Select Quote Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you continue to pay the premiums. It also has a cash value component that grows over time, which you can borrow against or withdraw from.

Whole life insurance was first developed in the 18th century, and it has since become one of the most popular types of life insurance. Today, Select Quote is one of the leading providers of whole life insurance in the United States.

Role of Select Quote in the Whole Life Insurance Industry

Select Quote is an independent insurance agency that works with a variety of insurance companies to provide you with the best possible rates on whole life insurance. We have a team of experienced agents who can help you find the right policy for your needs and budget.

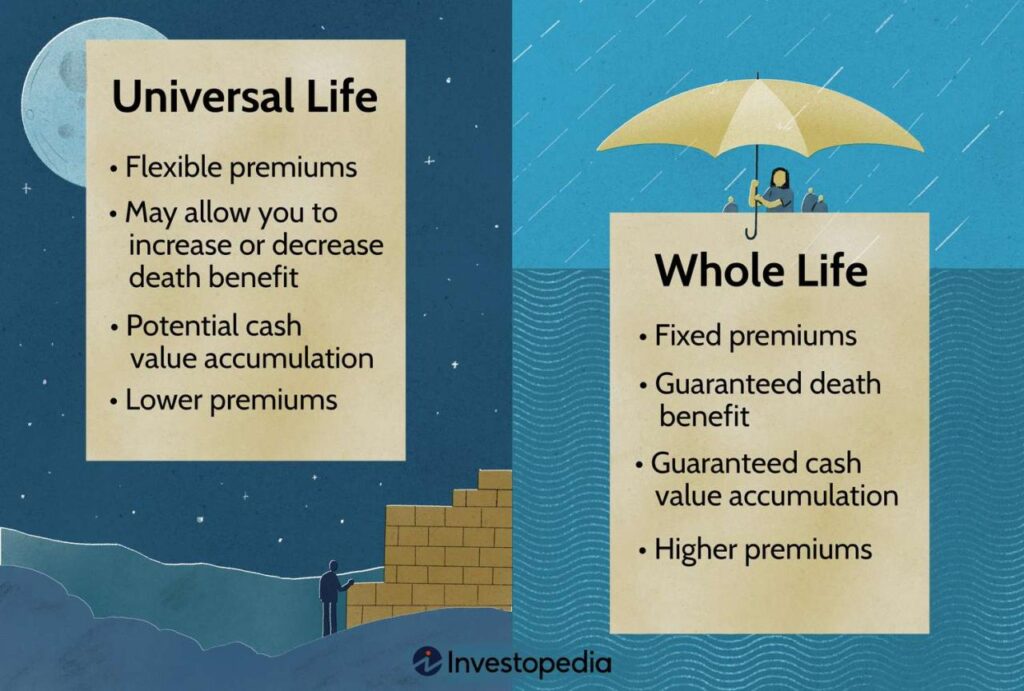

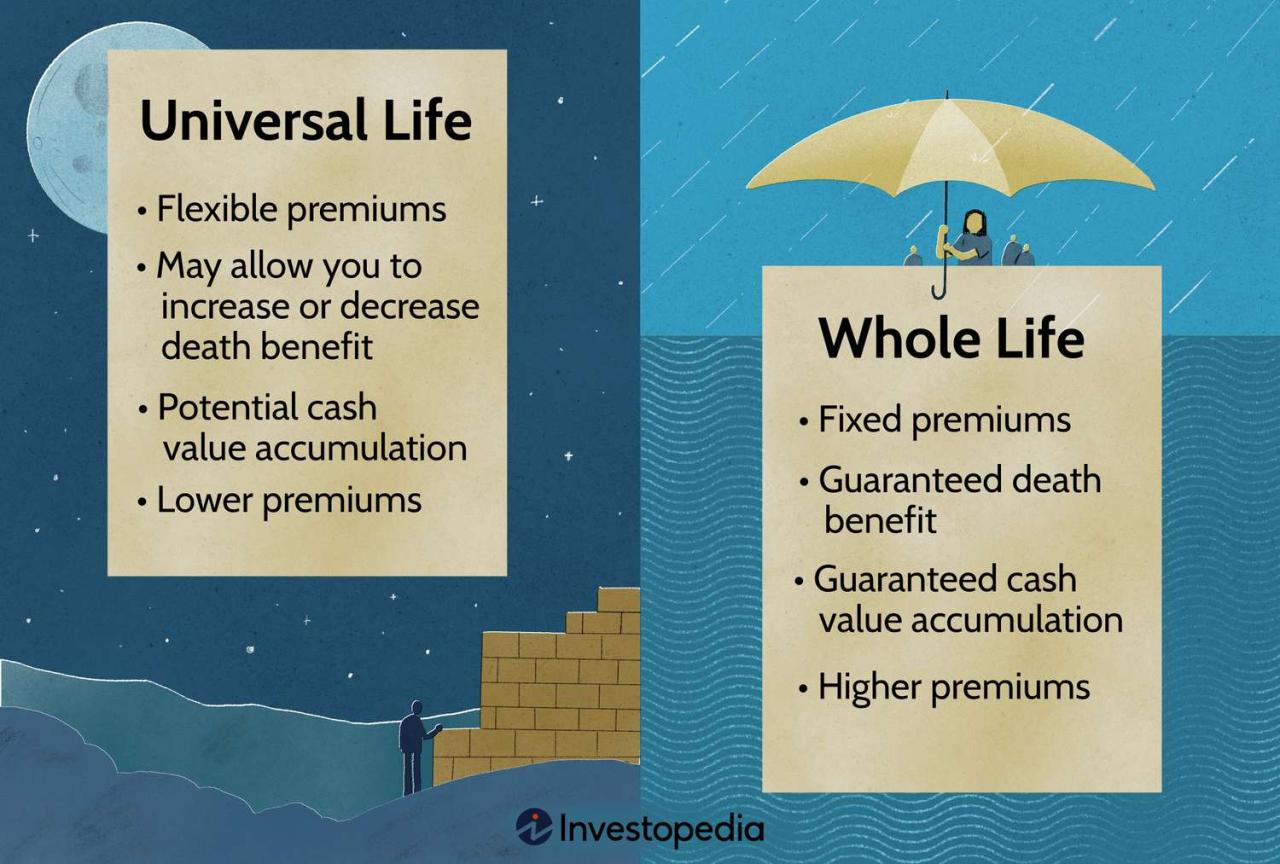

Benefits and Drawbacks of Select Quote Whole Life Insurance

Select Quote whole life insurance offers several advantages, including a guaranteed death benefit, cash value accumulation, and tax benefits. However, it also has some potential drawbacks, such as higher premiums and limited flexibility.

Benefits

- Guaranteed death benefit: Select Quote whole life insurance provides a guaranteed death benefit to your beneficiaries, regardless of how long you live. This can provide peace of mind knowing that your loved ones will be financially secure in the event of your death.

- Cash value accumulation: Select Quote whole life insurance policies accumulate cash value over time. This cash value can be borrowed against or withdrawn tax-free for qualified expenses, such as education or retirement.

