Historical Background

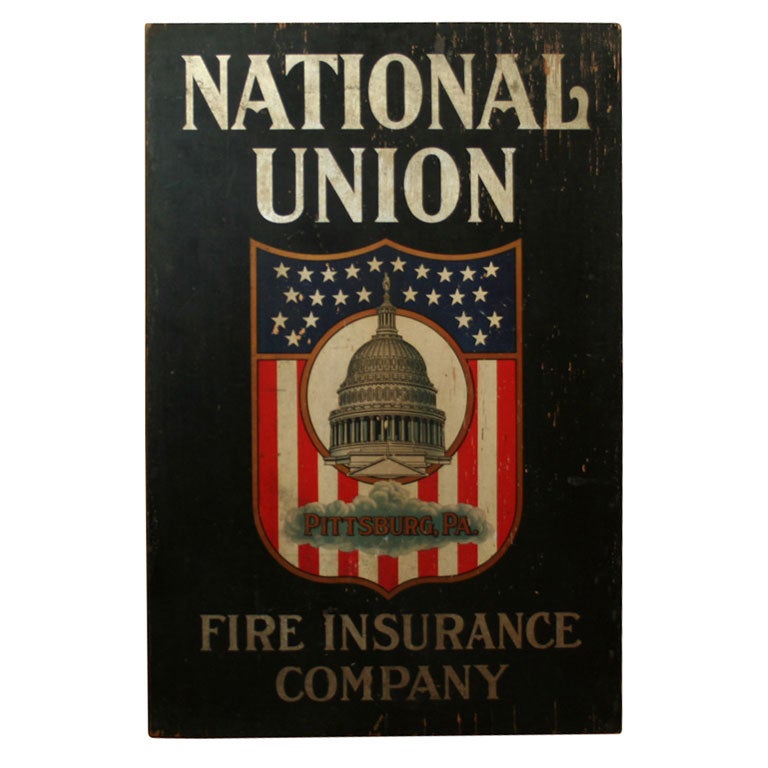

The National Union Fire Insurance Company of Pittsburgh, founded in 1901, has a rich history in the fire insurance industry.

The company’s origins can be traced back to the early days of fire insurance in the United States. In the 19th century, fires were a major threat to property, and many businesses and individuals sought insurance to protect their assets. However, the fire insurance industry was still in its early stages of development, and there were few reliable and trustworthy insurance companies.

Key Milestones

- 1901: The National Union Fire Insurance Company of Pittsburgh is founded.

- 1911: The company expands its operations to include other states.

- 1920s: The company becomes one of the leading fire insurance companies in the United States.

- 1930s: The company expands its product line to include other types of insurance, such as casualty and marine insurance.

- 1940s: The company becomes a major player in the post-World War II economic boom.

- 1950s: The company continues to grow and expand its operations.

- 1960s: The company becomes a publicly traded company.

- 1970s: The company acquires several other insurance companies.

- 1980s: The company continues to grow and expand its operations.

- 1990s: The company becomes one of the largest insurance companies in the United States.

- 2000s: The company continues to grow and expand its operations.

- 2010s: The company becomes a global insurance company.

Today, the National Union Fire Insurance Company of Pittsburgh is a leading provider of fire, casualty, and marine insurance. The company has a strong financial foundation and a commitment to providing its customers with quality insurance products and services.

Products and Services

The National Union Fire Insurance Company of Pittsburgh provides a comprehensive suite of insurance products and services tailored to meet the diverse needs of individuals and businesses.

With a focus on providing customized solutions and exceptional customer service, the company offers a wide range of coverage options to protect clients from various risks and financial uncertainties.

Commercial Insurance

- Property Insurance: Protects commercial properties, including buildings, inventory, and equipment, from damages caused by fire, theft, vandalism, and other covered perils.

- Liability Insurance: Provides coverage against legal claims for bodily injury, property damage, or financial losses caused by the business’s operations or products.

