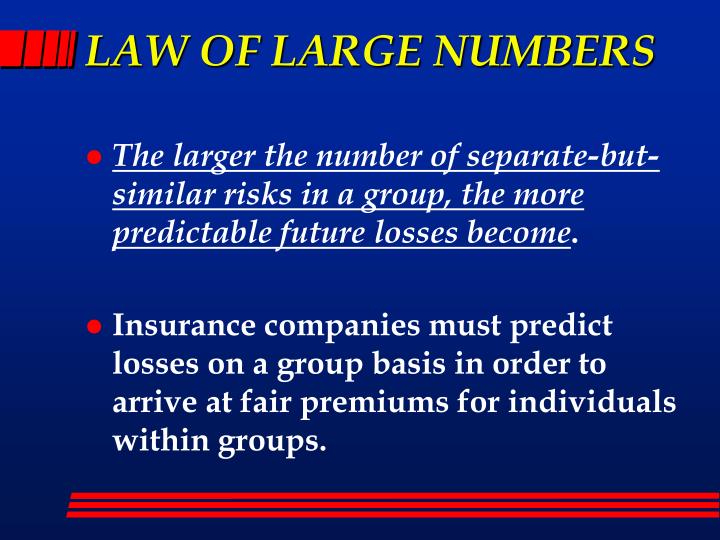

Definition of the Law of Large Numbers

The Law of Large Numbers is a fundamental theorem in probability theory that states that the sample average of a large number of independent, identically distributed random variables will converge to the expected value of the random variable as the sample size increases.

In the context of insurance, the Law of Large Numbers is significant because it provides a theoretical basis for the use of insurance premiums to cover future claims. Insurance companies use the Law of Large Numbers to estimate the probability of future claims and set premiums accordingly. This allows insurance companies to spread the risk of loss across a large number of policyholders, reducing the financial impact of individual claims.

Examples of Applications

- Insurance companies use the Law of Large Numbers to calculate the probability of future claims based on historical data. This information is used to set insurance premiums that are sufficient to cover expected claims and administrative costs.

- Actuaries use the Law of Large Numbers to develop mortality tables and other statistical tools that help insurance companies assess the risk of insuring different types of individuals.

- Insurance regulators use the Law of Large Numbers to ensure that insurance companies have adequate reserves to cover potential claims.

Application in Insurance Ratemaking

The Law of Large Numbers plays a pivotal role in determining insurance rates. It enables insurance companies to predict the probability of a loss event occurring within a large group of policyholders.

The process of risk pooling, where multiple individuals or entities combine their risks, is closely related to the Law of Large Numbers. By pooling risks, the insurance company can spread the potential losses over a larger population, making it more predictable and manageable.

Premium Calculation

- The total expected losses for a given group of policyholders are estimated based on historical data and actuarial analysis.

- The expected losses are then divided by the number of policyholders to determine the average expected loss per policyholder.

- This average expected loss is used as the basis for setting insurance rates, ensuring that the premiums collected are sufficient to cover the anticipated losses.

Stability of Rates

- The Law of Large Numbers helps stabilize insurance rates over time, even if the actual losses experienced by individual policyholders may vary significantly.

- As the number of policyholders increases, the distribution of losses becomes more predictable, reducing the likelihood of extreme fluctuations in insurance rates.

Implications for Insurance Companies

The Law of Large Numbers is a fundamental concept in insurance ratemaking. It provides a theoretical basis for predicting the average behavior of a large group of insured individuals or entities over time, even though the behavior of individual members may be unpredictable.

There are several key benefits to using the Law of Large Numbers for insurance companies:

- It allows insurers to predict the average claims experience of a group of policyholders, even if they do not have a long history of claims data for each individual policyholder.

- It helps insurers to set premiums that are fair and equitable for all policyholders, by spreading the risk of losses across a large group of individuals.

- It provides a basis for insurers to make decisions about underwriting and risk management, by helping them to identify and manage potential risks.

However, there are also some potential limitations or challenges in applying the Law of Large Numbers in insurance:

- The Law of Large Numbers assumes that the average behavior of a group of insured individuals or entities will be stable over time. However, in reality, the average behavior of a group can change over time, due to factors such as changes in demographics, economic conditions, or regulatory changes.

- The Law of Large Numbers does not apply to individual policyholders. Therefore, insurers cannot use the Law of Large Numbers to predict the claims experience of an individual policyholder with certainty.

- The Law of Large Numbers can be difficult to apply in practice, especially for small insurance companies with a limited number of policyholders.

Impact on Policyholders

The Law of Large Numbers significantly influences insurance premiums for policyholders. It enables insurance companies to predict the overall risk of a group, leading to fairer and more accurate premium calculations.

Risk classification, a crucial aspect of insurance ratemaking, groups policyholders based on their risk profiles. This allows insurers to charge premiums that reflect the actual risk each policyholder poses. Underwriting, the process of evaluating individual risk factors, further refines these classifications, ensuring that policyholders pay premiums commensurate with their risk level.

Role of Risk Classification

- Classifies policyholders into groups based on shared risk characteristics (e.g., age, driving history, health status).

- Enables insurers to set premiums that are tailored to the specific risk profile of each group.

- Reduces the likelihood of high-risk policyholders subsidizing premiums for low-risk policyholders.

Role of Underwriting

- Evaluates individual risk factors within each classification to determine the specific premium for each policyholder.

- Considers factors such as medical history, driving records, and property characteristics to assess individual risk.

- Ensures that premiums accurately reflect the risk posed by each policyholder, leading to fairer and more personalized pricing.

Examples of Insurance Products

The Law of Large Numbers is applied extensively in various insurance products, allowing insurers to estimate risks and set premiums accurately. Here are some examples of insurance products where the Law of Large Numbers plays a prominent role:

- Life Insurance: Life insurance companies use the Law of Large Numbers to predict the mortality rates of their policyholders based on historical data. This enables them to calculate premiums that reflect the risk of policyholders dying prematurely.

- Health Insurance: Health insurance companies utilize the Law of Large Numbers to estimate the frequency and severity of medical claims. By analyzing past claims data, they can determine the average cost of providing healthcare to a large group of policyholders, allowing them to set premiums that cover their expected expenses.

- Property Insurance: Property insurance companies apply the Law of Large Numbers to assess the risk of property damage or loss. They collect data on the frequency and severity of claims for different types of properties, such as homes, businesses, and vehicles, to determine the likelihood of a policyholder experiencing a loss.

- Auto Insurance: Auto insurance companies use the Law of Large Numbers to estimate the probability of accidents and the average cost of claims. They analyze data on driving records, vehicle types, and geographical locations to determine the risk profile of policyholders and set premiums accordingly.

Ethical Considerations

The Law of Large Numbers (LLN) has significant ethical implications in insurance. Its reliance on large groups and statistical averages raises concerns about potential bias or discrimination in insurance practices.

LLN assumes that the characteristics of a large group will apply to individual members. However, this assumption can lead to inaccurate predictions for individuals who deviate from the group average. For instance, an insurance company using LLN to determine premiums may overcharge individuals who pose a lower risk than the average group.

Bias and Discrimination

The LLN can perpetuate existing biases and lead to discriminatory practices. If historical data used to calculate insurance rates reflects systemic biases, the LLN will reinforce those biases. This can result in unfair treatment of certain groups, such as racial or ethnic minorities, who may face higher premiums or reduced coverage due to statistical generalizations.