Decreasing Term Life Insurance Definition

Decreasing term life insurance is a type of life insurance that provides coverage for a specific period, with the death benefit decreasing over time. This type of insurance is often used to cover debts or expenses that decrease over time, such as a mortgage or car loan. Decreasing term life insurance is typically less expensive than level term life insurance, which provides a fixed death benefit for the entire policy period.

Advantages of Decreasing Term Life Insurance

– Lower premiums: Decreasing term life insurance premiums are typically lower than level term life insurance premiums because the death benefit decreases over time.

– Coverage for specific needs: Decreasing term life insurance can be tailored to cover specific needs, such as a mortgage or car loan.

– Flexibility: Decreasing term life insurance policies can be customized to meet the individual’s needs, including the coverage amount and the policy period.

Disadvantages of Decreasing Term Life Insurance

– Decreasing death benefit: The death benefit of a decreasing term life insurance policy decreases over time, which means that it may not provide enough coverage in later years.

– Limited coverage: Decreasing term life insurance policies typically do not provide coverage for the entire life of the insured.

– Not suitable for all needs: Decreasing term life insurance may not be suitable for all needs, such as providing coverage for a spouse or children.

Common Uses of Decreasing Term Life Insurance

Decreasing term life insurance serves various purposes, particularly in situations where financial obligations gradually diminish over time. Let’s explore its common applications:

Mortgage Protection

A significant use of decreasing term life insurance is to secure mortgage payments. As the mortgage balance decreases with each payment, the corresponding life insurance coverage reduces accordingly. In the event of the policyholder’s untimely demise, the remaining mortgage balance is paid off, ensuring the family’s financial stability.

For instance, a 30-year mortgage of $200,000 can be paired with a decreasing term life insurance policy that initially covers the full amount. As the mortgage is paid down over time, the insurance coverage gradually decreases, aligning with the outstanding balance. This strategy ensures that the mortgage is paid off in its entirety, regardless of the policyholder’s life expectancy.

Debt Repayment

Decreasing term life insurance can also provide peace of mind by covering outstanding debts, such as personal loans, credit card balances, or business liabilities. By matching the policy’s coverage to the debt repayment schedule, the policyholder can ensure that their loved ones are not burdened with financial obligations in the event of their passing.

Consider a business owner with a $50,000 business loan. A decreasing term life insurance policy can be procured to cover the loan amount. As the loan is repaid over time, the insurance coverage reduces accordingly. In the event of the business owner’s demise, the remaining loan balance is covered by the insurance, preventing the business from falling into financial distress.

Estate Planning

Decreasing term life insurance can complement estate planning strategies by providing liquidity to cover estate taxes and administration expenses. The coverage amount is structured to decrease over time, aligning with the expected reduction in estate value as assets are distributed or consumed.

For example, an individual with a $1 million estate may purchase a decreasing term life insurance policy with an initial coverage amount of $500,000. As the estate is distributed over time, the insurance coverage gradually reduces, ensuring that sufficient funds are available to cover any remaining estate expenses or taxes.

Features and Benefits of Decreasing Term Life Insurance

Decreasing term life insurance is a type of life insurance that provides coverage for a specific period of time, with the death benefit decreasing over time. This type of insurance is often used to cover debts or expenses that decrease over time, such as a mortgage or a car loan.

Decreasing term life insurance has several key features and benefits:

Decreasing Death Benefit

The death benefit of decreasing term life insurance decreases over time. This is in contrast to level term life insurance, which provides a fixed death benefit for the entire policy period. The decreasing death benefit of decreasing term life insurance is designed to match the decreasing value of the debt or expense that is being covered.

Flexible Coverage Periods

Decreasing term life insurance policies can be purchased for a variety of coverage periods, typically ranging from 10 to 30 years. This flexibility allows you to choose a policy that matches the length of time that you need coverage.

Affordability

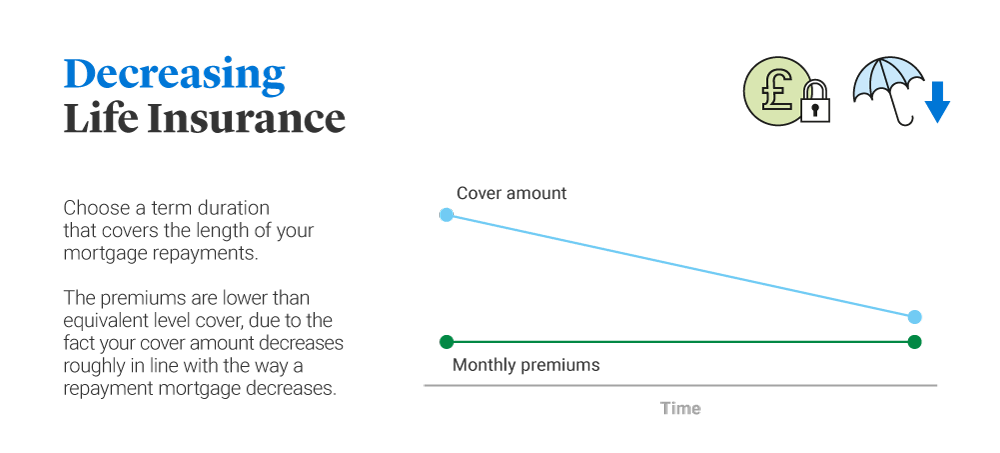

Decreasing term life insurance is typically more affordable than level term life insurance. This is because the death benefit decreases over time, which means that the insurance company takes on less risk.

Cost-Effectiveness

Decreasing term life insurance is a cost-effective way to protect your loved ones from financial hardship in the event of your death. The premiums are typically lower than for other types of life insurance, and the coverage can be tailored to your specific needs.

Adaptability to Changing Needs

Decreasing term life insurance can be adapted to your changing needs. If you need to increase or decrease your coverage, you can simply adjust the policy accordingly. This flexibility makes decreasing term life insurance a good option for people who are expecting their financial needs to change over time.

Considerations for Choosing Decreasing Term Life Insurance

When selecting a decreasing term life insurance policy, it is crucial to carefully consider several key factors to ensure that the coverage aligns with your specific needs and circumstances. These factors include:

- Coverage Amount: Determine the appropriate amount of coverage to protect your dependents and meet their financial obligations in the event of your passing. Consider your income, outstanding debts, mortgage, and other financial responsibilities.

- Coverage Period: Choose a coverage period that aligns with the duration of your financial obligations or until your dependents become financially independent. This may vary depending on your age, family situation, and retirement plans.

- Premium Payments: Understand the premium payments and ensure that they fit comfortably within your budget. Premiums for decreasing term life insurance typically remain level throughout the policy period, making them easier to manage.

Comparison with Other Life Insurance Types

Decreasing term life insurance differs from other life insurance types, such as whole life insurance and universal life insurance. The table below highlights the key differences between these types of insurance:

| Feature | Decreasing Term Life Insurance | Whole Life Insurance | Universal Life Insurance |

|—|—|—|—|

| Coverage | Decreases over time | Remains constant | Flexible and can increase or decrease |

| Premiums | Lower in the early years, higher in the later years | Level throughout the policy term | Variable, based on the policy’s cash value accumulation |

| Cash Value Accumulation | None | Accumulates over time, providing a cash value that can be borrowed against or withdrawn | Accumulates over time, providing a cash value that can be borrowed against or withdrawn |