Car Insurance Market in Fort Collins

Fort Collins has a large and vibrant car insurance market, with a high percentage of insured vehicles. According to the Colorado Division of Insurance, there were over 160,000 insured vehicles in Fort Collins in 2021, representing approximately 85% of all registered vehicles in the city.

The demographics of car owners in Fort Collins are diverse, with a mix of young professionals, families, and retirees. The city is home to Colorado State University, which contributes to a large student population. As a result, there is a high demand for affordable car insurance options for both students and young drivers.

Major Car Insurance Providers in Fort Collins

There are several major car insurance providers in Fort Collins, including:

- State Farm

- Geico

- Progressive

- Allstate

- Farmers Insurance

Factors Affecting Car Insurance Rates in Fort Collins

The cost of car insurance in Fort Collins is influenced by several key factors. Understanding these factors can help you make informed decisions and potentially lower your insurance premiums.

Driving History

Your driving history plays a significant role in determining your insurance rates. A clean driving record, free of accidents and traffic violations, typically results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUIs can lead to higher rates.

Vehicle Type and Age

The type and age of your vehicle also impact your insurance costs. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure than sedans or economy cars. Additionally, older vehicles may have higher insurance premiums due to the increased risk of mechanical problems.

Location and ZIP Code

Your location and ZIP code can also affect your car insurance rates. Areas with higher rates of accidents, theft, or vandalism typically have higher insurance costs. Conversely, areas with lower crime rates and safer driving conditions may have lower insurance premiums.

Coverage Options for Car Insurance in Fort Collins

Fort Collins offers a range of car insurance coverage options to meet the unique needs of drivers. Understanding the benefits and limitations of each option is crucial for making informed decisions.

Liability Coverage

Liability coverage protects you from financial responsibility for injuries or property damage caused to others in an accident you’re at fault for.

- Bodily Injury Liability: Covers medical expenses and lost wages for injured parties.

- Property Damage Liability: Pays for damage to property belonging to others.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object.

- Benefits: Provides financial protection for your vehicle’s value.

- Limitations: May have a higher deductible and premiums.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision-related events, such as theft, vandalism, or weather damage.

- Benefits: Offers broader protection against various risks.

- Limitations: Typically has a higher deductible and premiums than collision coverage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you from financial losses if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Benefits: Provides financial protection in case of accidents with uninsured or underinsured drivers.

- Limitations: May have a lower coverage limit than your liability coverage.

Personal Injury Protection (PIP)

PIP coverage pays for medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault.

- Benefits: Provides immediate financial assistance for medical expenses and lost income.

- Limitations: May have a lower coverage limit than your health insurance.

Rental Reimbursement Coverage

Rental reimbursement coverage pays for the cost of a rental car while your vehicle is being repaired after an accident.

- Benefits: Provides transportation during the repair period.

- Limitations: May have a daily or monthly coverage limit.

Finding the Best Car Insurance in Fort Collins

Securing the most suitable car insurance in Fort Collins requires careful consideration. By following a structured approach and employing savvy comparison techniques, you can optimize your coverage and secure the best value for your money.

To guide you through this process, we have designed a comprehensive flowchart that Artikels the key steps involved in finding the best car insurance in Fort Collins:

Flowchart: Steps to Find the Best Car Insurance

- Gather Information: Determine your insurance needs, including coverage levels, deductibles, and limits.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare coverage options and premiums.

- Consider Coverage Options: Evaluate the different types of coverage available, such as liability, collision, and comprehensive.

- Negotiate with Insurance Companies: Explore opportunities to negotiate lower premiums or additional coverage.

- Make an Informed Decision: Choose the insurance policy that best meets your needs and budget.

Tips for Comparing Quotes from Multiple Insurance Providers

- Use Online Comparison Tools: Utilize websites or apps that allow you to compare quotes from multiple insurers simultaneously.

- Contact Insurance Agents: Reach out to independent insurance agents who can provide quotes from various companies.

- Review Company Ratings and Reviews: Check the financial stability and customer satisfaction ratings of different insurance providers.

Negotiating with Insurance Companies

- Ask for Discounts: Inquire about discounts available for factors such as safe driving history, multiple vehicles, or bundling policies.

- Negotiate Deductibles: Discuss the possibility of adjusting your deductibles to lower your premiums.

- Explore Payment Options: Consider different payment plans, such as monthly or annual payments, to find the one that works best for you.

Additional Resources for Car Insurance in Fort Collins

Finding the right car insurance policy can be a daunting task. To help you make an informed decision, here are some additional resources that you may find helpful:

Reputable Websites and Local Agencies

- Colorado Division of Insurance: https://doi.colorado.gov/insurance

- Fort Collins Police Department: https://www.fcgov.com/police

- Larimer County Sheriff’s Office: https://www.larimer.org/sheriff

- Colorado Independent Insurance Agents Association: https://www.ciiaa.com/

- National Association of Insurance Commissioners: https://www.naic.org/

Frequently Asked Questions About Car Insurance in Fort Collins

- What are the minimum car insurance requirements in Fort Collins?

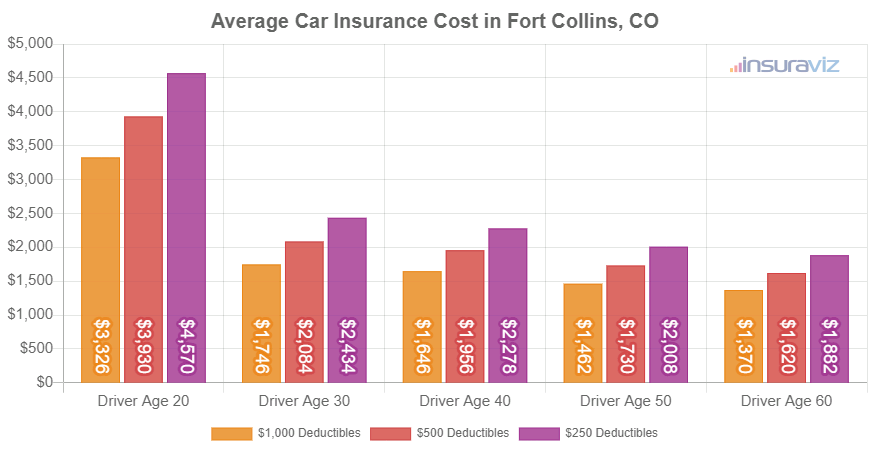

- How much does car insurance cost in Fort Collins?

- What are the different types of car insurance coverage available?

- How can I find the best car insurance rates in Fort Collins?

- What should I do if I am involved in a car accident in Fort Collins?

Glossary of Key Terms Related to Car Insurance

- Bodily injury liability: Coverage that pays for injuries to others caused by you or a driver covered by your policy.

- Collision coverage: Coverage that pays for damage to your car caused by a collision with another vehicle or object.

- Comprehensive coverage: Coverage that pays for damage to your car caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Deductible: The amount you pay out of pocket before your insurance coverage kicks in.

- Premium: The amount you pay for your car insurance policy.