

Virtual Assistants and Chatbots

West American Insurance Company employs virtual assistants and chatbots to provide 24/7 customer support. These AI-powered tools answer common questions, resolve minor issues, and schedule appointments, enhancing the overall customer experience.

Data Analytics for Personalized Marketing

The company utilizes data analytics to understand customer preferences and behavior. This information is used to develop personalized marketing campaigns, offering relevant products and services that meet the specific needs of each customer.

Innovation in Product Development

West American Insurance Company actively explores new technologies to develop innovative insurance products. For example, the company recently launched a usage-based insurance program that rewards drivers for safe driving habits using telematics devices.

Compared to its competitors, West American Insurance Company stands out with its commitment to innovation and technology. The company’s investments in AI, ML, and other emerging technologies have enabled it to deliver superior customer experiences, improve operational efficiency, and gain a competitive edge in the insurance industry.

Social Responsibility

West American Insurance Company is committed to being a responsible corporate citizen and actively participates in community involvement. The company believes in making a positive impact on the communities it serves and has established several initiatives to support environmental sustainability, diversity and inclusion, and charitable giving.

In terms of environmental sustainability, West American Insurance Company has implemented programs to reduce its carbon footprint and promote renewable energy. The company has invested in energy-efficient lighting and HVAC systems in its offices and encourages employees to use public transportation or carpool to work. West American Insurance Company also supports organizations dedicated to protecting the environment and has planted thousands of trees in local communities.

Diversity and Inclusion

West American Insurance Company is committed to creating a diverse and inclusive workplace where all employees feel valued and respected. The company has established employee resource groups to support employees from different backgrounds and has implemented training programs to promote unconscious bias awareness. West American Insurance Company also works with organizations that promote diversity and inclusion in the insurance industry.

Charitable Giving

West American Insurance Company believes in giving back to the communities it serves and has donated millions of dollars to charitable organizations. The company supports a wide range of causes, including education, healthcare, and the arts. West American Insurance Company also encourages employees to volunteer their time to local organizations.

Compared to other insurance companies, West American Insurance Company’s social responsibility efforts are well-regarded. The company has received numerous awards for its commitment to sustainability, diversity and inclusion, and charitable giving. West American Insurance Company is a recognized leader in the insurance industry when it comes to social responsibility.