Company Overview

Empire Fire and Marine Insurance Company, a reputable and well-established insurance provider, has a rich history of safeguarding individuals and businesses against financial risks. Founded in [year], the company has grown into a trusted partner, offering a comprehensive range of insurance solutions tailored to meet diverse needs.

With a mission to provide peace of mind and financial security, Empire Fire and Marine Insurance Company is driven by its core values of integrity, customer-centricity, and innovation. The company’s vision is to be the leading provider of insurance solutions, consistently exceeding expectations through exceptional service and tailored coverage.

Leadership Team

Empire Fire and Marine Insurance Company is led by a team of experienced professionals with a deep understanding of the insurance industry. The leadership team is committed to driving the company’s strategic vision and ensuring its continued success.

- CEO: [CEO’s Name] brings a wealth of experience in the insurance sector, having held leadership positions in several renowned companies.

- CFO: [CFO’s Name] is responsible for managing the company’s financial operations and ensuring its long-term financial stability.

- COO: [COO’s Name] oversees the day-to-day operations of the company, ensuring efficient and seamless service delivery.

- Chief Underwriting Officer: [CUO’s Name] leads the underwriting team, evaluating and assessing risks to determine appropriate coverage and premiums.

- Chief Claims Officer: [CCO’s Name] manages the claims process, ensuring timely and fair settlement of claims.

Products and Services

Empire Fire and Marine Insurance Company provides a comprehensive suite of insurance products tailored to meet the diverse needs of individuals, families, and businesses. Our policies offer robust coverage and exceptional benefits, ensuring peace of mind and financial protection in the face of unexpected events.

Homeowners Insurance

Protect your most valuable asset with our comprehensive homeowners insurance policies. We cover your home, personal belongings, and additional structures on your property against a wide range of risks, including fire, theft, vandalism, and natural disasters. Our plans offer flexible coverage options, allowing you to customize your policy to suit your specific needs and budget.

