Policy Document Inspection

To ascertain whether you possess gap insurance coverage, a thorough examination of your insurance policy document is paramount. This document Artikels the terms, conditions, and coverages associated with your insurance policy.

Locating Gap Insurance Coverage Section

Within the policy document, locate the section pertaining to comprehensive and collision coverage. Gap insurance is typically included as an add-on to these coverages. Carefully review the language within this section to identify any mention of gap insurance or “loan/lease payoff” coverage.

Interpreting Policy Language

The policy language may vary depending on the insurance provider. However, generally, if the policy states that it covers the “difference between the actual cash value of the vehicle and the amount owed on the loan or lease,” then gap insurance is included.

Communication with Insurance Provider

It is crucial to contact your insurance provider directly to determine if you have gap insurance coverage.

Prepare a list of questions to ask the insurance agent, such as:

- Is gap insurance included in my current policy?

- What is the coverage limit for gap insurance?

- Are there any exclusions or limitations to gap insurance coverage?

- What is the cost of adding gap insurance to my policy?

Listen attentively to the agent’s response and ask clarifying questions if needed. Ensure you understand the terms and conditions of the gap insurance coverage before making a decision.

Loan Agreement Review

Your loan agreement, provided by the lender when you finance your vehicle, contains crucial information about your loan terms, including whether gap insurance is required or recommended.

Locating the Gap Insurance Section

To find the section in your loan agreement that addresses gap insurance, look for the following terms:

- Gap insurance

- Guaranteed Auto Protection (GAP)

- Loan/Lease Protection

Interpreting the Loan Agreement Language

Once you’ve located the gap insurance section, carefully review the language. It will typically state whether gap insurance is:

- Required: You are obligated to purchase gap insurance as a condition of the loan.

- Recommended: Gap insurance is strongly advised but not mandatory.

- Optional: Gap insurance is available for purchase but not required.