- Tax advantages: The cash value in a Select Quote whole life insurance policy grows tax-deferred. This means that you will not pay taxes on the growth of the cash value until you withdraw it.

Drawbacks

- Higher premiums: Select Quote whole life insurance premiums are typically higher than term life insurance premiums. This is because whole life insurance provides a guaranteed death benefit for your entire life, while term life insurance only provides coverage for a specific period of time.

- Limited flexibility: Select Quote whole life insurance policies are less flexible than term life insurance policies. For example, you cannot change the death benefit or the premium amount once the policy is issued.

Here are some examples of how the benefits and drawbacks of Select Quote whole life insurance can apply to real-life scenarios:

- Benefit: A guaranteed death benefit can provide peace of mind knowing that your loved ones will be financially secure in the event of your death. For example, if you have a young family, a whole life insurance policy can help ensure that your children will have the financial resources they need to continue their education or pursue their dreams.

- Drawback: Higher premiums can make whole life insurance unaffordable for some people. For example, if you are on a tight budget, you may want to consider a term life insurance policy, which has lower premiums.

Eligibility and Application Process

Eligibility for Select Quote whole life insurance is determined by various factors, including age, health, and lifestyle habits. The application process involves submitting a comprehensive questionnaire and undergoing a medical exam to assess your health status.