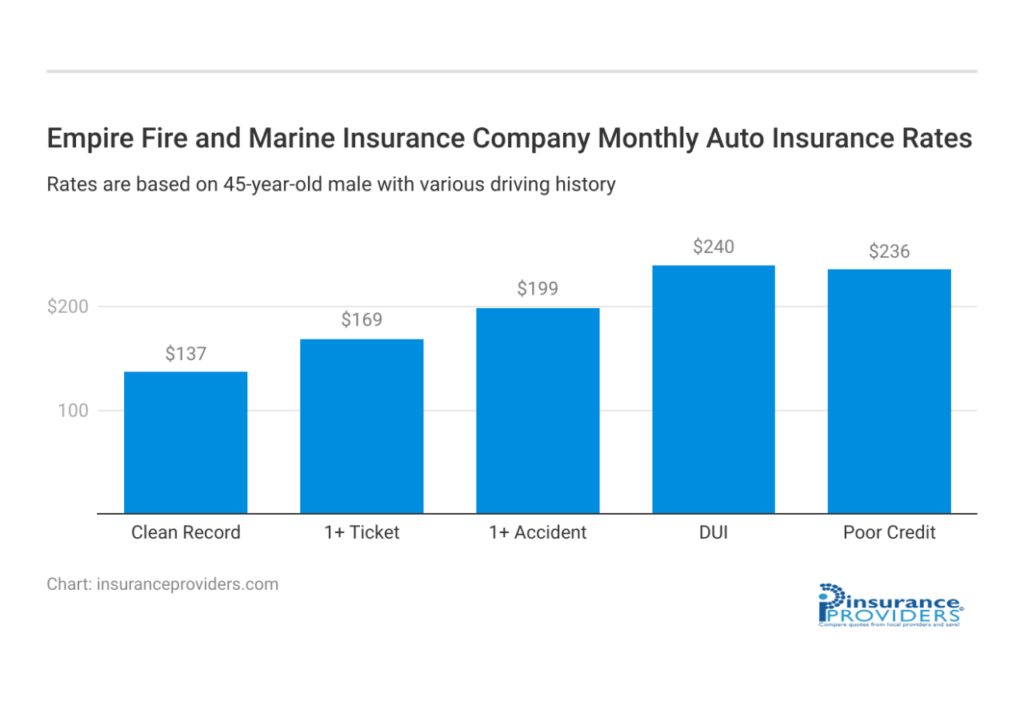

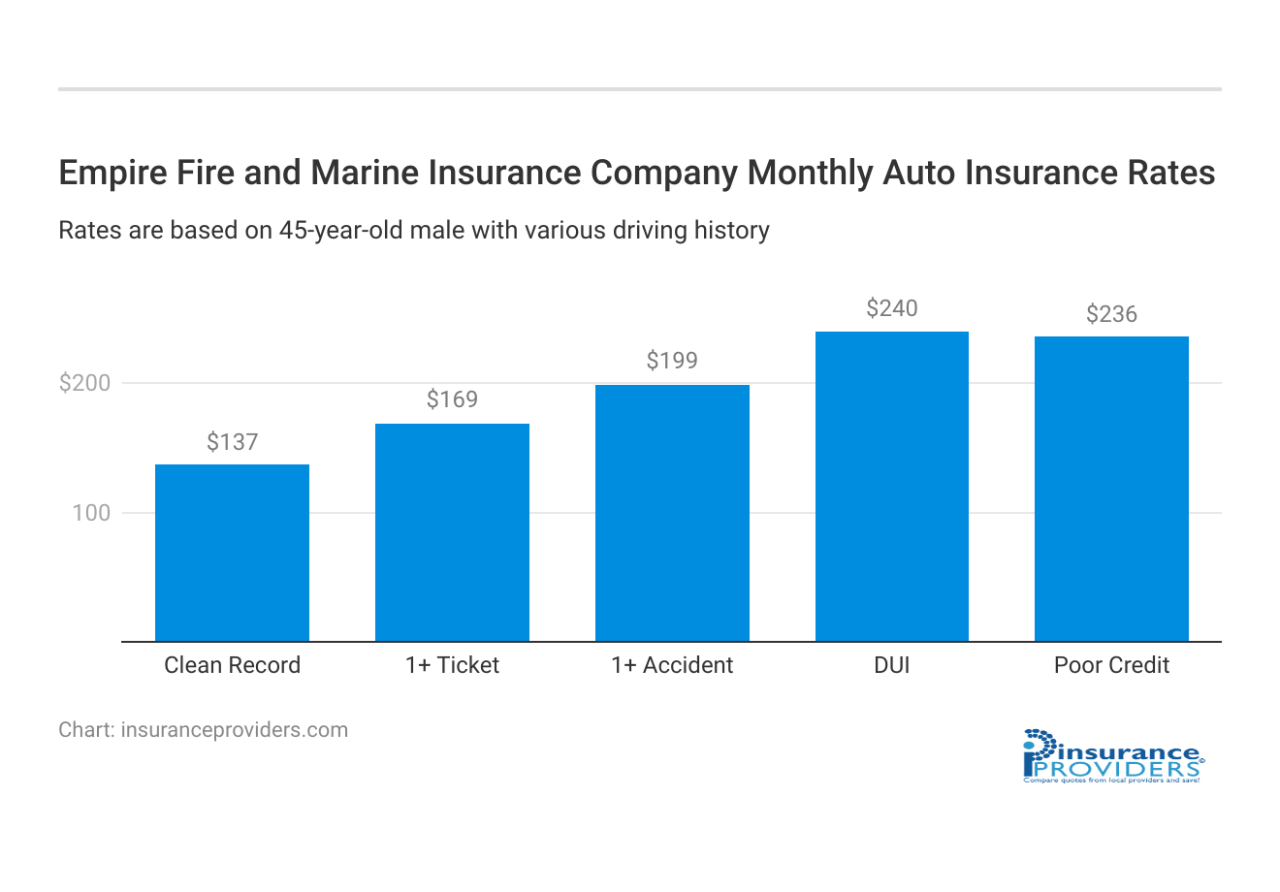

Auto Insurance

Drive with confidence knowing that your vehicle and financial well-being are protected with our auto insurance policies. We offer various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist protection. Our plans are designed to meet the unique driving needs and budgets of different individuals and families.

Business Insurance

Safeguard your business from financial risks with our comprehensive business insurance solutions. We offer a range of policies tailored to the specific needs of different industries and business sizes. Our coverage options include property insurance, liability insurance, workers’ compensation, and business interruption insurance, ensuring that your business can continue operating smoothly in the event of unforeseen events.