Vehicle Value Assessment

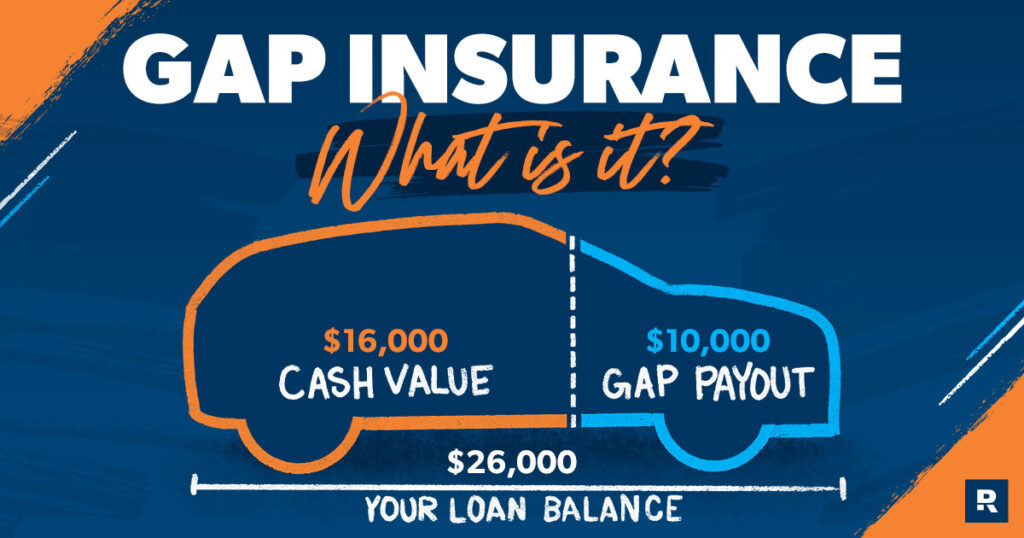

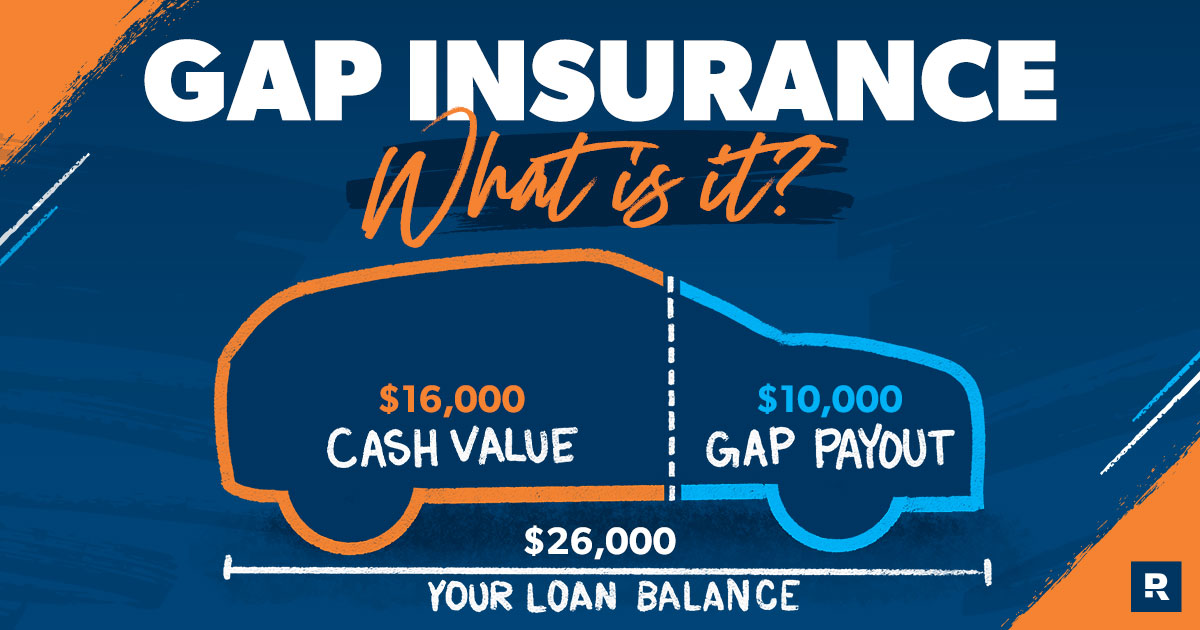

Determining the value of your vehicle is crucial for ascertaining the need for gap insurance. The vehicle’s value represents its current market worth and can be used to compare against the outstanding loan balance.

To obtain an accurate value, you can utilize online resources such as Kelley Blue Book or NADA Guides. These platforms provide estimated values based on the vehicle’s make, model, year, mileage, and condition. Alternatively, you can consult with a professional appraiser for a more precise assessment.

Comparing Vehicle Value to Loan Balance

Once you have determined the vehicle’s value, compare it to the remaining loan balance. If the loan balance exceeds the vehicle’s value, you have negative equity and gap insurance may be necessary to cover the difference in case of a total loss.

Negative Equity = Loan Balance – Vehicle Value

By understanding the vehicle’s value and comparing it to the loan balance, you can make an informed decision about whether gap insurance is right for you.

Coverage Comparison

Gap insurance comes in different types, each with its own set of features, benefits, and limitations. Understanding the various types of gap insurance coverage available will help you select the most suitable option for your needs.

The following table compares the key aspects of different gap insurance coverage types to help you make an informed decision:

| Type of Coverage | Features | Benefits | Limitations |

|---|---|---|---|

| Guaranteed Asset Protection (GAP) |

|

|

|

| Replacement Cost Coverage (RCC) |

|

|

|

| Vehicle Replacement Option (VRO) |

|

|

|

When selecting gap insurance coverage, it is important to consider your individual needs and financial situation. If you have a new car with a high loan-to-value ratio, you may want to consider GAP insurance to protect yourself from having to pay out of pocket if your car is totaled or stolen. If you have an older car with a lower loan-to-value ratio, you may not need gap insurance.

Financial Implications

Gap insurance has financial implications that both protect and incur costs. Understanding these implications is crucial before making a decision about purchasing gap insurance.

The primary financial benefit of gap insurance is its ability to cover the gap between the actual cash value (ACV) of your vehicle and the amount you owe on your loan in the event of a total loss or theft. This protection can save you from having to pay out-of-pocket for the remaining balance on your loan, which can be a significant financial burden.

Costs Associated with Gap Insurance

Gap insurance premiums vary depending on several factors, including the value of your vehicle, the amount you owe on your loan, and the length of your loan term. In general, gap insurance premiums are relatively low, typically ranging from $10 to $50 per year. However, the cost of gap insurance can add up over time, especially if you have a long loan term.

Financial Protection

In the event of a total loss or theft, gap insurance can provide valuable financial protection. Without gap insurance, you may be responsible for paying the remaining balance on your loan, even if the ACV of your vehicle is less than the amount you owe. This can result in a significant financial loss.

For example, if you owe $20,000 on your loan and your vehicle is totaled, the insurance company may only pay you $15,000 for the ACV of your vehicle. This leaves you with a $5,000 balance on your loan that you are responsible for paying. However, if you have gap insurance, the insurance company will pay the remaining $5,000 on your loan, protecting you from this financial loss.