Project Information

To accurately calculate the cost of builders risk insurance, we require specific details about your construction project. This information will provide the basis for determining the appropriate coverage and premium.

Please provide the following project details:

Project Location

- City and state where the project will be constructed.

Project Size

- Total square footage or dimensions of the building or structure.

Construction Type

- Type of construction, such as wood frame, masonry, or steel.

Estimated Project Cost

- Total estimated cost of the project, including materials, labor, and other expenses.

Risk Assessment

Risk assessment is a crucial step in determining the cost of builders risk insurance. It involves identifying and evaluating potential risks that may impact the construction project.

These risks can be categorized into three main types:

Weather Events

Weather-related events, such as storms, hurricanes, and floods, can cause significant damage to construction materials, equipment, and the structure itself. The likelihood and severity of these events vary depending on the location and time of year.

Theft

Theft is another common risk during construction projects. Valuable materials, tools, and equipment can be stolen, leading to delays and increased costs.

Liability

Liability risks arise from accidents or injuries that may occur on the construction site. These risks include bodily injury to workers, damage to neighboring properties, and environmental pollution.

Insurance Coverage

Builders risk insurance provides comprehensive protection for construction projects, covering various types of risks. The policy offers three main coverage categories: property, liability, and additional coverages.

Property coverage protects the physical assets of the construction project, including materials, equipment, and the structure itself. Liability coverage provides protection against claims arising from bodily injury or property damage to third parties during the construction process. Additional coverages can be tailored to specific project needs, such as coverage for theft, vandalism, and weather-related events.

Property Coverage

- Materials: Covers raw materials, supplies, and equipment used in the construction project.

- Structures: Protects the building or structure being constructed, including its components and fixtures.

- Temporary Structures: Covers temporary structures, such as scaffolding, fencing, and portable toilets.

- Debris Removal: Provides coverage for the removal and disposal of debris resulting from a covered loss.

Cost Calculation Factors

The cost of builders risk insurance is determined by several factors, including the project duration, risk exposure, and insurance provider. These factors influence the premium amount and can vary significantly depending on the specific circumstances of the project.

The project duration plays a significant role in determining the cost of builders risk insurance. Longer project durations typically result in higher premiums, as the insurance coverage is required for an extended period. This is because the longer the project, the greater the likelihood of an insured event occurring, such as damage to the property or materials due to weather or vandalism.

Risk Exposure

The risk exposure associated with the project also affects the cost of builders risk insurance. Projects that involve high-risk activities, such as construction in hazardous areas or using specialized equipment, typically have higher premiums. This is because the insurance company assesses the potential for losses and adjusts the premium accordingly.

Insurance Provider

The insurance provider also influences the cost of builders risk insurance. Different insurance companies offer varying rates and coverage options, and it is important to compare quotes from multiple providers to find the best deal. Factors such as the company’s financial stability, claims history, and reputation can impact the premium amount.

Cost Calculator Features

Builders risk insurance cost calculators simplify the estimation process by providing a user-friendly interface with straightforward input fields, calculation methods, and output options tailored to the specific needs of construction projects.

These calculators are designed to streamline the process, ensuring accuracy and efficiency in determining the appropriate insurance coverage and associated costs.

Input Fields

The input fields in a builders risk insurance cost calculator typically include:

- Project location and address

- Project type (residential, commercial, etc.)

- Construction value or estimated project cost

- Project duration

- Coverage options (e.g., perils insured against, deductibles)

Calculation Methods

The calculators employ sophisticated algorithms and industry-standard formulas to determine the insurance premium based on the inputted information. These methods consider factors such as:

- Project size and complexity

- Location-specific risk factors (e.g., natural disaster zones)

- Coverage limits and deductibles

- Historical claims data and industry trends

Output Options

The output of a builders risk insurance cost calculator typically includes:

- Estimated insurance premium

- Coverage details (e.g., perils insured against, coverage limits)

- Premium breakdown (e.g., base premium, additional charges)

- Customized reports and quotes

Using the Cost Calculator

Using a builders risk insurance cost calculator is a straightforward process that involves gathering project information, assessing risks, and inputting data into the calculator.