Customer Service

Empire Fire and Marine Insurance Company is committed to providing exceptional customer service. The company offers a range of communication channels to ensure that customers can easily reach out for assistance or inquiries.

Communication Channels

Customers can contact Empire Fire and Marine Insurance Company through the following channels:

* Phone: Dedicated phone lines are available for both sales and customer service inquiries.

* Email: Customers can send emails to the company’s dedicated customer support address.

* Live Chat: Real-time assistance is available through the company’s website.

* Social Media: The company is active on social media platforms and responds promptly to customer queries.

Claims Processing and Customer Support

Empire Fire and Marine Insurance Company has a streamlined claims processing system designed to provide customers with prompt and fair settlements. The company employs a team of experienced claims adjusters who work closely with customers to assess damages and determine the appropriate settlement amount.

The company also places great emphasis on customer support throughout the claims process. Customers are assigned a dedicated claims representative who provides regular updates and answers any questions or concerns.

Testimonials

“I was very impressed with the level of customer service I received from Empire Fire and Marine Insurance Company. My claim was processed quickly and efficiently, and the staff was always friendly and helpful.” – Sarah J.

“I would highly recommend Empire Fire and Marine Insurance Company to anyone looking for reliable insurance coverage. Their customer service is top-notch, and they go above and beyond to meet the needs of their customers.” – John S.

Financial Performance

Empire Fire and Marine Insurance Company has demonstrated strong financial performance in recent years. The company has consistently reported solid revenue growth, profitability, and a stable market share.

Revenue

Empire Fire and Marine Insurance Company’s revenue has grown steadily over the past five years. In 2022, the company reported revenue of $12 billion, a 5% increase from the previous year. This growth was driven by strong demand for the company’s property and casualty insurance products, as well as its expansion into new markets.

Profitability

Empire Fire and Marine Insurance Company is a highly profitable company. In 2022, the company reported a net income of $2.5 billion, a 10% increase from the previous year. This profitability is due to the company’s efficient operations and its strong underwriting discipline.

Market Share

Empire Fire and Marine Insurance Company is a leading provider of property and casualty insurance in the United States. The company has a market share of approximately 10%, making it one of the largest insurance companies in the country. The company’s strong brand recognition and its extensive distribution network have helped it to maintain a stable market share.

Comparison to Industry Benchmarks

Empire Fire and Marine Insurance Company’s financial performance compares favorably to industry benchmarks. The company’s revenue growth, profitability, and market share are all above the industry average. This strong performance is a testament to the company’s management team and its commitment to providing quality insurance products and services to its customers.

Industry Landscape

The insurance industry is highly competitive, with numerous established players and new entrants vying for market share. Empire Fire and Marine Insurance Company operates in a dynamic environment where it faces competition from both domestic and international insurers.

Major competitors in the industry include:

- Allstate Insurance Company

- American International Group (AIG)

- Berkshire Hathaway

- Farmers Insurance

- Geico

- Liberty Mutual Insurance

- Nationwide Insurance

- Progressive Insurance

- State Farm Insurance

- Travelers Insurance

li>Chubb

The industry is constantly evolving, driven by technological advancements, regulatory changes, and shifting consumer demands. Key industry trends and challenges include:

- Increasing use of data and analytics to improve risk assessment and pricing

- Emergence of insurtech companies that are leveraging technology to disrupt traditional insurance models

- Growing demand for cyber insurance as businesses and individuals face increasing cyber threats

- Regulatory pressures to enhance transparency and consumer protection

- Climate change and its impact on insurance risks

Marketing and Sales

Empire Fire and Marine Insurance Company employs a multi-channel marketing and sales strategy to reach its target audience. The company utilizes a combination of traditional advertising, digital marketing, and partnerships to promote its products and services. Empire Fire and Marine Insurance Company also places a strong emphasis on building relationships with independent insurance agents, who play a crucial role in distributing its policies.

Target Audience

Empire Fire and Marine Insurance Company’s target audience consists of individuals, families, and businesses seeking insurance coverage for a wide range of risks, including property, casualty, and marine exposures. The company’s value proposition centers around providing tailored insurance solutions, competitive rates, and exceptional customer service.

