Understanding Gap Insurance

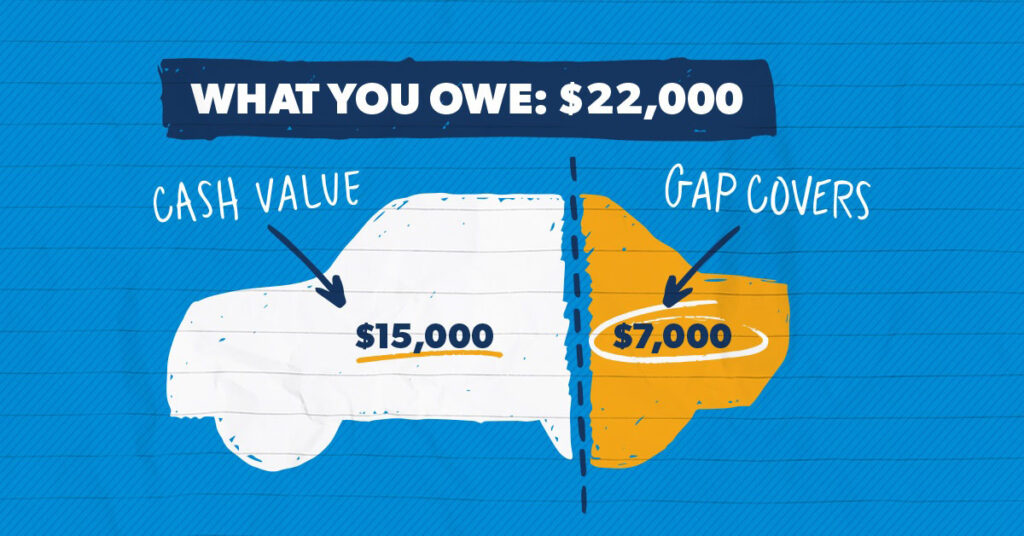

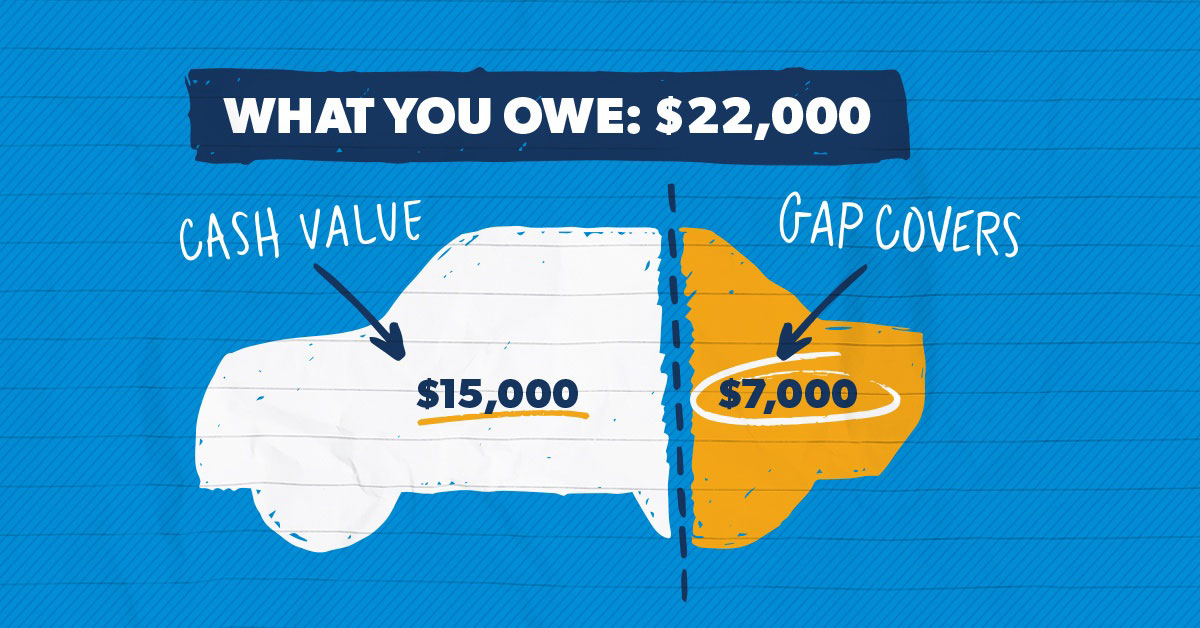

Gap insurance is a type of optional auto insurance that covers the difference between the actual cash value (ACV) of your car and the amount you owe on your loan or lease. This can be helpful if your car is totaled or stolen, and you still owe more on it than it’s worth.

Purpose and Benefits of Gap Insurance

The primary purpose of gap insurance is to protect you from being upside down on your car loan. This can happen if your car is totaled or stolen, and the ACV of the car is less than the amount you owe on it. Without gap insurance, you would be responsible for paying the difference between the ACV and the loan balance. This could be a significant financial burden, especially if you have a high-value car or a long-term loan.

Gap insurance can also provide peace of mind. If you know that you are covered in the event of a total loss, you can drive your car with confidence, knowing that you are financially protected.

Identifying Indicators of Gap Insurance Coverage

Determining if you have gap insurance coverage can be straightforward by examining various indicators. These include:

Reviewing Insurance Documents

Inspect your insurance policy or declarations page for mentions of “gap insurance” or similar terms. If included, it will typically be listed as an additional coverage or endorsement.

Checking Loan Agreements

Review your loan agreement for gap insurance details. Many lenders offer gap insurance as an optional add-on during the loan application process.

Examining Vehicle Registration

In some states, gap insurance coverage may be noted on your vehicle registration document. Check for any mention of gap insurance or a related fee.

Contacting Insurance Provider

Confirming your gap insurance coverage with your insurance provider is crucial. Reach out to their customer service department via phone, email, or online chat. Clearly state your request for information about gap insurance coverage on your policy. Provide them with your policy number and other relevant details to expedite the process.

Information to Provide

To ensure accurate information, prepare the following details before contacting your insurance provider:

– Your full name and contact information

– Your policy number

– The make, model, and year of your vehicle

