Life Insurance Weight Chart

An Overview

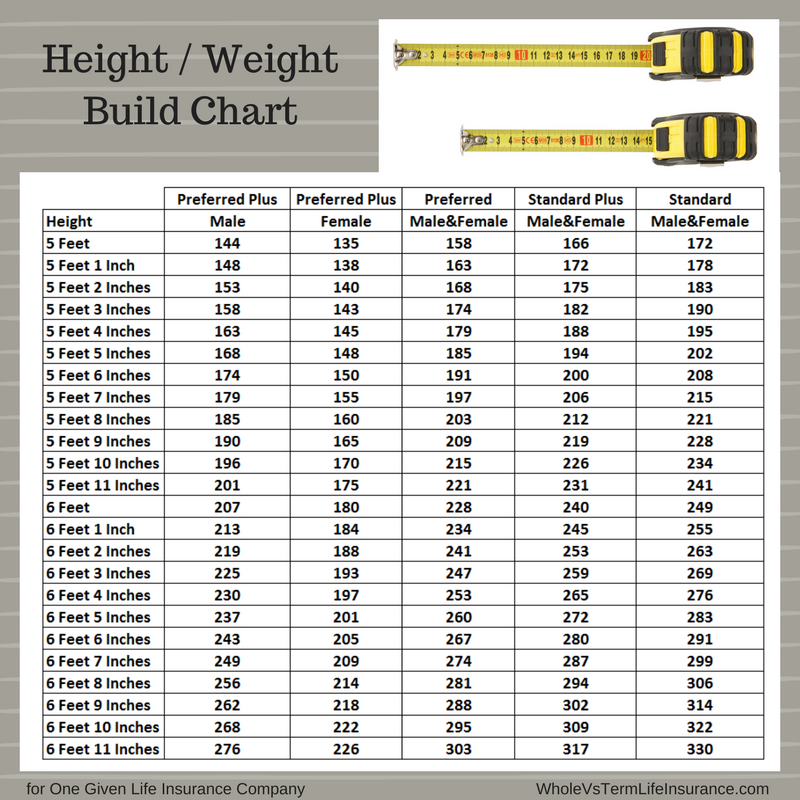

Life insurance weight charts are tables that show the maximum amount of life insurance coverage that a person can qualify for based on their weight and height. These charts are used by life insurance companies to assess the risk of insuring a person and to determine the appropriate premium rate.

There are different types of life insurance weight charts, each with its own set of criteria. Some charts are based on the applicant’s age, gender, and weight, while others also take into account the applicant’s height and build. The most common type of life insurance weight chart is the “unisex” chart, which applies to both men and women.

Factors Influencing Weight-Based Life Insurance Premiums

Weight is a significant factor influencing life insurance premiums. Individuals with higher weight are often considered at a higher risk for certain health conditions, such as heart disease, stroke, and diabetes. As a result, they may face higher premiums compared to those who maintain a healthy weight.

In addition to weight, other factors that affect life insurance premiums include age, gender, and health history. As we age, our risk of developing health problems increases, leading to higher premiums. Similarly, males are generally considered at a higher risk than females for certain conditions, resulting in higher premiums. Individuals with a family history of chronic diseases or pre-existing health conditions may also face higher premiums due to the increased likelihood of developing similar issues in the future.

Age

Age is a significant factor in determining life insurance premiums. As we age, our risk of developing health problems increases, which leads to higher premiums. For example, a 25-year-old may pay significantly lower premiums than a 55-year-old for the same amount of coverage.

Gender

Gender also plays a role in determining life insurance premiums. Males are generally considered at a higher risk than females for certain conditions, such as heart disease and stroke. As a result, males typically pay higher premiums than females for the same amount of coverage.

Health History

Health history is another important factor that affects life insurance premiums. Individuals with a family history of chronic diseases or pre-existing health conditions may face higher premiums due to the increased likelihood of developing similar issues in the future. For example, someone with a history of heart disease may pay higher premiums than someone with no such history.

Using Weight Charts to Determine Eligibility

Life insurance weight charts are a valuable tool for determining whether an individual is eligible for coverage. These charts provide a quick and easy way to assess a person’s weight relative to their height and age, and to determine if they fall within the acceptable range for insurance coverage.

The criteria for determining eligibility based on weight vary from insurer to insurer. However, most companies use a combination of height, weight, and age to calculate a body mass index (BMI). BMI is a measure of body fat based on a person’s height and weight. A BMI of 25 or higher is considered overweight, while a BMI of 30 or higher is considered obese.

Factors Influencing Weight-Based Life Insurance Premiums

- Age: The older you are, the higher your risk of developing health problems, including those related to weight. As a result, life insurance premiums tend to be higher for older individuals.

- Gender: Men are generally considered to be a higher risk for health problems than women, so they typically pay higher life insurance premiums.

- Smoking status: Smokers are at a higher risk of developing health problems, including those related to weight. As a result, life insurance premiums are typically higher for smokers.

- Family history: If you have a family history of weight-related health problems, you may be at a higher risk of developing these problems yourself. This can lead to higher life insurance premiums.

- Occupation: Some occupations are more likely to lead to weight-related health problems than others. For example, people who work in sedentary jobs are more likely to be overweight or obese than those who work in active jobs. This can lead to higher life insurance premiums.

Strategies for Improving Weight-Based Life Insurance Eligibility

Maintaining a healthy weight is crucial for improving your eligibility for weight-based life insurance premiums. Here are some effective strategies:

- Adopt a balanced diet: Focus on consuming nutrient-rich foods such as fruits, vegetables, whole grains, and lean protein. Avoid processed foods, sugary drinks, and excessive amounts of saturated and trans fats.

- Engage in regular physical activity: Aim for at least 150 minutes of moderate-intensity exercise or 75 minutes of vigorous-intensity exercise per week. Choose activities that you enjoy to make exercise a sustainable habit.

- Set realistic weight loss goals: Avoid setting unattainable targets that can lead to frustration and discouragement. Aim to lose 1-2.5 pounds per week, which is a healthy and sustainable pace.

- Seek professional guidance: Consider consulting with a registered dietitian or healthcare professional for personalized advice and support. They can help you create a tailored plan that meets your individual needs and goals.

- Join a weight loss program: Structured programs like Weight Watchers or Jenny Craig provide guidance, support, and accountability. They can help you learn healthy eating habits and develop a consistent exercise routine.

- Make lifestyle changes: Small adjustments to your daily routine can make a significant difference. Take the stairs instead of the elevator, park farther away from the store, or choose water over sugary drinks.

By implementing these strategies, you can improve your overall health and increase your chances of qualifying for lower weight-based life insurance premiums.

Alternatives to Traditional Weight-Based Life Insurance

Non-weight-based life insurance policies provide an alternative to traditional weight-based options. These policies consider factors such as overall health, lifestyle habits, and medical history, rather than solely relying on weight.

Advantages of Non-Weight-Based Life Insurance

- Fairer Assessment: Considers broader health indicators, providing a more accurate reflection of an individual’s risk profile.

- Wider Eligibility: Opens up coverage options for individuals who may not qualify for traditional weight-based policies due to weight-related factors.

- Improved Premiums: Non-weight-based policies often offer lower premiums for individuals with healthy lifestyles and medical histories.

Disadvantages of Non-Weight-Based Life Insurance

- Limited Availability: Non-weight-based life insurance policies may not be widely available from all insurers.

- Higher Underwriting Standards: The underwriting process for non-weight-based policies can be more stringent, requiring detailed medical information and lifestyle assessments.

- Potential Exclusions: Some non-weight-based policies may exclude coverage for weight-related health conditions or complications.