Risks Associated with Fake Car Insurance Cards

Using a fake car insurance card is a serious offense that can lead to severe consequences. It is essential to understand the potential risks involved before engaging in such illegal activities.

Fake car insurance cards are illegal and carry significant legal and financial penalties. Individuals caught using fake cards may face fines, jail time, and license suspensions or revocations.

Legal Consequences

- Fines: Using a fake car insurance card can result in substantial fines, ranging from hundreds to thousands of dollars.

- Jail Time: In some cases, individuals may face jail time for using a fake car insurance card, especially if they are involved in an accident or other traffic violation.

- License Suspension or Revocation: Using a fake car insurance card can lead to the suspension or revocation of your driver’s license, making it illegal to operate a vehicle.

Financial Consequences

- Denied Claims: If you are involved in an accident while using a fake car insurance card, your claim will be denied, leaving you financially responsible for all damages.

- Increased Insurance Premiums: If you are caught using a fake car insurance card, your insurance premiums may increase significantly, as insurance companies view you as a high-risk driver.

- Civil Lawsuits: Victims of accidents involving drivers with fake car insurance cards may file civil lawsuits against the driver, seeking compensation for damages.

Real-Life Examples

In 2022, a driver in California was arrested for using a fake car insurance card after being involved in a hit-and-run accident. The driver was fined $5,000 and sentenced to 30 days in jail.

In 2021, a driver in Texas had their license revoked for using a fake car insurance card. The driver was stopped by the police for speeding and was unable to provide proof of insurance.

Methods of Detecting Fake Car Insurance Cards

Identifying fake car insurance cards is crucial to ensure the validity and authenticity of the coverage. There are several methods to spot fraudulent cards, ranging from visual inspection to online verification.

Physical Examination

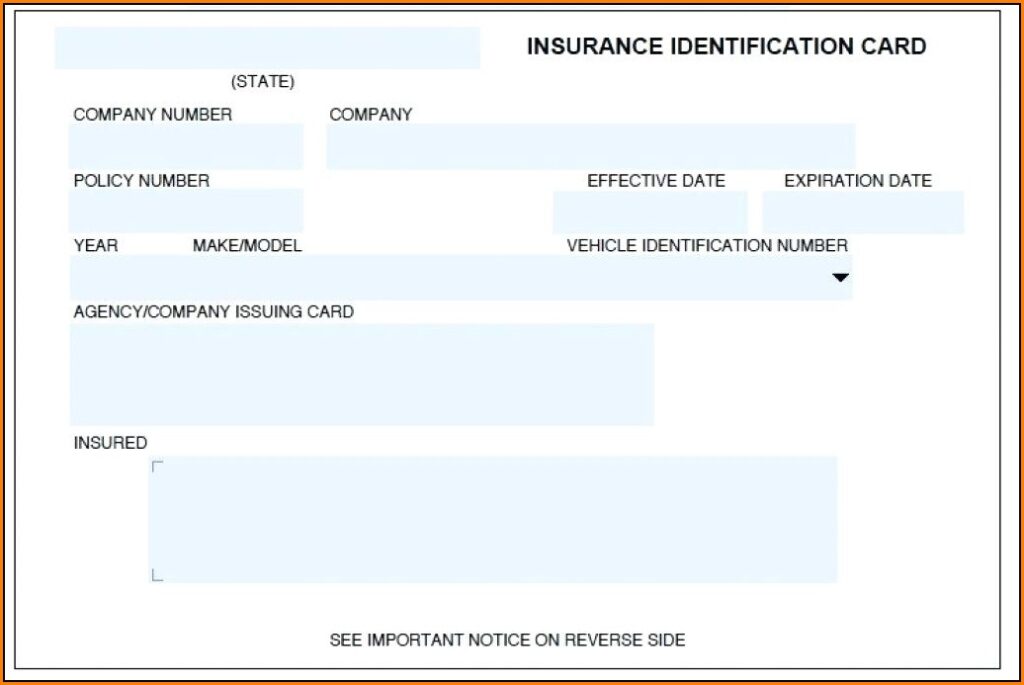

Inspect the physical characteristics of the card thoroughly. Genuine cards typically have the following features:

- High-quality printing with clear and sharp details

- Embossed or raised lettering and numbers

- Holograms or watermarks

- Security features such as microprinting or UV-reactive ink

Online Verification

Many insurance companies provide online portals where you can verify the authenticity of a car insurance card. Simply enter the policy number or other identifying information to check if the card is valid.