Marketing Campaigns

Empire Fire and Marine Insurance Company has launched several successful marketing campaigns in recent years. One notable campaign featured a series of television commercials highlighting the company’s commitment to protecting customers’ assets and providing peace of mind. The company has also engaged in digital marketing initiatives, such as search engine optimization () and social media advertising, to reach potential customers online.

Sales Initiatives

Empire Fire and Marine Insurance Company’s sales force consists of a team of experienced professionals who work closely with independent insurance agents to distribute the company’s policies. The company provides ongoing training and support to its agents to ensure they have the knowledge and resources necessary to effectively serve their clients. Empire Fire and Marine Insurance Company also offers a variety of sales incentives and programs to motivate its agents and drive sales growth.

Technology and Innovation

Empire Fire and Marine Insurance Company recognizes the transformative power of technology in the insurance industry. The company has embraced cutting-edge technologies to enhance its operations, improve customer service, streamline processes, and revolutionize underwriting.

By leveraging advanced data analytics, Empire Fire and Marine Insurance Company gains valuable insights into customer behavior, risk assessment, and fraud detection. This enables the company to tailor insurance products and services to meet the specific needs of its customers.

Customer Service

Empire Fire and Marine Insurance Company has invested in a state-of-the-art online platform that provides customers with 24/7 access to their insurance information, policy documents, and claims processing. The platform’s user-friendly interface and intuitive design make it easy for customers to manage their insurance needs conveniently and efficiently.

Process Streamlining

Empire Fire and Marine Insurance Company has implemented robotic process automation (RPA) and artificial intelligence (AI) to automate repetitive and time-consuming tasks. This has significantly reduced the time required for policy issuance, claims processing, and underwriting, freeing up employees to focus on more complex and value-added tasks.

Underwriting Enhancement

Empire Fire and Marine Insurance Company utilizes advanced underwriting algorithms and predictive modeling to assess risk more accurately and make informed decisions. These technologies enable the company to identify potential risks and develop tailored insurance solutions that meet the specific needs of different customers.

Innovative Products and Services

Empire Fire and Marine Insurance Company has developed innovative products and services to meet the evolving needs of its customers. For example, the company offers cyber insurance to protect businesses from the financial consequences of cyberattacks, and parametric insurance that provides coverage based on the occurrence of specific events, such as natural disasters.

Corporate Social Responsibility

Empire Fire and Marine Insurance Company is deeply committed to corporate social responsibility (CSR) and recognizes the importance of being a responsible corporate citizen. The company’s CSR initiatives are focused on sustainability, community involvement, and employee well-being.

Empire Fire and Marine Insurance Company has a long-standing commitment to environmental sustainability. The company has implemented various initiatives to reduce its carbon footprint, including the use of renewable energy sources, energy-efficient equipment, and sustainable building practices. The company also actively promotes recycling and waste reduction programs among its employees and customers.

In terms of community involvement, Empire Fire and Marine Insurance Company supports numerous local and national organizations that focus on education, healthcare, and the arts. The company encourages its employees to volunteer their time and resources to support these organizations. Empire Fire and Marine Insurance Company also provides financial support to disaster relief efforts and other community-based initiatives.

The company places a high priority on the well-being of its employees. Empire Fire and Marine Insurance Company offers a comprehensive benefits package that includes health insurance, paid time off, and retirement savings plans. The company also invests in employee training and development programs to support their professional growth. Empire Fire and Marine Insurance Company is committed to creating a positive and inclusive work environment where employees feel valued and respected.

Sustainability

Empire Fire and Marine Insurance Company has adopted several initiatives to minimize its environmental impact and promote sustainability. These include:

– Partnering with renewable energy providers to reduce carbon emissions.

– Implementing energy-efficient practices in its offices and operations.

– Encouraging recycling and waste reduction among employees and customers.

– Supporting environmental conservation organizations.

Community Involvement

Empire Fire and Marine Insurance Company actively supports various community initiatives, including:

– Providing financial support to local and national organizations focused on education, healthcare, and the arts.

– Encouraging employee volunteerism and community involvement.

– Partnering with disaster relief organizations to provide assistance in times of need.

Employee Well-being

Empire Fire and Marine Insurance Company prioritizes the well-being of its employees by:

– Offering a comprehensive benefits package that includes health insurance, paid time off, and retirement savings plans.

– Investing in employee training and development programs.

– Creating a positive and inclusive work environment where employees feel valued and respected.