Material Changes

Material changes refer to significant alterations in your circumstances or information that could impact your insurance coverage or premium.

Examples of material changes include:

Changes in Health Status

- New medical diagnoses or treatments

- Hospitalizations or surgeries

- Changes in medication or prescription drug use

Changes in Lifestyle

- Starting or quitting smoking

- Changes in alcohol consumption

- Participation in hazardous activities

Changes in Occupation

- Starting a new job with different duties or risks

- Changes in work environment or exposure to hazards

- Becoming self-employed or starting a business

Changes in Property

- Acquiring or disposing of property

- Renovations or additions to property

- Changes in property use or occupancy

Changes in Marital Status

- Marriage or divorce

- Changes in the number of dependents

- Changes in income or financial situation

Failing to disclose material changes can have serious consequences, including:

- Denial of coverage

- Cancellation of your policy

- Increased premiums

- Legal penalties

Non-Material Changes

Non-material changes are alterations to an insurance policy that do not significantly affect the risk assumed by the insurer. They typically involve minor adjustments to policy details or coverage that do not impact the overall coverage or premium.

Unlike material changes, which require prompt disclosure to the insurer, non-material changes may not need to be reported immediately. However, it’s important to understand when and why non-material changes should be disclosed to ensure proper coverage and avoid potential disputes.

Examples of Non-Material Changes

- Change in marital status (unless it affects the number of drivers insured)

- Addition of a new vehicle that is similar to existing vehicles insured

- Minor changes to business operations or property usage

- Corrections to policyholder information (e.g., address, phone number)

Importance of Disclosing Non-Material Changes

While non-material changes may not always require immediate disclosure, it’s still important to inform the insurer of such changes in certain cases:

- When required by the policy: Some insurance policies may specifically require disclosure of certain non-material changes.

- To avoid future disputes: Disclosing non-material changes helps create a clear record of all policy changes, reducing the risk of disputes over coverage later on.

- To maintain accurate coverage: Even minor changes can affect coverage in unexpected ways. Disclosing non-material changes ensures that the policy remains up-to-date and provides the intended protection.

Timing of Disclosure

Timely disclosure of material changes is crucial to maintain the integrity of the insurance contract. The policyholder has a duty to disclose any relevant changes that may affect the risk assessment or coverage provided by the insurance policy.

Changes should be disclosed within a reasonable time frame after they occur or become known to the policyholder. The specific time frame may vary depending on the jurisdiction and the type of insurance policy, but it is generally expected that changes should be disclosed promptly.

Consequences of Late Disclosure

Failure to disclose material changes after the policy has been issued may have serious consequences. The insurer may have the right to:

- Cancel the policy

- Deny coverage for claims related to the undisclosed change

- Adjust the premium to reflect the increased risk

Handling Changes During Underwriting

Changes that occur during the underwriting process should be disclosed to the insurer as soon as possible. This will allow the insurer to assess the impact of the change on the risk assessment and make any necessary adjustments to the policy terms or premium.

Methods of Disclosure

Once you have identified a material change that needs to be disclosed to your insurance company, you have several options for submitting your disclosure. Each method has its own advantages and disadvantages.

Online Disclosure

Many insurance companies now offer online portals where you can submit changes to your application. This is a convenient and efficient way to disclose changes, and it provides you with a record of your submission.

Pros:

- Convenient and efficient

- Provides a record of your submission

Cons:

