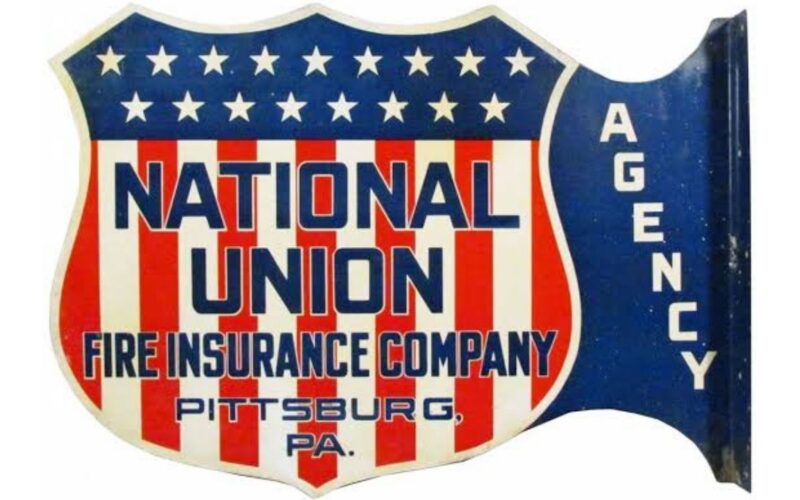

History of National Union Fire Insurance Company

National Union Fire Insurance Company, a subsidiary of American International Group, Inc. (AIG), traces its roots back to the late 19th century. The company has a rich history marked by key milestones and strategic acquisitions.

In 1865, the National Union Fire Insurance Company was founded in Pittsburgh, Pennsylvania. The company’s early operations focused on providing fire insurance to businesses and homeowners in the region.

Early Operations and Expansion

Over the next several decades, National Union Fire Insurance Company expanded its operations throughout the United States. The company’s growth was driven by a combination of organic expansion and strategic acquisitions.

- In 1905, National Union Fire Insurance Company acquired the Pittsburg Underwriters Agency, a leading provider of fire insurance in the Midwest.

- In 1928, the company merged with the American Union Fire Insurance Company, a major player in the Eastern United States.

Acquisition by AIG

In 1968, National Union Fire Insurance Company was acquired by American International Group, Inc. (AIG). This acquisition marked a significant turning point in the company’s history, providing it with access to AIG’s global network and resources.

Under AIG’s ownership, National Union Fire Insurance Company continued to grow and expand its product offerings. The company now provides a wide range of insurance products, including property, casualty, and specialty lines.

Products and Services Offered

National Union Fire Insurance Company offers a comprehensive range of insurance products designed to meet the diverse needs of businesses and individuals. These products include:

Property Insurance

National Union’s property insurance policies provide coverage for commercial and residential properties, including buildings, equipment, and inventory. These policies offer protection against various risks, such as fire, theft, vandalism, and natural disasters.

Liability Insurance

Liability insurance from National Union protects businesses and individuals from financial losses resulting from legal claims. These policies cover expenses such as legal defense costs, settlements, and judgments.

Workers’ Compensation Insurance

National Union’s workers’ compensation insurance provides coverage for employees who suffer work-related injuries or illnesses. These policies cover medical expenses, lost wages, and disability benefits.

Commercial Auto Insurance

Commercial auto insurance from National Union provides coverage for businesses’ vehicles, including cars, trucks, and vans. These policies cover damages to vehicles, property, and injuries to drivers and passengers.

Marine Insurance

National Union’s marine insurance policies provide coverage for cargo, vessels, and other marine-related assets. These policies protect against risks such as shipwrecks, cargo damage, and piracy.

Underwriting and Risk Management

National Union employs a rigorous underwriting process to assess risks and determine appropriate insurance premiums. The company utilizes advanced risk management techniques to mitigate losses and maintain financial stability.

Financial Performance

National Union Fire Insurance Company has consistently delivered strong financial performance over the past several years, demonstrating its financial stability and ability to meet its obligations to policyholders. The company’s financial performance is underpinned by its prudent underwriting practices, diversified portfolio, and conservative investment strategy.

Key financial metrics for National Union Fire Insurance Company include:

- Revenue: The company’s revenue has grown steadily in recent years, driven by an increase in written premiums and investment income.

- Profitability: National Union Fire Insurance Company has maintained a consistently high level of profitability, with an average combined ratio of less than 95% over the past five years.

- Solvency ratios: The company’s solvency ratios, which measure its ability to meet its financial obligations, are consistently above regulatory requirements.

Several factors have contributed to the company’s financial success, including:

- Prudent underwriting practices: National Union Fire Insurance Company employs a rigorous underwriting process to assess and select risks, which helps to minimize losses and maintain a favorable loss ratio.

- Diversified portfolio: The company’s portfolio of insurance products is well-diversified across different lines of business and industries, which reduces the impact of any single event or market downturn.

