Types of Dentures Covered by Insurance

Insurance policies may cover different types of dentures, depending on the specific plan and coverage limits. Generally, the following types of dentures are commonly covered:

Full Dentures

Full dentures are complete sets of teeth that replace all the natural teeth in an arch (upper or lower jaw). They are typically made of acrylic resin or a combination of acrylic and metal. Full dentures are used when all or most of the natural teeth in an arch are missing or severely damaged.

Partial Dentures

Partial dentures are designed to replace only some of the missing teeth in an arch. They are typically made of a metal framework with acrylic or metal teeth attached. Partial dentures are used when some natural teeth remain in the arch and can be used to support the denture.

Implant-Supported Dentures

Implant-supported dentures are a type of denture that is anchored to dental implants. Dental implants are small titanium posts that are surgically placed in the jawbone. The denture is then attached to the implants, providing a more stable and secure fit compared to traditional dentures.

Coverage Limits and Exclusions

Understanding the coverage limits and exclusions for dentures under insurance plans is crucial to avoid unexpected expenses. Most insurance policies have specific guidelines outlining what types of dentures are covered, the frequency of replacements, and any restrictions or limitations.

Coverage limits typically vary depending on the insurance plan and the type of denture being considered. Basic plans may cover only a portion of the costs, while more comprehensive plans may offer higher coverage limits. Exclusions may include cosmetic enhancements, repairs, or dentures deemed unnecessary or excessive.

Frequency of Denture Replacements

Insurance plans often impose restrictions on the frequency of denture replacements. This is because dentures are expected to last for a certain number of years before needing to be replaced. Common replacement intervals range from five to eight years, depending on the plan and the materials used in the dentures.

Exceeding the recommended replacement interval may result in denied claims or reduced coverage. Therefore, it’s important to adhere to the guidelines set by the insurance provider to ensure timely and appropriate coverage for denture replacements.

Out-of-Pocket Costs

Determining the estimated out-of-pocket costs for dentures with insurance requires careful consideration of several factors. These factors include co-pays, deductibles, and coinsurance.

Co-pays are fixed amounts you pay for specific services, such as a dentist visit or denture fitting. Deductibles are the amount you must pay out-of-pocket before insurance coverage begins. Coinsurance is the percentage of the remaining cost you are responsible for after meeting your deductible.

Co-pays

- Typically range from $25 to $50 per visit.

- May vary depending on the type of denture and the dentist’s fees.

Deductibles

- Can range from $50 to $500 or more.

- Must be met before insurance starts to cover any costs.

Coinsurance

- Usually falls between 20% and 50%.

- Represents the percentage of the remaining cost you are responsible for after meeting your deductible.

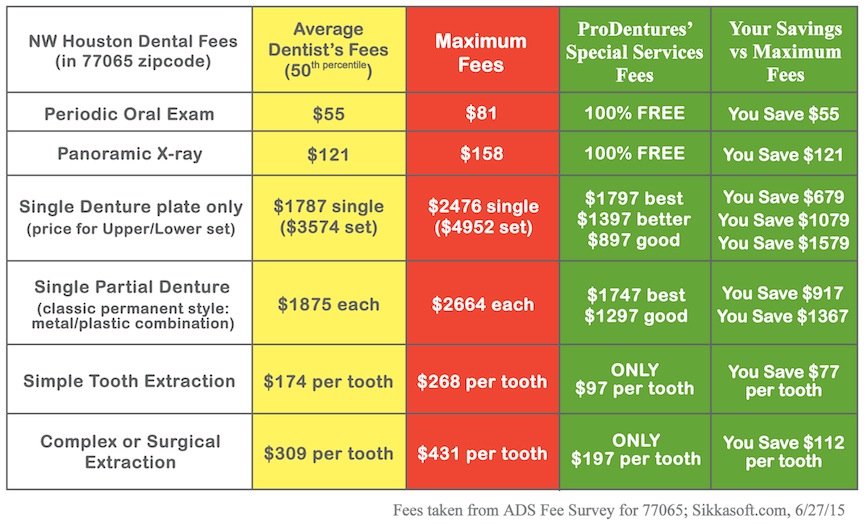

Comparison of Insurance Plans

Different insurance plans offer varying levels of coverage and costs for dentures. It’s essential to compare plans carefully to find the one that best meets your needs and budget.

Coverage and Costs

The following table compares the coverage and costs of dentures under different insurance plans:

| Plan | Premium | Deductible | Out-of-Pocket Expenses | Coverage |

|---|---|---|---|---|

| Plan A | $50/month | $500 | 20% | 50% of denture costs |

| Plan B | $75/month | $250 | 15% | 60% of denture costs |

| Plan C | $100/month | $100 | 10% | 70% of denture costs |

Maximizing Insurance Benefits

To maximize insurance benefits for dentures, consider the following strategies:

Choose an In-Network Provider

Choosing an in-network provider can significantly reduce out-of-pocket costs. In-network providers have negotiated lower rates with insurance companies, resulting in lower co-pays and deductibles for patients.

Negotiate Payment Plans

If you’re facing high out-of-pocket costs, don’t hesitate to negotiate payment plans with your dental provider. Many providers are willing to work with patients to create payment arrangements that fit their budget.