Customer Service Issues

Progressive Insurance has faced criticism for its customer service practices. Complaints often revolve around:

- Long wait times on the phone and online chat.

- Unresponsive or unhelpful customer service representatives.

- Difficulty resolving claims and disputes.

- Lack of transparency and clear communication.

Impact on Customer Satisfaction and Loyalty

Poor customer service can significantly impact customer satisfaction and loyalty. When customers feel frustrated or dissatisfied with their interactions with a company, they are less likely to do business with them in the future. In the case of Progressive Insurance, negative customer service experiences have led to:

- Customers switching to other insurance providers.

- Negative reviews and complaints on social media and online forums.

- Damage to the company’s reputation.

Claim Handling

Progressive Insurance’s claim handling process has been met with widespread dissatisfaction among its customers. The company has been accused of delaying or denying claims, often without providing a clear explanation. This has led to a loss of trust and confidence among policyholders, who feel that they are not being treated fairly.

Delayed Claims

One of the most common complaints about Progressive Insurance is that it takes too long to process claims. Customers have reported waiting weeks or even months for their claims to be settled, which can cause significant financial hardship. In some cases, customers have been forced to pay out-of-pocket for repairs or medical expenses while they wait for their claims to be processed.

Denied Claims

Another major issue with Progressive Insurance is that it has a high rate of denied claims. Customers have reported being denied for a variety of reasons, including:

- The claim was not covered by their policy.

- The claim was not filed within the time limit.

- The claim was fraudulent.

In some cases, customers have been denied for claims that they believe should have been covered. This has led to frustration and anger among policyholders, who feel that they are being taken advantage of.

Impact on Customer Trust and Confidence

The inefficient claim handling process at Progressive Insurance has had a significant impact on customer trust and confidence. Customers who have had their claims delayed or denied are less likely to trust the company in the future. This can lead to customers switching to other insurance providers, which can result in lost revenue for Progressive Insurance.

Premium Costs

Progressive Insurance premiums often exceed those of its competitors, raising concerns about affordability and value for customers. Excessive premium increases, sometimes without justification, have been reported by policyholders. Factors contributing to high premiums include the company’s underwriting practices, claims history, and operational expenses. These elevated costs impact customer affordability, potentially limiting access to essential insurance coverage.

Comparative Analysis

Progressive Insurance’s premiums are generally higher than industry averages. According to a study by the National Association of Insurance Commissioners (NAIC), Progressive’s average annual premium for full coverage auto insurance is $1,732, compared to the industry average of $1,428. This premium disparity is particularly noticeable in certain states, where Progressive’s rates can be significantly higher than local competitors.

Unreasonable Premium Increases

Policyholders have expressed concerns about excessive and unreasonable premium increases. Some have reported premium hikes of over 50% within a short period, even without any accidents or violations on their driving record. These unexplained increases have led to financial hardship for many customers, forcing them to consider alternative insurance options.

Contributing Factors

Several factors contribute to Progressive Insurance’s high premium costs:

– Underwriting Practices: Progressive uses a proprietary underwriting model that considers various factors to assess risk, including driving history, credit score, and vehicle type. This model may result in higher premiums for certain drivers, even if they have a clean driving record.

– Claims History: Progressive’s claims handling practices have been criticized by some policyholders. Delays in processing claims and disputes over coverage can lead to higher premiums for customers who file claims.

– Operational Expenses: Progressive’s high operational expenses, including marketing and advertising costs, contribute to its elevated premiums. These expenses are passed on to customers in the form of higher premiums.

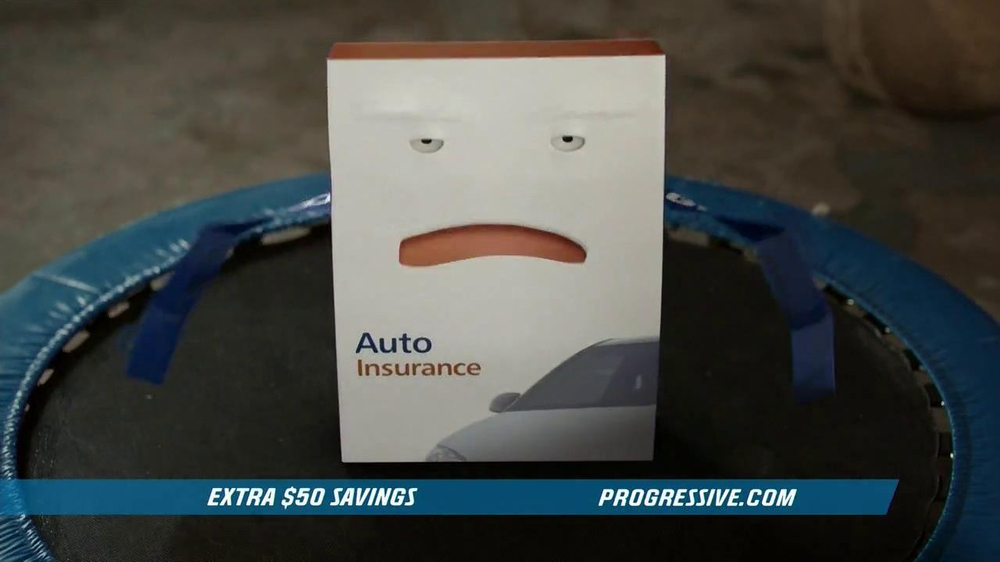

Marketing and Advertising

Progressive Insurance has consistently employed creative and memorable marketing campaigns, featuring characters like Flo and Jamie. However, these campaigns have also faced criticism and backlash.

