Understanding Long-Term Care Insurance Cost Calculators

Long-term care insurance cost calculators are valuable tools that can help you estimate the potential costs of long-term care and make informed decisions about your financial planning. These calculators consider various factors, such as your age, health status, and desired level of care, to provide personalized cost estimates.

There are several types of long-term care insurance cost calculators available, each with its unique features and benefits. Some calculators are offered by insurance companies, while others are independent and unbiased. It’s important to compare different calculators and choose one that meets your specific needs and provides accurate estimates.

The accuracy of long-term care insurance cost calculator results depends on several factors, including the accuracy of the information you provide, the assumptions used by the calculator, and the quality of the underlying data. It’s important to note that cost estimates are just approximations and may not reflect the actual costs you incur.

Key Factors to Consider When Using a Calculator

Long-term care insurance cost calculators can provide valuable insights into the potential costs of long-term care, but it’s important to consider key factors that can influence the accuracy of the results. Understanding these factors can help you maximize the usefulness of the calculator and make informed decisions about your long-term care planning.

Factors to consider include:

Age

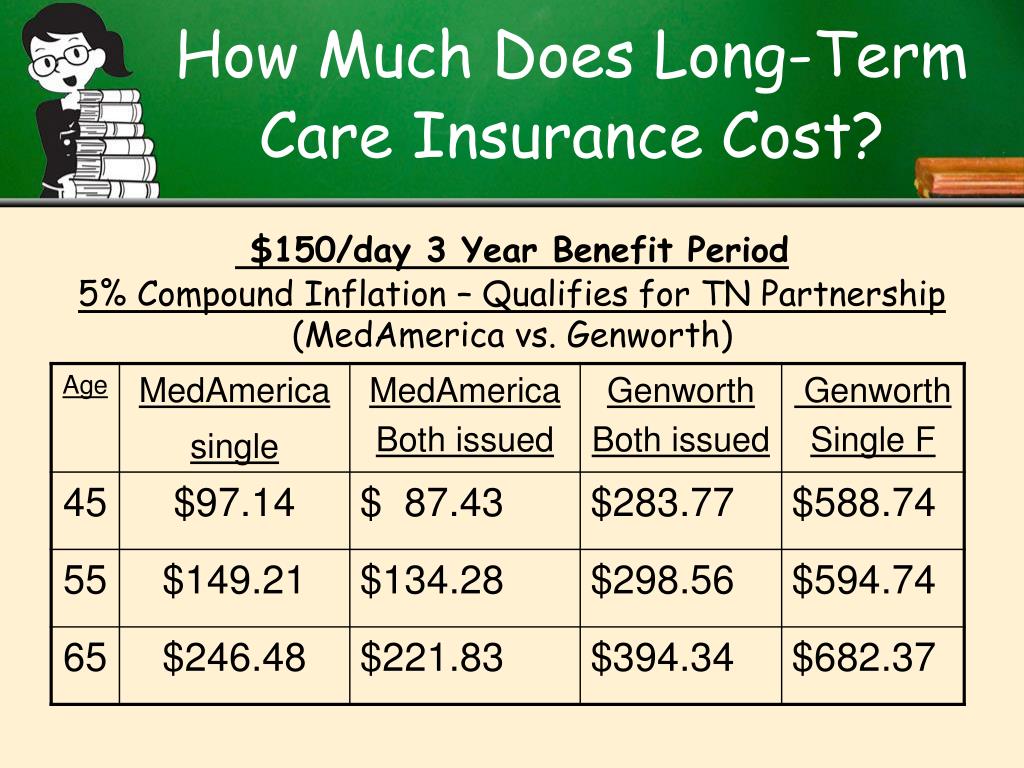

- The age at which you purchase a policy can significantly impact the premium costs. Generally, the younger you are when you buy the policy, the lower the premiums will be.

- As you age, your risk of needing long-term care increases, which can lead to higher premiums.

Health

- Your current health status can also affect the cost of your policy. If you have pre-existing health conditions or a family history of chronic illnesses, you may be considered a higher risk and may have to pay higher premiums.

- On the other hand, if you are in good health and have no major health concerns, you may be eligible for lower premiums.

Lifestyle

- Certain lifestyle factors, such as smoking, drinking alcohol excessively, or having a sedentary lifestyle, can increase your risk of needing long-term care and may result in higher premiums.

- Adopting a healthy lifestyle, including regular exercise, a balanced diet, and avoiding risky behaviors, can help reduce your risk and potentially lower your premiums.

Interpreting the Results of a Cost Calculator

Once you have entered your information into a long-term care insurance cost calculator, you will be presented with a cost estimate. This estimate will typically include the following components:

- Premiums: The amount you will pay each month or year for your policy.

- Benefits: The amount of coverage you will receive if you need long-term care.

- Riders: Optional add-ons that can provide additional coverage, such as inflation protection or home health care.

It is important to carefully review the cost estimate and make sure you understand all of the components. You should also compare the results from different calculators to get a sense of the range of costs you can expect to pay.

Comparing the Results from Different Calculators

When comparing the results from different calculators, it is important to keep the following factors in mind:

- The type of calculator: Some calculators are more comprehensive than others and may include more factors in their calculations.

- The assumptions used: The assumptions that a calculator uses can have a significant impact on the cost estimate. For example, some calculators assume that you will need long-term care for a certain number of years, while others allow you to input your own assumptions.

- The data used: The data that a calculator uses can also affect the cost estimate. For example, some calculators use data from insurance companies, while others use data from government agencies.

By understanding the factors that can affect the cost estimate, you can make an informed decision about which calculator to use and how to interpret the results.

Using Cost Calculators for Planning and Decision-Making

Long-term care insurance cost calculators are valuable tools for financial planning and decision-making. They help you estimate future costs, assess your financial needs, and make informed choices about long-term care insurance coverage.

By inputting your age, health status, location, and desired level of care, cost calculators provide personalized estimates of potential long-term care expenses. This information can help you:

Estimate Future Costs

- Understand the potential financial burden of long-term care.

- Plan for future healthcare expenses and avoid unexpected financial strain.

Make Informed Choices

- Compare different long-term care insurance policies and coverage options.

- Determine the appropriate level of coverage for your individual needs.

li>Evaluate the potential benefits and costs of long-term care insurance.

It’s important to note that cost calculators are estimates and should not be taken as absolute values. Factors such as inflation, changes in healthcare costs, and individual circumstances can affect actual expenses. Therefore, it’s crucial to seek professional advice from a financial advisor or insurance agent to make informed decisions about long-term care insurance coverage.

Advanced Features of Cost Calculators

Long-term care insurance cost calculators often offer advanced features that can enhance their accuracy and usability. These features can include:

Inflation Adjustments

Inflation can significantly increase the cost of long-term care over time. Advanced calculators allow you to adjust for inflation to get a more accurate estimate of future costs.

Customized Coverage Options

Some calculators let you customize your coverage options, such as the length of coverage, daily benefit amount, and elimination period. This allows you to tailor the calculator to your specific needs and preferences.

Tax Implications

Advanced calculators may consider the tax implications of long-term care insurance. This can help you understand the potential tax savings or penalties associated with different coverage options.

Comparison Tools

Some calculators allow you to compare different long-term care insurance policies side-by-side. This can help you make an informed decision about which policy is right for you.