- May not be available for all insurance companies

- May require you to create an account

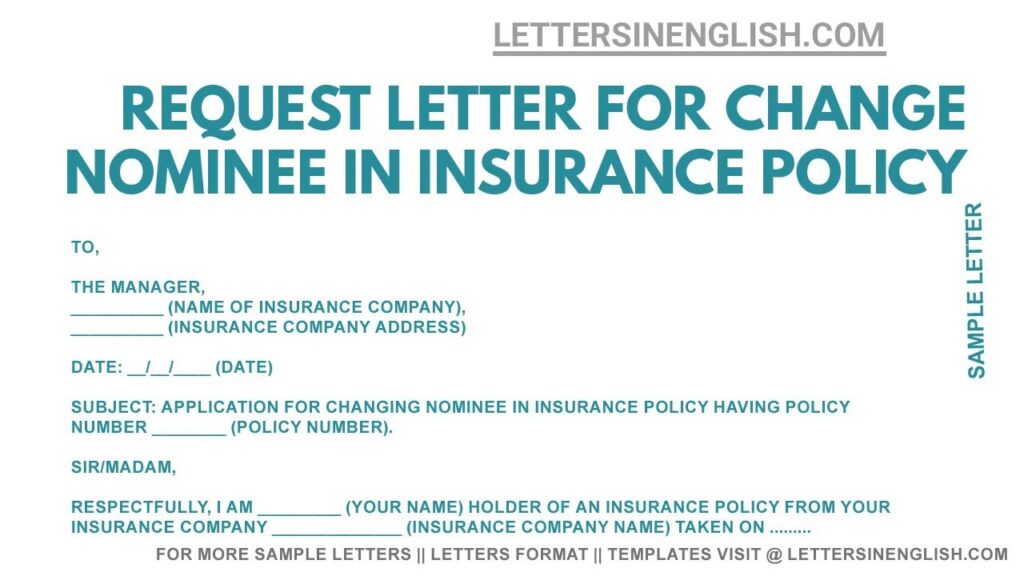

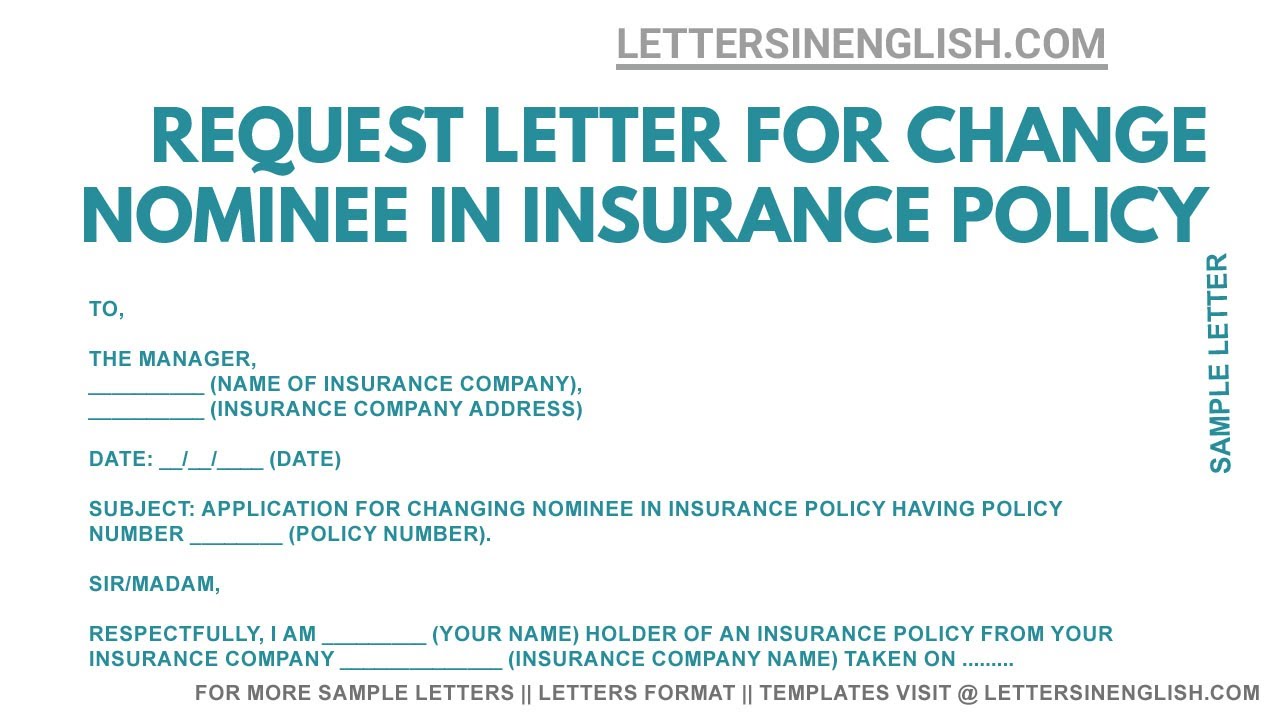

Mail Disclosure

You can also disclose changes to your insurance application by mail. This is a more traditional method, but it can be less convenient than online disclosure.

Pros:

- Available for all insurance companies

- Does not require you to create an account

Cons:

- Less convenient than online disclosure

- May take longer for your disclosure to be processed

Phone Disclosure

You can also disclose changes to your insurance application by phone. This is a good option if you need to speak to a representative directly.

Pros:

- Allows you to speak to a representative directly

- Can be convenient if you do not have access to a computer

Cons:

- May be less efficient than online disclosure

- May require you to wait on hold

In-Person Disclosure

Finally, you can also disclose changes to your insurance application in person at your insurance company’s office. This is a good option if you want to speak to a representative directly and have your disclosure processed immediately.

Pros:

- Allows you to speak to a representative directly

- Can have your disclosure processed immediately

Cons:

- May not be convenient if your insurance company’s office is not located near you

- May require you to wait in line

Consequences of Misrepresentation

Misrepresenting or omitting information on an insurance application can have severe consequences. It can lead to legal and financial penalties, and can even invalidate your insurance policy.

When you apply for insurance, you are required to disclose all material information that could affect the insurer’s decision to issue a policy. Material information includes anything that could increase the risk of loss to the insurer, such as your health history, driving record, or criminal history.

Legal Implications

Misrepresenting or omitting material information on an insurance application is a form of fraud. As such, it can have serious legal consequences. You could be charged with a crime, and you could be ordered to pay damages to the insurance company.

Financial Implications

In addition to the legal consequences, misrepresenting or omitting information on an insurance application can also have serious financial implications. If the insurance company discovers that you have misrepresented or omitted information, they may deny your claim or cancel your policy. This could leave you financially responsible for any losses that occur.

Impact on Policy Validity

Misrepresenting or omitting material information on an insurance application can also affect the validity of your policy. If the insurance company discovers that you have misrepresented or omitted information, they may void your policy. This means that you will not be covered for any losses that occur, even if you have paid your premiums.