Industry Overview

The insurance industry in [local area] is experiencing a period of significant growth, driven by rising demand for insurance products and services. According to the [source], the industry is projected to grow by [percentage]% in the next five years, creating a high demand for qualified insurance professionals.

The demand for insurance professionals is particularly strong in areas such as [list of areas], where there is a growing need for individuals with specialized knowledge and expertise.

Types of Insurance Jobs

The insurance industry offers a wide range of job opportunities, including:

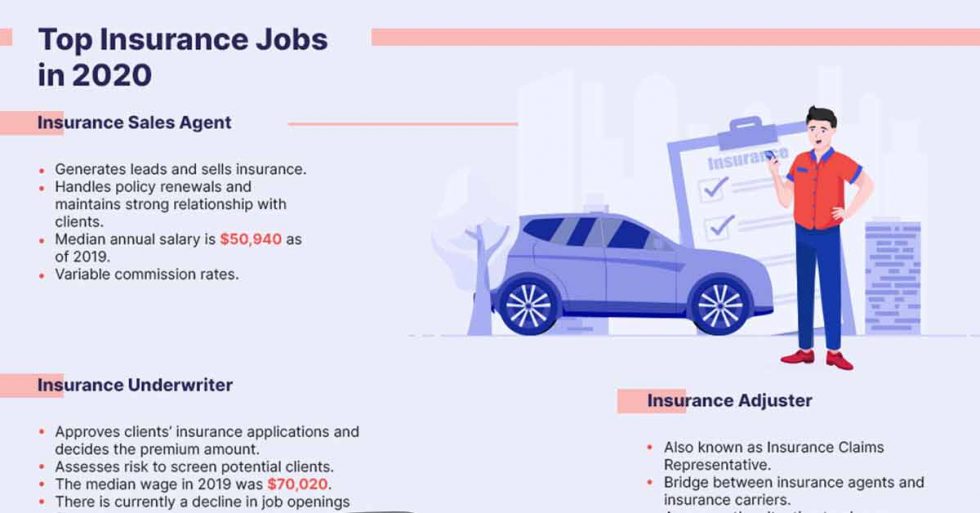

- Insurance agents and brokers: Advise clients on insurance needs, sell policies, and manage claims.

- Underwriters: Evaluate and assess risks to determine the appropriate insurance premiums.

- Claims adjusters: Investigate and settle insurance claims.

- Actuaries: Use mathematical and statistical methods to calculate risks and premiums.

- Insurance lawyers: Handle legal matters related to insurance policies and claims.

Job Search Strategies

Securing an insurance job near you requires a proactive approach. Explore the following strategies to enhance your chances of success:

Online Job Boards

Leverage reputable online job boards to access a wide range of insurance-related positions. Tailor your search criteria to align with your skills and experience. Consider using filters for location, industry, and job title.

Networking Events

Attend industry events, conferences, and meetups to connect with professionals in the insurance field. Engage in meaningful conversations, share your expertise, and inquire about potential job openings.

Company Websites

Visit the websites of insurance companies that interest you. Check their career pages for job postings and submit your application directly. This approach demonstrates your interest in a specific organization.

Resume and LinkedIn Optimization

Ensure your resume and LinkedIn profile highlight your relevant skills and experience for the insurance industry. Use industry-specific s and quantify your accomplishments with data and metrics.

Insurance Company Profiles

Discover local insurance companies offering exciting job opportunities near you. Explore their services, culture, and contact information to find the perfect fit for your career aspirations.

