Definition of Limited Pay Life Insurance

Limited pay life insurance is a type of life insurance policy where you pay premiums for a limited number of years, after which the policy remains in force without further premium payments. This type of policy provides coverage for the entire life of the insured, but the premiums are typically higher than those for a whole life policy.

Key Features and Characteristics

- Limited pay period: You pay premiums for a set number of years, such as 10, 15, or 20 years.

- Lifetime coverage: The policy remains in force for the entire life of the insured, even after the premium paying period ends.

- Higher premiums: The premiums for limited pay life insurance are typically higher than those for whole life policies because the insurance company assumes a greater risk by guaranteeing coverage for the entire life of the insured.

- Cash value: Some limited pay life insurance policies accumulate a cash value that can be borrowed against or withdrawn.

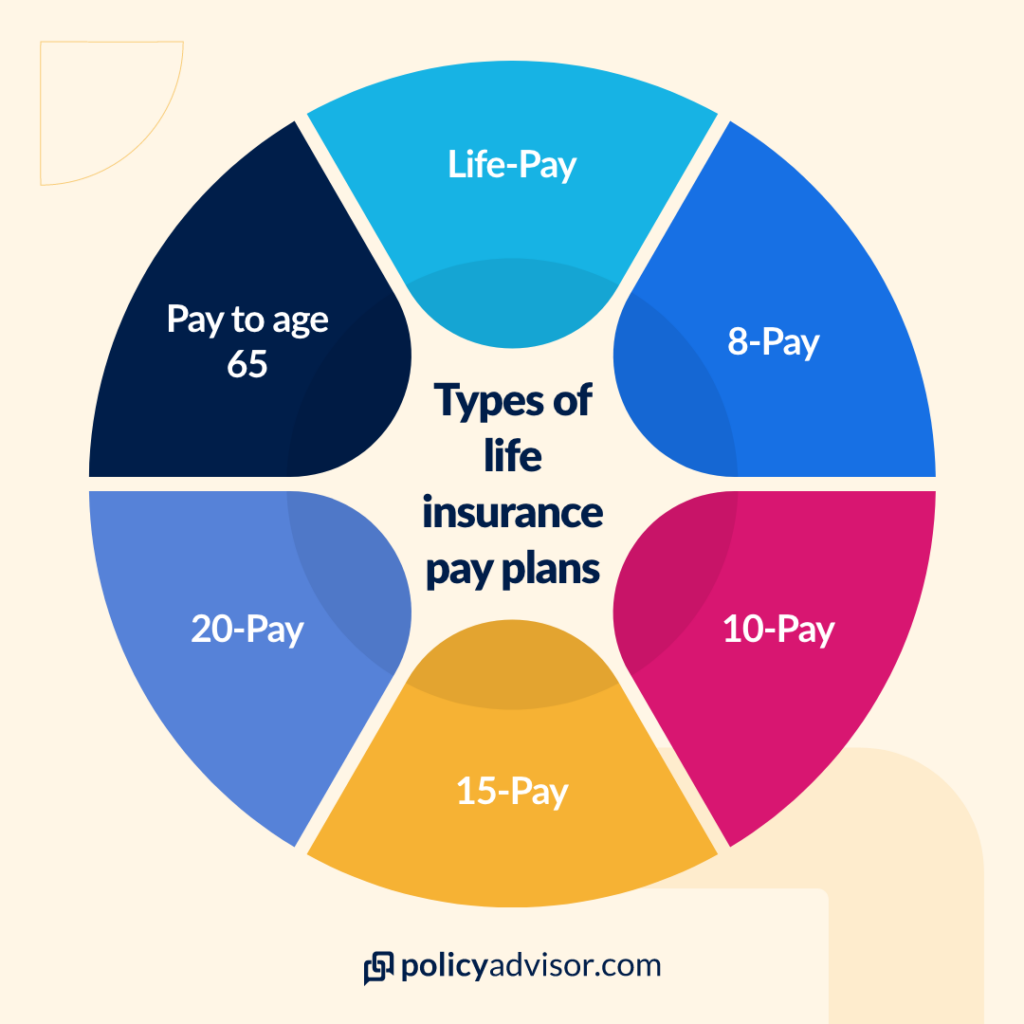

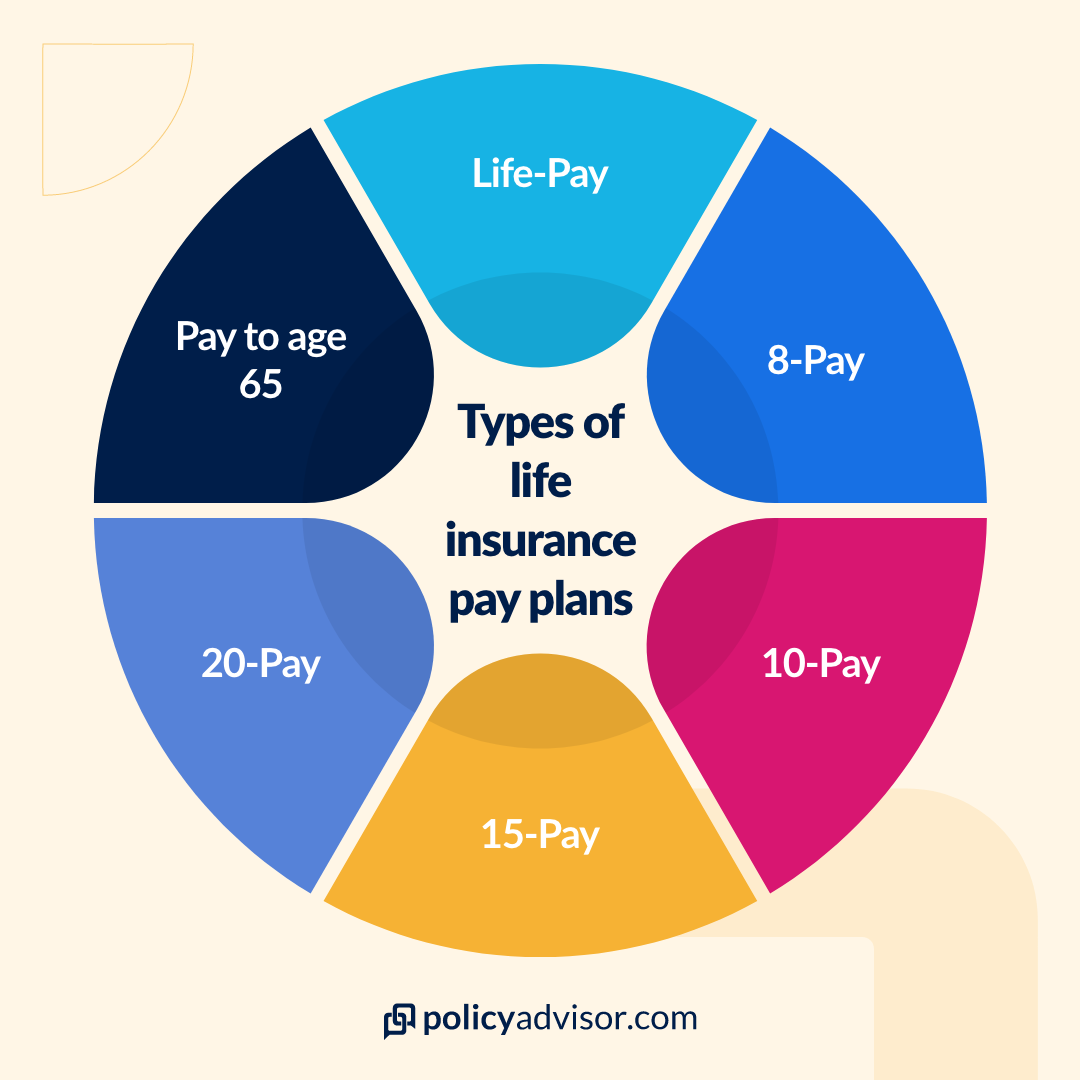

Types of Limited Pay Life Insurance

Limited pay life insurance policies vary in their payment structures and coverage durations. Here are some common types:

Single-Premium Limited Pay Life Insurance

In a single-premium limited pay life insurance policy, the policyholder makes a single lump-sum payment to cover all future premiums for the policy’s duration. This type of policy is often used for estate planning or as a form of inheritance for beneficiaries.