To increase your chances of approval, it’s essential to provide accurate and complete information on the application. Disclosing any pre-existing medical conditions or lifestyle habits that may affect your health is crucial. Additionally, maintaining a healthy lifestyle and engaging in regular physical activity can positively impact your underwriting assessment.

Medical Exams and Underwriting

As part of the application process, you may be required to undergo a medical exam. This exam typically includes a physical examination, blood tests, and a review of your medical history. The results of the medical exam are used by the insurance company to assess your health risks and determine your premium rate.

Underwriting is the process of evaluating your application and determining your eligibility for coverage. The underwriter considers factors such as your age, health, lifestyle, and occupation to assess your risk profile. Based on this assessment, the underwriter will determine whether to approve your application and at what premium rate.

Premiums and Cash Value

Select Quote whole life insurance premiums are influenced by age, health, and coverage amount. The younger and healthier you are, the lower your premiums will be. The higher the coverage amount, the higher your premiums will be.

Cash value accumulates over time as a portion of your premiums are invested. The cash value grows at a rate that is determined by the insurance company’s investment performance. You can borrow against the cash value or withdraw it, but doing so will reduce the death benefit.

Factors Influencing Premium Rates and Cash Value Growth

- Age: Premiums increase with age as the risk of death increases.

- Health: People with health conditions or who smoke will pay higher premiums.

- Coverage Amount: The higher the death benefit, the higher the premiums.

- Investment Performance: The cash value grows at a rate that is determined by the insurance company’s investment performance.

Hypothetical Scenarios

The following table shows how premiums and cash value accumulate over time for a $100,000 whole life insurance policy:

| Age | Annual Premium | Cash Value After 10 Years | Cash Value After 20 Years |

|---|---|---|---|

| 25 | $500 | $2,500 | $7,500 |

| 35 | $600 | $3,000 | $9,000 |

| 45 | $700 | $3,500 | $10,500 |

As you can see, premiums increase with age, but the cash value also grows over time. The cash value can be a valuable asset that you can borrow against or withdraw in the future.

5. Riders and Optional Benefits

Select Quote Whole Life Insurance offers a range of riders and optional benefits that can enhance your coverage and tailor it to your specific needs.

These riders provide additional protection and flexibility, ensuring that your policy remains comprehensive and adapts to life’s unexpected events.

Accidental Death Benefit

- Provides an additional death benefit if the insured dies due to an accident.

- Offers peace of mind knowing that your loved ones will receive additional financial support in the event of an unexpected tragedy.

Waiver of Premium

- Waives the premium payments if the insured becomes totally disabled.

- Protects your policy from lapsing due to financial hardship caused by disability, ensuring continued coverage without worry.

Long-Term Care

- Provides coverage for long-term care expenses, such as nursing home care or assisted living.

- Helps offset the financial burden associated with aging and potential health challenges, ensuring access to necessary care.

Policy Comparison and Selection

Selecting the right whole life insurance policy requires a comprehensive comparison of available options. Consider your coverage needs, budget, and long-term financial goals.

To facilitate comparison, we’ve compiled a table outlining key features of Select Quote whole life insurance policies and similar products from other insurers:

| Feature | Select Quote | Insurer A | Insurer B |

|---|---|---|---|

| Death Benefit | Guaranteed | Guaranteed | Guaranteed |

| Cash Value Growth | Competitive rates | Variable rates | Fixed rates |

| Premiums | Level or increasing | Increasing | Level |

| Riders | Limited options | Extensive options | Standard options |

| Customer Service | Online and phone support | Agent-based support | Online and in-person support |

Factors to Consider

When selecting a policy, consider the following factors:

- Coverage Needs: Determine the amount of coverage you need to meet your financial obligations and protect your loved ones.

- Budget: Ensure the premiums are affordable within your financial plan.

- Long-Term Goals: Consider the potential growth of the cash value and how it aligns with your retirement or savings objectives.

Tips for Making an Informed Decision

To make an informed decision, follow these tips:

- Compare policies from multiple insurers to find the best fit for your needs.

- Consult with a licensed insurance agent or financial advisor for personalized guidance.

- Read and understand the policy details, including the death benefit, cash value growth, and premium structure.

- Consider the reputation and financial stability of the insurance company.

- Weigh the benefits and drawbacks of each policy before making a decision.