Negative Perceptions from Advertising

Progressive’s marketing efforts have contributed to negative perceptions of the company, particularly due to:

- Exaggerated Claims: Some advertisements have been accused of making unrealistic promises, leading to customer disappointment when expectations are not met.

- Unfair Portrayals: Critics argue that certain ads unfairly depict other insurance companies or customers as incompetent or irresponsible.

- Repetitive Nature: The constant presence of Flo and other characters in Progressive’s advertising can become irritating and repetitive for some consumers.

Specific Controversial Campaigns

Some specific Progressive Insurance advertisements have drawn significant criticism, including:

- “Insurance Sucks”: A campaign that used the slogan “Insurance Sucks” was criticized for being negative and not reflecting the actual value of insurance products.

- “Parent Test”: An advertisement that showed a parent testing their child’s driving skills was criticized for being insensitive and promoting risky behavior.

- “Famous Flo”: A series of ads featuring celebrities playing the role of Flo faced backlash for being confusing and not effectively promoting the company’s products.

Online Presence

Progressive Insurance maintains a comprehensive online presence, offering its services through a website and a mobile app. The website features a user-friendly interface, allowing customers to easily access information about the company’s products, policies, and claims processes. The mobile app provides a convenient platform for policy management, bill payment, and roadside assistance.

User Experience

The website and mobile app provide a seamless user experience, with intuitive navigation and clear presentation of information. Users can quickly find the information they need, whether it’s comparing quotes, filing a claim, or managing their policy. The website also features interactive tools, such as a claims estimator and a policy comparison tool, which enhance the user experience.

Technical Issues and Navigation Challenges

Overall, the website and mobile app function smoothly, with minimal technical issues or navigation challenges. However, some users have reported occasional glitches, such as slow loading times or difficulties accessing certain features. These issues are typically resolved quickly by Progressive’s technical support team.

Impact of Negative Online Reviews and Social Media Sentiment

Progressive Insurance has received mixed reviews online, with some customers expressing dissatisfaction with the company’s claims handling or customer service. Negative reviews and social media sentiment can impact the company’s reputation, potentially leading to loss of customers. However, Progressive actively monitors online reviews and social media platforms, responding to customer concerns and addressing any issues raised.

Company Policies

Progressive Insurance has faced criticism over certain company policies that have been perceived as unfair or discriminatory.

Underwriting Practices

Progressive’s underwriting practices have been scrutinized for potential biases. Critics argue that the company’s use of certain factors, such as credit history and driving records, can lead to unfair discrimination against certain demographic groups. For instance, individuals with lower credit scores or a history of minor traffic violations may be charged higher premiums or denied coverage altogether. These practices have raised concerns about the company’s commitment to fair and equitable treatment of all customers.

Industry Comparisons

Progressive Insurance has a significant presence in the insurance industry, but its performance and reputation may vary in comparison to other providers. Here’s a detailed analysis of Progressive Insurance’s standing within the industry:

Strengths and Weaknesses

Progressive Insurance holds several advantages over its competitors. It is renowned for its innovative advertising campaigns, user-friendly online platform, and tailored insurance products. However, it also faces challenges in certain areas. Some customers have reported difficulties with customer service and claim handling processes, which can impact overall satisfaction.

Competitive Landscape

Progressive Insurance operates in a highly competitive insurance market. Major rivals include State Farm, Geico, and Allstate. These companies offer a wide range of insurance products, including auto, home, and business insurance. They also employ various marketing and advertising strategies to attract customers.

Industry Benchmarks

To evaluate Progressive Insurance’s performance objectively, it is essential to compare it against industry benchmarks. Key metrics include customer satisfaction ratings, financial stability, and claim settlement ratios. By analyzing these factors, we can determine how Progressive Insurance fares in comparison to its peers.

Areas for Improvement

Based on customer feedback and industry analysis, Progressive Insurance can improve in certain areas. Enhancing customer service responsiveness and streamlining claim handling processes could lead to higher satisfaction levels. Additionally, expanding coverage options and offering competitive pricing can help the company gain a stronger foothold in the market.

Customer Testimonials

Negative customer testimonials and reviews can be a valuable source of feedback for Progressive Insurance. By collecting and organizing these complaints, the company can identify common themes and patterns that can help it improve its products and services. Negative customer feedback can also have a significant impact on the company’s credibility and reputation, so it is important for Progressive Insurance to take these complaints seriously and address them in a timely and professional manner.

Common Themes and Patterns in Customer Complaints

- Delays in claims processing: Many customers have complained about long delays in the claims processing process. This can be a major inconvenience for customers who are waiting to receive compensation for their losses.

- Denial of claims: Some customers have complained that Progressive Insurance has denied their claims without providing a clear explanation. This can be frustrating and confusing for customers who believe that they have a valid claim.

- Poor customer service: Many customers have complained about poor customer service from Progressive Insurance. This includes rude or unhelpful customer service representatives, long wait times on the phone, and difficulty getting a response to emails or letters.

- Hidden fees: Some customers have complained about hidden fees that they were not aware of when they purchased their insurance policy. This can lead to unexpected costs and frustration.

Impact of Negative Customer Feedback on the Company’s Credibility and Reputation

Negative customer feedback can have a significant impact on a company’s credibility and reputation. When customers have a bad experience with a company, they are more likely to share their experience with others. This can damage the company’s reputation and make it more difficult to attract new customers. In the case of Progressive Insurance, negative customer feedback has led to a decrease in the company’s overall rating on consumer review websites. This has made it more difficult for Progressive Insurance to compete with other insurance companies that have a better reputation for customer service.