Level-Premium Limited Pay Life Insurance

With a level-premium limited pay life insurance policy, the policyholder pays a fixed amount of premium for a specified number of years. The coverage amount remains the same throughout the policy’s duration, and premiums are typically paid over a shorter period, such as 10, 15, or 20 years.

Increasing-Premium Limited Pay Life Insurance

In an increasing-premium limited pay life insurance policy, the premiums increase gradually over the policy’s duration. This type of policy is designed to provide a higher coverage amount as the policyholder ages and their financial needs may increase.

Benefits of Limited Pay Life Insurance

Limited pay life insurance offers several advantages over other types of life insurance policies. One of the most significant benefits is that it allows you to pay your premiums over a shorter period, such as 10, 15, or 20 years. This can be a great option for those who want to secure their family’s financial future without having to make ongoing premium payments for the rest of their lives.

Another benefit of limited pay life insurance is that it can provide peace of mind knowing that your loved ones will be financially secure in the event of your death, even if you are no longer able to make premium payments. This can be especially important for those who have young children or other dependents who rely on them financially.

Considerations for Purchasing Limited Pay Life Insurance

When considering purchasing a limited pay life insurance policy, several factors warrant careful evaluation. Assessing one’s financial needs, health status, and risk tolerance is crucial for making an informed decision.

Financial Needs

Evaluating your current and future financial obligations, including dependents, retirement goals, and potential liabilities, is essential. Determine the amount of coverage required to provide financial security for your loved ones in the event of your untimely demise.

Health Status

Your health status significantly impacts the cost of life insurance premiums. Individuals with pre-existing conditions or high-risk behaviors may face higher premiums or limited coverage options. Undergoing a medical exam can provide a comprehensive assessment of your health and influence the terms of your policy.

Risk Tolerance

Your risk tolerance should guide your decision-making process. Limited pay life insurance offers guaranteed premiums for a fixed period, providing stability and peace of mind. However, it may come with higher premiums compared to traditional whole life insurance. If you are comfortable with market fluctuations and prefer flexibility, traditional whole life insurance might be a more suitable option.

Comparison with Other Life Insurance Products

Limited pay life insurance differs from other life insurance products like whole life and term life in terms of premium payment period and coverage duration.

Whole Life Insurance

Whole life insurance provides lifelong coverage with premiums paid throughout the policyholder’s life. Advantages include guaranteed death benefit, cash value accumulation, and potential for dividends. However, it has higher premiums than limited pay life insurance.

Term Life Insurance

Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. Premiums are lower than limited pay life insurance but cease after the term ends, and there is no cash value or death benefit beyond the term.

Role of Limited Pay Life Insurance in Financial Planning

Limited pay life insurance can serve as a valuable component within a comprehensive financial plan, offering unique advantages in protecting assets, providing liquidity, and ensuring financial stability.

By focusing on premium payments during a limited period, limited pay life insurance allows policyholders to accumulate cash value more rapidly, creating a potential source of liquidity and supplemental retirement income. Additionally, the death benefit provides a layer of financial protection for beneficiaries, ensuring their financial well-being in the event of the insured’s untimely demise.

Protecting Assets

Limited pay life insurance can be used to protect assets such as a home or business from potential financial liabilities. In the event of the insured’s death, the death benefit can be used to pay off outstanding debts, such as a mortgage or business loans, ensuring that the assets remain in the family or business.

Providing Liquidity

The cash value component of limited pay life insurance can serve as a source of liquidity during emergencies or unexpected expenses. Policyholders can access this cash value through loans or withdrawals, providing financial flexibility without the need to liquidate other assets.

Ensuring Financial Stability

Limited pay life insurance can contribute to financial stability by providing a guaranteed death benefit that can supplement retirement income or cover end-of-life expenses. The cash value component can also provide a source of income during retirement, reducing the risk of outliving financial resources.