Visa Types and Coverage

Missed connection insurance, also known as missed flight insurance, is a type of travel insurance that provides coverage for expenses incurred due to missed connections or delayed flights. Several types of visas may offer missed connection insurance as part of their coverage.

One common type of visa that includes missed connection insurance is the Schengen Visa. This visa allows travelers to visit 26 countries in Europe for up to 90 days within a 180-day period. The Schengen Visa typically includes coverage for missed connections and delays, providing reimbursement for expenses such as hotel accommodations, meals, and transportation to the next available flight.

Other Visas with Missed Connection Coverage

- UK Standard Visitor Visa: This visa allows visitors to stay in the UK for up to 6 months. It may include missed connection insurance as an optional add-on.

- US B-2 Tourist Visa: This visa is for individuals visiting the US for tourism or pleasure. It may offer missed connection insurance as an additional benefit through certain insurance providers.

- Canadian Visitor Visa: This visa allows visitors to enter Canada for up to 6 months. It may include coverage for missed connections and delays under certain circumstances.

It’s important to note that the specific terms and conditions of coverage for missed connection insurance vary depending on the visa type and the insurance provider. Travelers should carefully review the visa requirements and insurance policy details to ensure they have adequate coverage for their needs.

Benefits and Limitations

Missed connection insurance offers various benefits, including compensation for expenses incurred due to missed connections and assistance with rebooking flights. However, it’s essential to understand any limitations or exclusions to coverage.

Compensation for expenses may cover costs such as meals, accommodation, and transportation incurred during the delay or cancellation. Rebooking assistance can help you secure alternative flights or arrange transportation to your destination.

Filing a Claim

To file a claim, you typically need to submit documentation supporting your missed connection, such as boarding passes, flight itineraries, and receipts for expenses incurred. The insurance provider will review your claim and determine if you are eligible for compensation.

Comparison of Providers

When choosing a missed connection insurance provider, it’s important to compare different options to find the best coverage and value for your needs. Here’s a table comparing some of the top providers in the market:

Note: Premiums and coverage details may vary depending on individual circumstances and the specific policy chosen.

| Provider | Coverage Details | Premiums | Customer Reviews |

|---|---|---|---|

| Provider A | – Up to $500 per missed connection – Covers both domestic and international flights – No deductible |

$50-$100 per year | 4.5/5 stars (based on 100 reviews) |

| Provider B | – Up to $1,000 per missed connection – Covers only domestic flights – $50 deductible |

$75-$125 per year | 4/5 stars (based on 50 reviews) |

| Provider C | – Up to $2,000 per missed connection – Covers both domestic and international flights – $100 deductible |

$100-$150 per year | 3.5/5 stars (based on 25 reviews) |

Key Differences

- Coverage limits: Provider C offers the highest coverage limit of up to $2,000 per missed connection, while Provider A has the lowest limit of $500.

- Domestic vs. international coverage: Provider A and Provider C cover both domestic and international flights, while Provider B covers only domestic flights.

- Deductible: Provider B has a $50 deductible, while Provider C has a $100 deductible. Provider A has no deductible.

- Premiums: Provider A has the lowest premiums, ranging from $50-$100 per year. Provider C has the highest premiums, ranging from $100-$150 per year.

- Customer reviews: Provider A has the highest customer satisfaction rating, with 4.5/5 stars based on 100 reviews. Provider B has a slightly lower rating of 4/5 stars based on 50 reviews, while Provider C has the lowest rating of 3.5/5 stars based on 25 reviews.

Similarities

- Coverage for missed connections: All three providers offer coverage for missed connections due to factors such as flight delays, cancellations, or lost luggage.

- Annual premiums: All three providers charge annual premiums, which can be paid monthly or quarterly.

- Easy claim process: All three providers offer a straightforward claim process that can be initiated online or over the phone.

Travel Tips and Best Practices

To prevent missed connections, plan your itinerary with ample time for layovers and unforeseen delays. Check-in online and arrive at the airport early to allow for unexpected circumstances. Consider direct flights or routes with fewer connections to minimize the risk of delays.