Company Information

Below is a comprehensive table showcasing insurance companies in your area, along with their locations, current job openings, and contact details:

| Company Name | Location | Job Openings | Contact Information |

|---|---|---|---|

| ABC Insurance | 123 Main Street, City | Claims Adjuster, Underwriter | (555) 123-4567 |

| XYZ Insurance Group | 456 Oak Avenue, City | Sales Agent, Customer Service Representative | (555) 234-5678 |

| LMN Insurance | 789 Maple Street, City | Actuary, Risk Analyst | (555) 345-6789 |

| PQR Insurance Company | 1011 Elm Street, City | Insurance Agent, Claims Manager | (555) 456-7890 |

Salary and Benefits

The insurance industry offers competitive salaries and comprehensive benefits packages. The average salary range for insurance jobs in your area varies depending on the position, experience level, and company size. According to industry data, entry-level insurance agents can expect to earn between $30,000 to $50,000 per year. Experienced insurance professionals with specialized skills and designations can earn significantly more.

Insurance companies typically provide generous benefits packages that include health, dental, and vision insurance, paid time off, and retirement plans. Many companies also offer additional perks and incentives, such as:

Perks and Incentives

- Flexible work schedules

- Employee discounts on insurance products

- Tuition reimbursement

- Professional development opportunities

- Company-sponsored events and activities

These benefits and perks help to attract and retain talented insurance professionals.

Career Advancement Opportunities

The insurance industry offers a wide range of career advancement opportunities for professionals at all levels. With hard work, dedication, and the right qualifications, individuals can progress through various roles and responsibilities, leading to managerial and executive positions.

Roles and Responsibilities at Various Levels

Entry-level positions in the insurance industry typically involve administrative tasks, such as data entry, policy processing, and customer service. As professionals gain experience and knowledge, they can move into more specialized roles, such as underwriting, claims adjusting, and sales. Senior-level positions include management roles, such as department heads and executives, who oversee the operations and strategic direction of the company.

Career Paths for Insurance Professionals

Common career paths for insurance professionals include:

- Underwriting: Professionals in this field assess risks and determine the terms and conditions of insurance policies. With experience, they can advance to senior underwriting roles, such as chief underwriter or head of underwriting.

- Claims Adjusting: These professionals investigate and settle insurance claims. They can progress to roles such as claims manager or head of claims.

- Sales: Insurance sales professionals sell insurance products to individuals and businesses. They can advance to sales management positions, such as sales manager or head of sales.

- Management: Individuals with strong leadership and management skills can progress to managerial roles, such as department head, vice president, or chief executive officer (CEO).

Training and Development

Insurance companies offer comprehensive training and development programs to equip their employees with the necessary knowledge and skills to succeed in the industry. These programs cover a wide range of topics, including insurance products, underwriting, claims handling, and regulatory compliance.

Industry certifications and designations are highly valued in the insurance industry. They demonstrate an individual’s expertise and commitment to professional development. Some of the most recognized certifications include the Chartered Property Casualty Underwriter (CPCU), the Associate in Risk Management (ARM), and the Certified Insurance Counselor (CIC).

Staying Up-to-Date

The insurance industry is constantly evolving, with new regulations and trends emerging regularly. To stay up-to-date, it is essential to attend industry conferences, read trade publications, and participate in continuing education courses. Insurance companies often provide access to online learning platforms and webinars to help employees stay current on the latest developments.

Insurance Industry Events

Attending industry events is a great way to network with other professionals, learn about the latest trends, and advance your career. Here are some upcoming insurance industry events in your area:

- Insurance Industry Conference, March 15-17, 2023, at the Hilton Hotel in Downtown. This conference will feature speakers from leading insurance companies, as well as breakout sessions on a variety of topics, including underwriting, claims, and marketing.

- Insurance Career Fair, April 12, 2023, at the Convention Center. This career fair will bring together insurance companies from all over the country. It’s a great opportunity to meet with potential employers and learn about job openings.

- Insurance Industry Workshop, May 10-12, 2023, at the University of California, Berkeley. This workshop will provide in-depth training on a variety of insurance topics, including risk management, insurance law, and financial planning.

By attending these events, you can:

- Network with other insurance professionals

- Learn about the latest trends in the insurance industry

- Advance your career by gaining new skills and knowledge