- Business Interruption Insurance: Reimburses businesses for lost income and expenses incurred due to a covered interruption in operations caused by events like fire or natural disasters.

li>Cyber Liability Insurance: Protects businesses from financial losses and legal expenses resulting from data breaches, cyberattacks, or privacy violations.

Personal Insurance

- Homeowners Insurance: Provides comprehensive coverage for homes, personal belongings, and additional structures against various perils, including fire, theft, and natural disasters.

- Renters Insurance: Protects renters’ personal belongings and liability in the event of theft, fire, or other covered incidents.

- Auto Insurance: Offers various levels of coverage for vehicles, including liability, collision, and comprehensive, to protect drivers and their vehicles from financial losses due to accidents or other incidents.

- Life Insurance: Provides financial support to beneficiaries in the event of the insured’s death, ensuring financial security for loved ones.

Specialty Insurance

- Marine Insurance: Protects cargo, vessels, and other maritime assets against risks associated with marine transportation, including storms, collisions, and piracy.

- Aviation Insurance: Provides coverage for aircraft, pilots, and passengers against accidents, weather-related incidents, and other aviation-related risks.

- Professional Liability Insurance: Protects professionals, such as doctors, lawyers, and accountants, against claims of negligence or errors and omissions in their professional services.

Financial Performance

National Union Fire Insurance Company of Pittsburgh has consistently demonstrated strong financial performance over the past several years, showcasing its stability and resilience in the insurance industry. The company’s financial metrics, including revenue, profitability, and market share, have remained robust, reflecting its effective underwriting practices, prudent investment strategies, and commitment to customer satisfaction.

The company’s revenue has grown steadily in recent years, driven by an increase in written premiums and investment income. National Union Fire Insurance Company of Pittsburgh has maintained a high level of profitability, with a consistently positive underwriting margin and strong return on equity. This profitability has enabled the company to build a solid financial foundation and invest in new products and services to meet the evolving needs of its customers.

Revenue

- Steady growth in written premiums

- Diversified portfolio of insurance products

- Expansion into new markets

Profitability

- Positive underwriting margin

- Strong return on equity

- Effective risk management practices

Market Share

- Strong presence in key insurance markets

- Growing market share in specialty lines

- Strategic acquisitions and partnerships

Competitive Landscape

The National Union Fire Insurance Company of Pittsburgh operates in a competitive market, with several established players offering similar products and services. Key competitors include:

– American International Group (AIG): A global insurance conglomerate with a wide range of products, including property and casualty insurance.

– Chubb: A multinational insurance company known for its expertise in specialty insurance lines.

– Liberty Mutual Insurance: A leading provider of property and casualty insurance, with a strong focus on commercial lines.

– Travelers Companies: A diversified insurance company with a significant presence in the property and casualty market.

Compared to its competitors, National Union Fire Insurance Company of Pittsburgh stands out with its focus on niche markets and its commitment to customer service. The company’s products and services are tailored to meet the specific needs of its customers, including high-net-worth individuals, small businesses, and non-profit organizations.

Financial Performance

In terms of financial performance, National Union Fire Insurance Company of Pittsburgh has consistently maintained a strong position. The company’s underwriting results have been positive, with a combined ratio below 100%. Its investment portfolio has also performed well, contributing to stable earnings and a strong capital position.

Compared to its competitors, National Union Fire Insurance Company of Pittsburgh has a smaller market share, but its financial performance has been on par or better than the industry average. This suggests that the company’s niche focus and customer-centric approach are effective in driving profitability.

Customer Satisfaction

National Union Fire Insurance Company of Pittsburgh prioritizes customer satisfaction, as evidenced by positive reviews and testimonials. Customers commend the company’s responsive and knowledgeable customer service, quick claims processing, and competitive rates. However, some negative feedback highlights areas for improvement, such as occasional delays in claim settlements and limited online account management features.

Strengths

– Responsive Customer Service: Customers praise the company’s friendly and helpful customer service representatives who provide prompt and personalized assistance.