Step 1: Gather Project Information

The first step is to gather essential project information, such as the project location, construction type, estimated project cost, and project duration. This information provides the calculator with a foundation for determining the insurance premium.

Step 2: Assess Risks

Next, assess the potential risks associated with the project. Consider factors such as the weather conditions in the project area, the type of construction materials being used, and any potential hazards on the job site. Identifying these risks helps the calculator determine the appropriate level of coverage.

Step 3: Input Data into the Calculator

Once the project information and risk assessment are complete, input the data into the cost calculator. The calculator will typically ask for information such as the project address, estimated project cost, construction type, project duration, and any additional coverage options desired.

Step 4: Generate the Cost Estimate

Once all the necessary data is entered, the calculator will generate a cost estimate for the builders risk insurance policy. This estimate provides an approximation of the premium that will be charged for the policy.

Step 5: Review and Compare Quotes

If desired, compare quotes from multiple insurance providers to ensure you are getting the best coverage at a competitive price. Carefully review the terms and conditions of each policy to ensure it meets your project’s specific needs.

Additional Considerations

In addition to the factors discussed above, several other considerations can impact the cost of builders risk insurance. These include deductibles, limits, and exclusions.

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. A higher deductible will generally result in a lower premium. However, it’s important to choose a deductible that you can afford to pay if you need to file a claim.

Limits refer to the maximum amount your insurance company will pay for a covered loss. It’s important to choose limits that are high enough to cover the potential cost of rebuilding or repairing your home in the event of a covered loss.

Exclusions are specific events or situations that are not covered by your insurance policy. It’s important to review your policy carefully to understand what is and is not covered.

Policy Endorsements

Policy endorsements can be added to your builders risk insurance policy to provide additional coverage. For example, you can purchase an endorsement to cover theft of materials or damage caused by vandalism.

Premium Discounts

There are several ways to save money on your builders risk insurance premium. These include:

- Installing security features, such as a burglar alarm or security fence.

- Maintaining a good claims history.

- Bundling your builders risk insurance with other types of insurance, such as homeowners insurance.

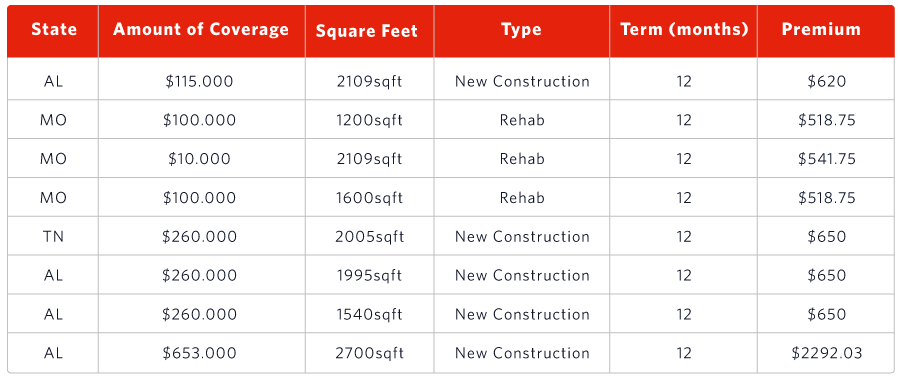

Examples and Case Studies

Builders risk insurance cost calculators have become a valuable tool for contractors and property owners in managing risk and estimating project costs. Here are a few examples of how these calculators have been used in real-world scenarios:

One contractor used a cost calculator to determine the appropriate amount of insurance coverage for a large-scale construction project. The calculator helped them estimate the potential financial losses associated with various risks, such as weather events, theft, and vandalism. This information enabled them to make informed decisions about their insurance policy and secure adequate protection for their project.

Case Study

A property owner utilized a cost calculator to compare insurance quotes from different providers. By inputting project details and risk factors, they were able to identify the most competitive and comprehensive insurance options available. This analysis saved them time and money by allowing them to select the policy that best met their specific needs.