Definition of Key Person Disability Insurance

Key person disability insurance is a type of insurance that provides financial protection to businesses in the event that a key person becomes disabled and unable to work.

Key person disability insurance typically covers the following types of benefits:

Benefits Provided

- Lost income

- Medical expenses

- Rehabilitation costs

- Business interruption costs

Benefits of Key Person Disability Insurance

Key person disability insurance offers numerous financial benefits to businesses. It provides a financial safety net in the event that a key person becomes disabled and unable to work. This can help businesses avoid significant financial losses and maintain stability during a challenging time.

Protecting Business from Financial Losses

When a key person becomes disabled, the business may experience a loss of revenue, increased expenses, and a decline in productivity. Key person disability insurance can help offset these losses by providing a monthly benefit to the business. This benefit can be used to cover the costs of hiring a replacement, training new staff, or implementing new strategies to mitigate the impact of the key person’s absence.

Examples of How Key Person Disability Insurance Has Helped Businesses

* Case Study 1: A small business owner purchased key person disability insurance for himself. When he was diagnosed with a debilitating illness, the insurance policy provided a monthly benefit that allowed the business to continue operating and maintain its customer base.

* Case Study 2: A technology company insured its CEO, who was essential to the company’s growth and success. When the CEO suffered a serious injury, the insurance policy provided a benefit that enabled the company to hire a highly skilled replacement and avoid a significant loss of revenue.

Eligibility for Key Person Disability Insurance

To qualify for key person disability insurance, certain eligibility criteria must be met. Insurers evaluate applications based on factors such as the applicant’s:

- Age and health

- Occupation and industry

- Income and financial situation

- Company’s financial stability and dependence on the key person

Cost of Key Person Disability Insurance

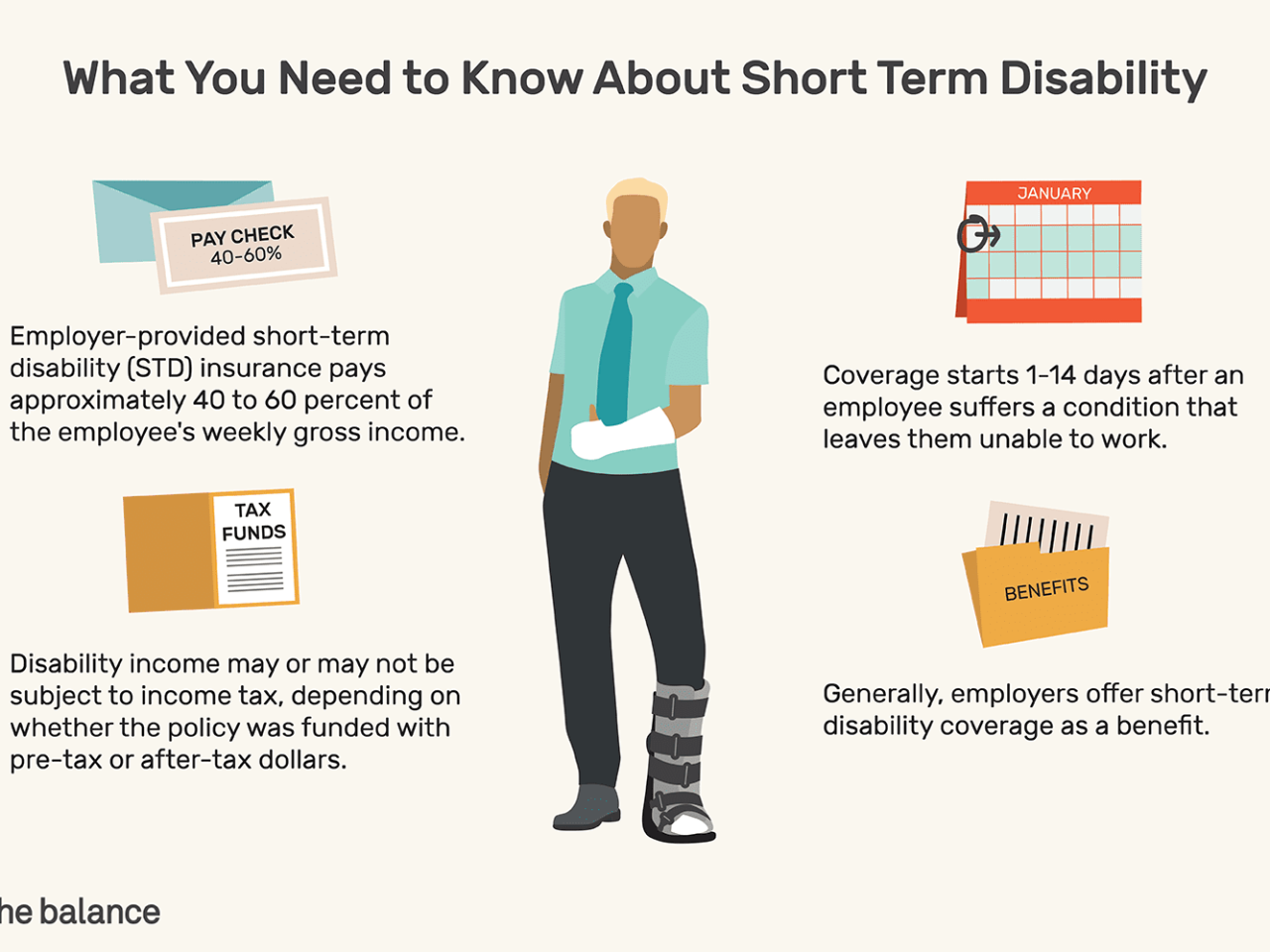

The cost of key person disability insurance varies depending on several factors, including the age, health, and occupation of the insured individual, as well as the amount of coverage and the length of the benefit period.