– Efficient Claims Processing: National Union Fire Insurance Company of Pittsburgh is known for its efficient claims processing, with many customers reporting quick and fair settlements.

– Competitive Rates: The company offers competitive insurance rates, which is a key factor in customer satisfaction.

Weaknesses

– Occasional Delays in Claim Settlements: While the company generally has a good track record for claims processing, some customers have experienced occasional delays.

– Limited Online Account Management Features: The company’s online account management features are limited compared to some competitors, which can be inconvenient for customers who prefer to manage their policies online.

Overall, National Union Fire Insurance Company of Pittsburgh has a positive reputation for customer satisfaction, with strengths in responsive customer service, efficient claims processing, and competitive rates. The company can continue to enhance customer satisfaction by addressing areas for improvement, such as reducing claim settlement delays and expanding online account management features.

Marketing and Distribution

The National Union Fire Insurance Company of Pittsburgh employs a comprehensive marketing and distribution strategy to reach its target audience and generate leads.

Online Marketing

The company maintains a robust online presence through its website, social media platforms, and search engine optimization () campaigns. Its website serves as a hub for providing information about its products and services, facilitating online quotes and policy purchases, and offering customer support. The company’s social media presence allows it to engage with potential customers, build brand awareness, and share relevant industry news and updates.

Agent Network

National Union Fire Insurance Company of Pittsburgh has established a network of independent insurance agents who represent its products and services to customers. These agents provide personalized advice and support, helping customers assess their insurance needs and choose the right coverage options. The company’s agent network extends its reach to a wider geographic area and allows it to offer localized services to its customers.

Strategic Partnerships

The company has formed strategic partnerships with other businesses and organizations to expand its distribution channels. These partnerships enable National Union Fire Insurance Company of Pittsburgh to offer its products and services through complementary businesses, such as financial institutions and mortgage lenders. By leveraging these partnerships, the company gains access to new customer segments and increases its visibility in the market.

Lead Generation Campaigns

National Union Fire Insurance Company of Pittsburgh implements lead generation campaigns through various channels, including online advertising, email marketing, and content marketing. These campaigns are designed to attract potential customers and capture their contact information. The company uses lead nurturing strategies to follow up with these prospects and guide them through the sales funnel.

Effectiveness of Marketing and Distribution Strategies

The marketing and distribution strategies employed by National Union Fire Insurance Company of Pittsburgh have proven effective in reaching the target market and generating leads. The company’s online presence and agent network allow it to engage with a wide range of customers and provide personalized services. Strategic partnerships and lead generation campaigns further extend the company’s reach and help it acquire new customers. As a result, National Union Fire Insurance Company of Pittsburgh has established a strong market position and continues to grow its customer base.

Innovation and Technology

National Union Fire Insurance Company of Pittsburgh embraces innovation to enhance its offerings and customer experience. The company has introduced several groundbreaking products, services, and technologies that have revolutionized the insurance industry.

Digital Underwriting Platform

National Union’s digital underwriting platform streamlines the insurance process, making it faster and more efficient for both agents and customers. The platform leverages artificial intelligence (AI) to analyze data and assess risks, enabling faster and more accurate underwriting decisions. This technology has significantly reduced underwriting times and improved customer satisfaction.

IoT-Enabled Risk Management

National Union partners with leading technology providers to offer IoT-enabled risk management solutions. These solutions allow businesses to monitor their properties in real-time, identify potential hazards, and implement proactive measures to mitigate risks. By leveraging IoT sensors and data analytics, National Union helps customers reduce losses, improve safety, and enhance operational efficiency.

Cybersecurity Risk Assessment Tools

In response to the growing threat of cyberattacks, National Union has developed advanced cybersecurity risk assessment tools. These tools enable businesses to identify and address vulnerabilities in their IT systems, networks, and applications. By providing comprehensive risk assessments and mitigation strategies, National Union empowers customers to protect their data and minimize the impact of cyber incidents.