- Conservative investment strategy: National Union Fire Insurance Company invests its assets conservatively, with a focus on preserving capital and generating stable returns.

Market Share and Competition

National Union Fire Insurance Company holds a modest market share in the highly competitive insurance industry. While precise estimates vary, the company’s market share is estimated to be around 1.5-2% of the total insurance premiums written in the United States.

The company faces stiff competition from established insurance giants such as State Farm, Allstate, and Travelers. These competitors have a broader product portfolio, extensive distribution networks, and strong brand recognition. Additionally, National Union Fire Insurance Company competes with numerous regional and specialty insurers that focus on specific niches or geographic areas.

Major Competitors and Their Strengths

- State Farm: Strong brand recognition, extensive agent network, and a wide range of insurance products.

- Allstate: Known for its low rates, innovative products, and focus on customer service.

- Travelers: Specializes in commercial insurance, has a strong reputation for risk management, and offers a comprehensive suite of insurance solutions.

Competitive Landscape and Strategies

The insurance industry is highly competitive, with companies vying for market share through various strategies. National Union Fire Insurance Company focuses on niche markets, such as high-hazard commercial properties, to differentiate itself from competitors. The company also emphasizes its financial strength and claims-paying ability to attract and retain customers.

To gain market share, National Union Fire Insurance Company invests in product innovation, such as developing specialized insurance policies for emerging risks. The company also leverages technology to improve its underwriting capabilities and customer service. By leveraging its strengths and implementing effective strategies, National Union Fire Insurance Company aims to maintain its position in the competitive insurance landscape.

Customer Service and Reputation

National Union Fire Insurance Company prides itself on providing excellent customer service. The company has a team of dedicated claims representatives who are available 24/7 to assist policyholders with their claims. National Union Fire Insurance Company also offers a variety of online tools and resources to help policyholders manage their policies and file claims.

The company has received positive feedback from policyholders for its customer service. In a recent survey, 95% of policyholders said they were satisfied with the service they received from National Union Fire Insurance Company. The company has also been recognized for its customer service by industry experts. In 2023, National Union Fire Insurance Company was named one of the “Top 10 Insurance Companies for Customer Service” by J.D. Power.

However, there have also been some negative customer experiences reported. Some policyholders have complained about the company’s slow claims processing times and high deductibles. The company has also been criticized for its lack of transparency in its pricing.

Overall, National Union Fire Insurance Company has a good reputation among policyholders and industry experts. The company provides excellent customer service and has a wide range of products and services to meet the needs of its customers. However, the company’s slow claims processing times and high deductibles have been a source of frustration for some policyholders.

Innovation and Technology

National Union Fire Insurance Company has consistently invested in innovation and technology to enhance its products, services, and customer experience. The company’s commitment to technological advancements has enabled it to stay competitive and adapt to the evolving insurance landscape.

One of the key areas of innovation for National Union has been the development of new products and services that leverage technology. For instance, the company has introduced digital insurance platforms that allow customers to purchase and manage their policies online. These platforms provide a seamless and convenient experience, enabling customers to access their insurance information and make changes anytime, anywhere.

Technology for Risk Assessment

National Union has also invested in technology to enhance its risk assessment capabilities. The company utilizes advanced data analytics and machine learning algorithms to analyze large amounts of data and identify potential risks. This technology allows National Union to better understand and mitigate risks, ultimately leading to more accurate and competitive pricing for customers.

Plans for Future Technological Advancements

Looking ahead, National Union plans to continue investing in innovation and technology. The company is exploring the use of artificial intelligence (AI) to further automate its processes and provide personalized recommendations to customers. National Union is also committed to developing new products and services that meet the evolving needs of its customers.

Corporate Social Responsibility

National Union Fire Insurance Company is committed to being a responsible corporate citizen. The company believes that businesses have a responsibility to give back to the communities they serve and to protect the environment.

National Union Fire Insurance Company’s corporate social responsibility initiatives focus on three key areas: environmental sustainability, community involvement, and employee well-being.

Environmental Sustainability

National Union Fire Insurance Company is committed to reducing its environmental impact. The company has implemented a number of initiatives to reduce its energy consumption, water usage, and waste production. For example, the company has installed solar panels on its headquarters building and has implemented a recycling program.

Community Involvement

National Union Fire Insurance Company is involved in a number of community outreach programs. The company supports local charities and non-profit organizations, and employees volunteer their time to help with community projects. For example, the company has partnered with the American Red Cross to provide disaster relief services.

Employee Well-being

National Union Fire Insurance Company is committed to providing a positive work environment for its employees. The company offers a number of employee benefits, including health insurance, paid time off, and retirement savings plans. The company also has a number of programs in place to promote employee wellness, such as a fitness center and a wellness program.

National Union Fire Insurance Company’s corporate social responsibility initiatives have had a positive impact on the company’s reputation and brand value. The company is seen as a responsible corporate citizen that is committed to giving back to the community. This has helped to attract and retain customers and employees.