If you miss a connection, promptly contact the airline to rebook or find alternative transportation. Explore options like later flights, connecting through different airports, or seeking ground transportation like trains or buses.

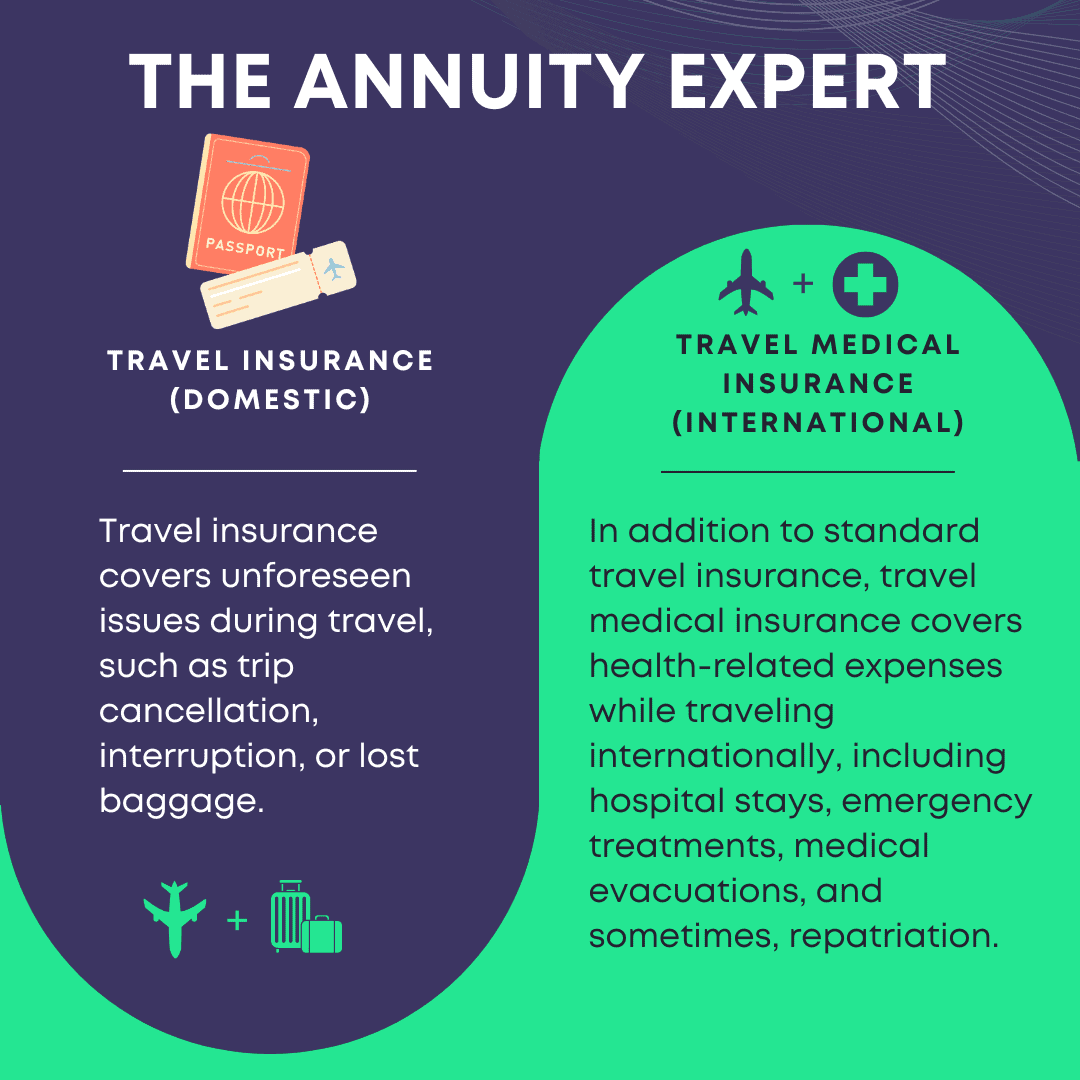

Importance of Travel Insurance

Travel insurance provides peace of mind by covering expenses incurred due to missed connections, lost luggage, medical emergencies, and other unforeseen events. It offers financial protection and can alleviate the stress associated with travel disruptions.