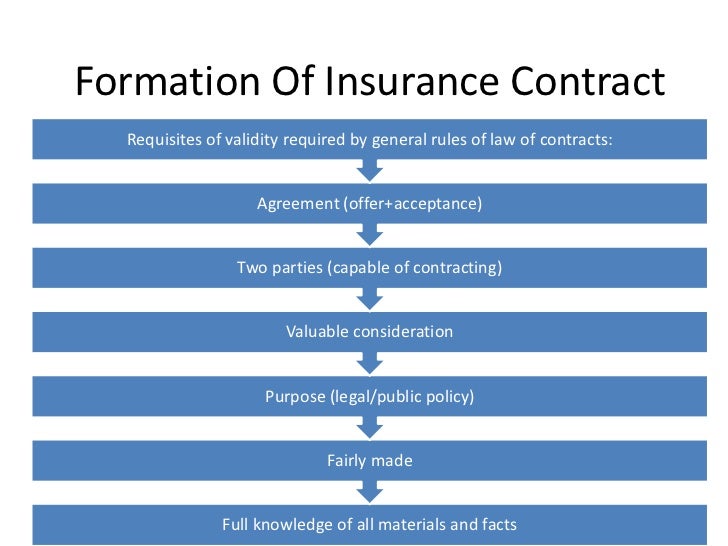

Understanding Acceptance in Insurance Contracts

Acceptance is a crucial element in the formation of an insurance contract. It signifies the mutual agreement between the insurer and the insured, creating a legally binding obligation. Acceptance completes the offer and proposal process, transforming the contract from a mere proposal into a valid and enforceable agreement.

Legal Significance of Acceptance

Acceptance serves as the final and irrevocable expression of the insured’s willingness to be bound by the terms and conditions of the insurance policy. It establishes a contractual relationship between the parties, giving rise to specific rights and obligations. The insurer becomes legally bound to provide coverage as Artikeld in the policy, while the insured is obligated to pay the agreed-upon premiums and comply with the policy’s provisions.

Timing of Acceptance

In insurance contracts, acceptance can occur in various ways, such as through verbal communication, written notice, or conduct indicating assent to the terms of the contract. The general rule regarding the timing of acceptance is that it takes effect when the offeree (the party to whom the offer is made) communicates their acceptance to the offeror (the party making the offer).

This rule applies even if the acceptance is delayed or lost in transit. For instance, if an insurance company sends an offer letter to an applicant, and the applicant signs and returns the letter a week later, the acceptance is effective upon receipt by the insurance company, even though there was a delay in the applicant’s response.

Methods of Acceptance

- Verbal Acceptance: Acceptance can be communicated verbally, either in person or over the phone. However, verbal acceptance may be difficult to prove in the event of a dispute.

- Written Acceptance: Written acceptance is a more formal and reliable method. It can be done through a signed contract, letter, or email.

- Conduct Indicating Acceptance: Acceptance can also be implied through conduct that demonstrates the offeree’s intent to accept the offer. For example, if an applicant pays the insurance premium, this may be considered an acceptance of the insurance offer.

Exceptions to the General Rule

The general rule regarding the timing of acceptance in insurance contracts is that acceptance occurs when the insurer communicates its acceptance to the insured. However, there are a few exceptions to this rule.

One exception is when the offer is made by mail. In this case, acceptance occurs when the insured mails the acceptance, not when the insurer receives it.

Another exception is when the offer is made through an agent. In this case, acceptance occurs when the agent communicates the acceptance to the insured, not when the insurer receives it.

Finally, there is an exception when the offer is made through an electronic medium. In this case, acceptance occurs when the insured sends the acceptance, not when the insurer receives it.

Real-Life Examples

- An insured mails an acceptance of an offer of insurance to the insurer. The acceptance is effective when the insured mails it, even if the insurer does not receive it for several days.

- An agent communicates an acceptance of an offer of insurance to the insured. The acceptance is effective when the agent communicates it to the insured, even if the insurer does not receive it for several days.

- An insured sends an acceptance of an offer of insurance through an electronic medium to the insurer. The acceptance is effective when the insured sends it, even if the insurer does not receive it for several days.