Other Indicators

Additional telltale signs of a fake car insurance card include:

- Misspellings or grammatical errors

- Inconsistent or incomplete information

- Lack of a policy expiration date

- Suspiciously low premiums

Consequences of Using Fake Car Insurance Cards

Using a fake car insurance card is a serious offense with severe consequences. It can lead to a lack of coverage in the event of an accident, potential legal implications, and even criminal charges.

Impact on Insurance Coverage and Claims

A fake car insurance card will render any insurance policy invalid, leaving you financially responsible for any damages or injuries resulting from an accident. Insurance companies have the right to investigate claims and may request proof of insurance. If a fake card is presented, the claim will likely be denied, and you will be held liable for all expenses.

Legal Implications

Using a fake car insurance card is illegal and can result in criminal charges, such as:

- Forgery

- Fraud

- Driving without insurance

These charges can carry fines, jail time, and suspension or revocation of your driver’s license.

Preventing the Use of Fake Car Insurance Cards

Preventing the use of fake car insurance cards requires a multifaceted approach involving insurance companies, law enforcement, and public education. Here are some strategies to combat this issue:

Insurance Company Initiatives

- Implement advanced verification systems: Use sophisticated technology to verify the authenticity of insurance cards, such as holograms, watermarks, and unique identifiers.

- Educate agents and customers: Train insurance agents to identify suspicious insurance cards and inform customers about the dangers of using fake ones.

- Collaborate with law enforcement: Share information and resources with law enforcement agencies to investigate and prosecute individuals involved in fake insurance card schemes.

Law Enforcement Role

Law enforcement plays a crucial role in deterring and punishing the use of fake car insurance cards:

- Increase penalties: Enact stricter laws and impose harsher penalties for possessing or using fake insurance cards.

- Conduct sting operations: Use undercover operations to identify and arrest individuals involved in the distribution of fake insurance cards.

- Educate the public: Inform the community about the consequences of using fake insurance cards and encourage reporting suspicious activity.

Public Education and Awareness

Educating the public about the risks and consequences of using fake car insurance cards is essential for prevention:

- Public awareness campaigns: Launch campaigns to inform drivers about the dangers of fake insurance cards and the importance of obtaining genuine coverage.

- Media outreach: Collaborate with the media to spread awareness about the issue and share stories of individuals affected by fake insurance cards.

- Community outreach: Engage with local organizations and community groups to educate residents about the risks of fake insurance cards.

Case Studies of Fake Car Insurance Card Fraud

Fake car insurance card fraud involves the use of forged or altered insurance cards to deceive law enforcement, insurance companies, and other parties. These cases highlight the prevalence of insurance fraud and its far-reaching consequences.

Detection and Prosecution

Detecting fake car insurance cards requires vigilance from various stakeholders. Law enforcement officers may verify insurance information through databases or contact the insurance company directly. Insurance companies employ fraud detection systems and investigate suspicious claims. Prosecutions rely on evidence such as forged signatures, altered documents, and discrepancies in insurance records.

Impact on Insurance Industry

Fake car insurance cards increase the cost of insurance for legitimate drivers. Insurance companies must cover the costs associated with fraudulent claims, leading to higher premiums for all policyholders. Moreover, fraud undermines the integrity of the insurance system and erodes public trust.

Impact on Society

Fake car insurance cards pose risks to public safety. Uninsured drivers involved in accidents may leave victims without compensation. Furthermore, fraud diverts resources away from legitimate insurance claims and can contribute to a sense of impunity among criminals.

Notable Cases

- In 2021, a Florida man was arrested for possessing over 200 fake car insurance cards. He sold these cards to uninsured drivers, allowing them to avoid detection by law enforcement.

- In 2019, an insurance company in California uncovered a large-scale ring that produced and distributed fake car insurance cards. The cards were used by organized crime groups to launder money and evade detection.

Technological Advancements in Detecting Fake Car Insurance Cards

The rise of sophisticated technology has revolutionized the detection of fake car insurance cards. These advancements empower insurers and law enforcement agencies to identify fraudulent activities with greater accuracy and efficiency.

One significant advancement is the use of artificial intelligence (AI) algorithms. AI-powered systems can analyze vast databases of genuine and fake insurance cards, identifying patterns and anomalies that escape human detection. These algorithms can flag suspicious cards based on factors such as inconsistencies in font, layout, and security features.

Data Analytics and Cross-Referencing

Advanced data analytics techniques enable insurers to cross-reference information from multiple sources, such as vehicle registration records and police reports. By comparing data points, they can detect discrepancies that indicate potential fraud. For instance, a vehicle registered to one person may have an insurance card issued under a different name.