Overview of Credit Life Insurance

Credit life insurance is a type of insurance that pays off the remaining balance on a loan if the borrower dies before the loan is paid off. It is typically offered by lenders when you take out a loan, and it can provide peace of mind knowing that your loved ones will not be burdened with your debt if you pass away.

There are two main types of credit life insurance: term life insurance and whole life insurance. Term life insurance provides coverage for a specific period of time, such as the length of your loan. Whole life insurance provides coverage for your entire life, and it also has a cash value component that grows over time.

There are several benefits to having credit life insurance. First, it can provide peace of mind knowing that your loved ones will not be burdened with your debt if you pass away. Second, it can help protect your credit score. If you die with an unpaid loan, your credit score could be damaged, which could make it difficult for your loved ones to get credit in the future.

There are also some limitations to credit life insurance. First, it can be expensive. The cost of credit life insurance is typically added to your loan balance, which means you will pay interest on the cost of the insurance. Second, credit life insurance only covers the balance of your loan. If you have other debts, such as credit card debt, credit life insurance will not cover those debts.

Overall, credit life insurance can be a valuable tool for protecting your loved ones and your credit score. However, it is important to understand the costs and limitations of credit life insurance before you purchase it.

Types of Credit Life Insurance

- Term life insurance

- Whole life insurance

Benefits of Credit Life Insurance

- Provides peace of mind

- Protects your credit score

Limitations of Credit Life Insurance

- Can be expensive

- Only covers the balance of your loan

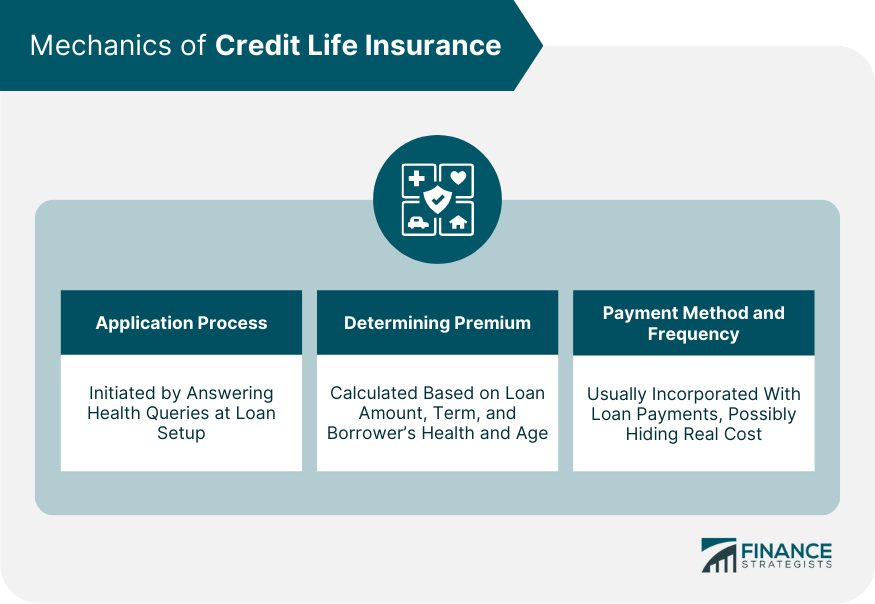

How Credit Life Insurance Works

Obtaining credit life insurance involves contacting an insurance company or lender that offers the coverage. The application process typically requires providing personal and financial information, including your income, debts, and health history. The insurer will review your application and determine your eligibility and premium amount.

Credit life insurance premiums are calculated based on factors such as your age, health, loan amount, and loan term. The premium is typically paid monthly or annually and added to your loan payment. The coverage amount is usually equal to the outstanding loan balance and decreases as you repay the loan.

Coverage Limits and Exclusions

Credit life insurance policies have coverage limits, which vary depending on the insurer and the loan amount. Some policies may also have exclusions, such as death due to suicide, war, or high-risk activities.

Pros and Cons of Credit Life Insurance

Credit life insurance has both advantages and disadvantages. It is important to weigh the pros and cons before deciding whether or not to purchase this type of insurance.