Communication of Acceptance

Once the offer is made, the offeree must communicate their acceptance to the offeror for the insurance contract to be formed. Communication of acceptance is crucial as it signifies the offeree’s agreement to the terms of the offer and creates a binding agreement between the parties.

The communication of acceptance can be made through various methods, including:

Verbal Acceptance

Verbal acceptance is the simplest and most common method of communicating acceptance. It involves the offeree expressing their agreement to the offer verbally, either in person or over the phone. However, verbal acceptance can be difficult to prove later on, so it is advisable to follow up with written confirmation.

Written Acceptance

Written acceptance is more formal and provides stronger evidence of the offeree’s acceptance. It can be made through a letter, email, or other written document that clearly states the offeree’s acceptance of the offer.

Implied Acceptance

In some cases, acceptance can be implied from the offeree’s conduct. For example, if the offeree begins to perform the obligations under the contract, this may be interpreted as implied acceptance of the offer.

To ensure effective communication of acceptance, the following legal requirements must be met:

- The acceptance must be unconditional and unambiguous.

- The acceptance must be communicated to the offeror within a reasonable time.

- The acceptance must be in the same form as the offer, unless otherwise specified by the offeror.

Conditional Acceptance

Conditional acceptance occurs when the offeree (the person receiving the offer) accepts the offer but makes it subject to one or more conditions. The condition may be anything that the offeree wants, such as a change in the price, a change in the terms of the contract, or a change in the subject matter of the contract.

Conditional acceptance is a counteroffer, which means that it rejects the original offer and proposes a new one. The original offeror is then free to accept or reject the counteroffer. If the original offeror accepts the counteroffer, then a contract is formed on the terms of the counteroffer.

Legal Implications of Conditional Acceptance

Conditional acceptance has several legal implications. First, it prevents a contract from being formed until the condition is met. Second, it gives the original offeror the right to reject the counteroffer. Third, it may allow the offeree to withdraw their acceptance if the condition is not met.

Examples of Conditional Acceptance in Insurance Contracts

Conditional acceptance is common in insurance contracts. For example, an applicant for an insurance policy may accept the policy but only if the policy is issued at a certain premium rate. Or, an applicant may accept the policy but only if the policy covers certain risks.

Implied Acceptance

Implied acceptance occurs when the insured’s conduct reasonably indicates an intent to accept the insurance policy, even if the insured does not explicitly express their agreement.

Acceptance may be implied in various circumstances:

Conduct Demonstrating Acceptance

* Paying the insurance premium

* Retaining the policy without objection for a reasonable period

* Acting in reliance on the policy, such as filing a claim

Examples of Implied Acceptance

* A policyholder pays the first premium installment, indicating an intent to accept the policy.

* An insured receives the policy, reviews it, and keeps it without objection for several weeks, implying acceptance.

* An individual files a claim under the policy, demonstrating their belief that the policy is in effect.

Practical Considerations

Understanding the timing of acceptance is crucial for both insurance companies and policyholders. Timely and effective communication of acceptance ensures clarity, minimizes disputes, and protects the interests of all parties involved.

For insurance companies, promptly communicating acceptance allows them to establish coverage promptly, fulfill their contractual obligations, and mitigate risks. For policyholders, receiving timely acceptance provides peace of mind, ensures they have the necessary protection, and allows them to plan their finances accordingly.

Tips for Ensuring Timely and Effective Communication of Acceptance

- Establish clear communication channels and procedures.

- Use multiple methods of communication, such as email, phone, or mail.

- Document all communication and maintain records for future reference.

- Set realistic timelines for acceptance and communicate them clearly.

- Follow up regularly to ensure receipt and understanding of acceptance.

Best Practices for Avoiding Disputes Related to the Timing of Acceptance

- Adhere to the terms and conditions of the insurance contract.

- Communicate acceptance within the specified time frame.

- Obtain written confirmation of acceptance when possible.

- Seek clarification if there is any ambiguity regarding the timing of acceptance.

- Involve legal counsel if disputes arise.