It is important to shop around for the best rates on key person disability insurance. By comparing quotes from multiple insurers, you can ensure that you are getting the best possible coverage at the most affordable price.

Factors that Affect the Cost of Key Person Disability Insurance

- Age: Younger individuals typically pay lower premiums than older individuals.

- Health: Individuals with good health histories typically pay lower premiums than those with poor health histories.

- Occupation: Individuals in high-risk occupations, such as construction workers or pilots, typically pay higher premiums than those in low-risk occupations, such as office workers.

- Amount of Coverage: The higher the amount of coverage, the higher the premium.

- Length of Benefit Period: The longer the benefit period, the higher the premium.

Table Comparing the Costs of Different Key Person Disability Insurance Policies

| Insurer | Premium | Amount of Coverage | Length of Benefit Period |

|---|---|---|---|

| Insurer A | $1,000 | $1,000,000 | 5 years |

| Insurer B | $1,200 | $1,000,000 | 10 years |

| Insurer C | $1,500 | $2,000,000 | 5 years |

Choosing the Right Key Person Disability Insurance Policy

Selecting the optimal key person disability insurance policy requires careful consideration of various factors. Different types of policies cater to specific needs, and it’s crucial to understand the available options and their respective features.

Types of Key Person Disability Insurance Policies

- Own-Occupation Policies: Benefits are payable if the insured is unable to perform the duties of their own occupation.

- Any-Occupation Policies: Benefits are payable if the insured is unable to perform any occupation for which they are reasonably qualified.

- Business Overhead Expense (BOE) Policies: Covers essential business expenses, such as rent, utilities, and salaries, in the event of a key person’s disability.

Features to Consider

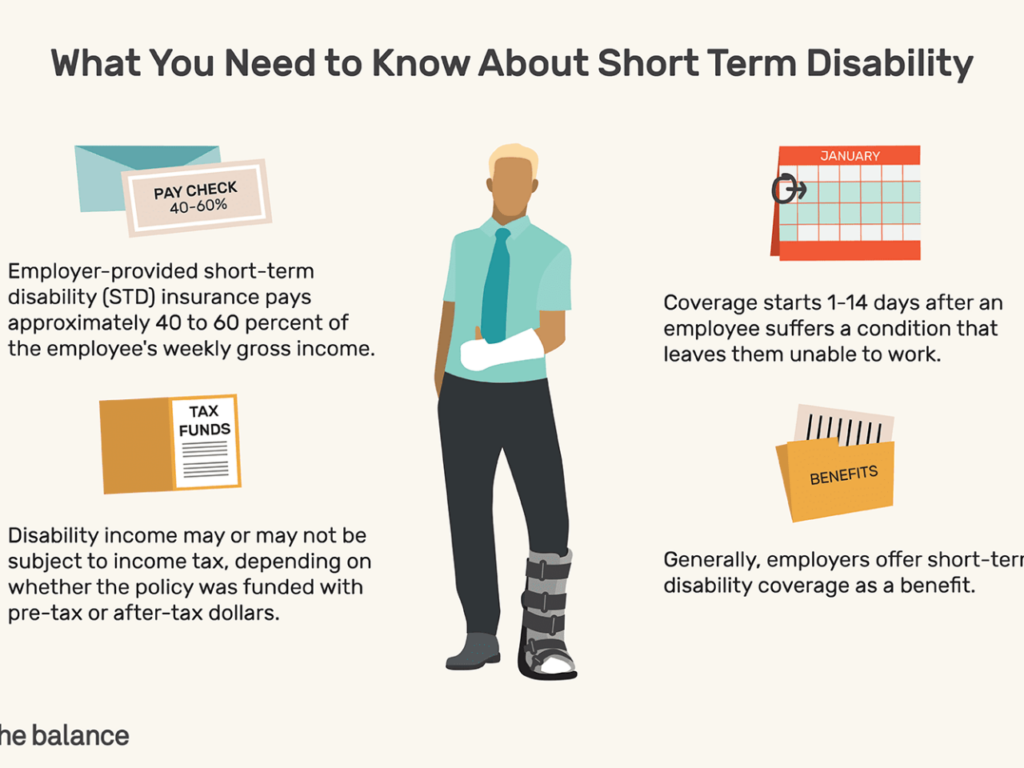

- Definition of Disability: Clearly defines the criteria for eligibility for benefits.

- Benefit Period: The duration for which benefits are payable.

- Waiting Period: The time between the onset of disability and the start of benefit payments.

- Benefit Amount: The monthly income replacement provided during disability.

- Riders: Optional coverage enhancements, such as cost-of-living adjustments or rehabilitation benefits.

Checklist for Comparing Policies

- What is the definition of disability used in the policy?

- How long is the benefit period?

- What is the waiting period?

- What is the maximum benefit amount?

- Are there any riders available?