– The loan amount or lease balance on your vehicle

Reviewing Insurance Policy Documents

Determining gap insurance coverage through policy documents requires careful examination of specific sections and terms. This guide will help you navigate your policy to identify any gap insurance provisions.

Key Sections and Terms

To locate gap insurance coverage information, focus on the following sections within your policy:

- Declarations Page: This page provides an overview of your policy, including coverage limits and any additional coverages you have purchased.

- Coverage Section: This section Artikels the specific types of coverage provided under your policy, including comprehensive and collision coverage.

- Endorsements: Endorsements are amendments or additions to your policy that may include gap insurance coverage.

Pay attention to the following key terms that may indicate gap insurance coverage:

- Gap Insurance

- Loan/Lease Gap Coverage

- Guaranteed Asset Protection (GAP)

Additional Considerations

Gap insurance coverage may not be applicable or available in all situations. For instance, if your vehicle is financed through a leasing arrangement, gap insurance may not be an option. Additionally, some insurance companies may not offer gap insurance coverage for vehicles that are older or have high mileage.

The potential impact of gap insurance on your overall insurance premiums should also be considered. Gap insurance typically comes with an additional cost, which can increase your monthly insurance payments. However, the cost of gap insurance is usually relatively low compared to the potential financial protection it provides.

When making decisions about gap insurance coverage, it’s important to consider your individual financial situation and risk tolerance. If you’re concerned about the potential financial impact of a total loss, gap insurance may be a valuable addition to your insurance policy.

Tips for Making Informed Decisions About Gap Insurance Coverage

* Research different gap insurance providers to compare coverage options and premiums.

* Read the terms and conditions of your gap insurance policy carefully to understand the coverage details and exclusions.

* Consider your financial situation and risk tolerance to determine if gap insurance is a suitable option for you.

* If you’re unsure whether gap insurance is right for you, consult with an insurance professional for guidance.