Some of the advantages of credit life insurance include:

- It can help to protect your family from financial hardship in the event of your death.

- It can help to pay off your debts, such as a mortgage or car loan, in the event of your death.

- It can be relatively inexpensive.

Some of the disadvantages of credit life insurance include:

- It may not cover all of your debts.

- It may not be necessary if you have other life insurance policies.

- It may be more expensive than other types of life insurance.

It is important to compare credit life insurance to other types of life insurance before making a decision. Term life insurance is typically less expensive than credit life insurance and can provide more coverage. Whole life insurance provides lifelong coverage and can build cash value over time, but it is more expensive than term life insurance.

Factors to Consider Before Purchasing Credit Life Insurance

Before deciding whether to purchase credit life insurance, it’s crucial to consider the following factors:

– Assess your financial situation: Determine if you have sufficient assets or other sources of income to cover your debts in the event of your death.

– Consider your health and age: Credit life insurance premiums are typically higher for individuals with pre-existing health conditions or who are older.

– Evaluate the cost of the policy: Compare the cost of the premium with the amount of coverage you will receive. Ensure that the policy provides adequate protection without being too expensive.

– Read the policy carefully: Understand the terms and conditions of the policy, including the coverage limits, exclusions, and premium payment schedule.

Importance of Comparing Different Policies

Comparing different credit life insurance policies is essential to find the best coverage for your needs. Consider the following when comparing policies:

– Coverage amount: Determine the amount of coverage you need to pay off your debts in the event of your death.

– Premium costs: Compare the premiums of different policies to find the most affordable option.

– Exclusions: Review the exclusions in each policy to ensure they align with your specific circumstances.

– Reputation of the insurer: Research the reputation and financial stability of the insurance company.

Finding the Best Credit Life Insurance Policy

To find the best credit life insurance policy, follow these steps:

– Get quotes from multiple insurers: Contact different insurance companies to obtain quotes and compare their offerings.

– Consider your specific needs: Evaluate your financial situation, health, and coverage requirements to determine the best policy for you.

– Read reviews and ratings: Check online reviews and ratings from reputable sources to learn about the experiences of other policyholders.

– Consult a financial advisor: If needed, seek professional advice from a financial advisor who can guide you through the process and help you make an informed decision.

By considering these factors and following these steps, you can make an informed decision about whether to purchase credit life insurance and find the best policy to meet your needs.

Alternatives to Credit Life Insurance

Credit life insurance is not the only option for protecting against the financial burden of unpaid debt. Several alternatives offer similar coverage, each with its own benefits and drawbacks.

Exploring these alternatives can help individuals make informed decisions based on their specific needs and financial circumstances.

Personal Savings

Maintaining a sufficient emergency fund can serve as an alternative to credit life insurance. By setting aside money regularly, individuals can create a financial cushion to cover unexpected expenses, including debt payments in the event of job loss or disability.

The primary benefit of personal savings is the flexibility it provides. Unlike credit life insurance, which is tied to a specific loan or credit account, savings can be used for any purpose.

However, relying solely on personal savings may not be feasible for everyone, especially those with limited income or high debt obligations.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can reduce monthly payments and make it easier to manage debt.

Debt consolidation can be a viable alternative to credit life insurance for individuals with good credit scores who can qualify for favorable loan terms. However, it is important to note that debt consolidation does not eliminate debt but simply changes its structure.

Credit Counseling

Non-profit credit counseling agencies offer free or low-cost services to help individuals manage debt and improve their financial health. Credit counselors can provide personalized advice, negotiate with creditors, and develop a budget to reduce expenses and pay down debt.

Credit counseling is a valuable resource for individuals who are struggling with debt and need assistance in creating a plan to become debt-free.

Bankruptcy

Bankruptcy is a legal process that allows individuals to discharge or reorganize their debts. While bankruptcy can provide relief from overwhelming debt, it has serious consequences and should only be considered as a last resort.

Filing for bankruptcy can damage credit scores, making it difficult to obtain credit in the future. It is essential to consult with an attorney to fully understand the implications of bankruptcy before making a decision.