Life Insurance Coverage

Life insurance provides financial protection for your loved ones in the event of your untimely demise. For a 20-year term, various coverage options are available to suit your specific needs and budget.

There are two primary types of life insurance coverage:

- Term life insurance: Provides coverage for a specific period, typically 10, 20, or 30 years. If you pass away during the term, the death benefit is paid to your beneficiaries. If you outlive the term, the policy expires without any payout.

- Whole life insurance: Provides lifelong coverage and accumulates a cash value component that grows over time. The cash value can be borrowed against or withdrawn, but doing so may reduce the death benefit.

In addition to these basic types, there are various riders and optional benefits that can be added to your policy to enhance coverage:

- Accidental death benefit: Provides an additional payout if death occurs due to an accident.

- Disability waiver of premium: Waives your premium payments if you become disabled and unable to work.

- Return of premium rider: Refunds a portion or all of the premiums paid if you outlive the policy term.

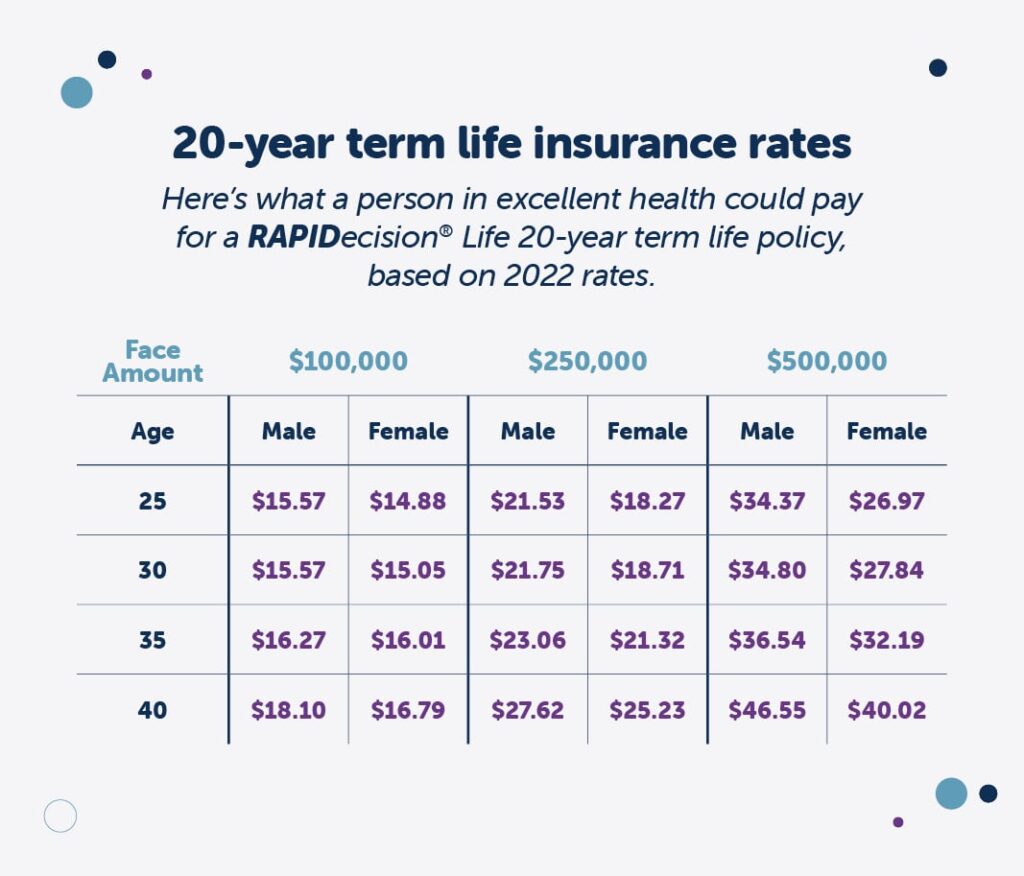

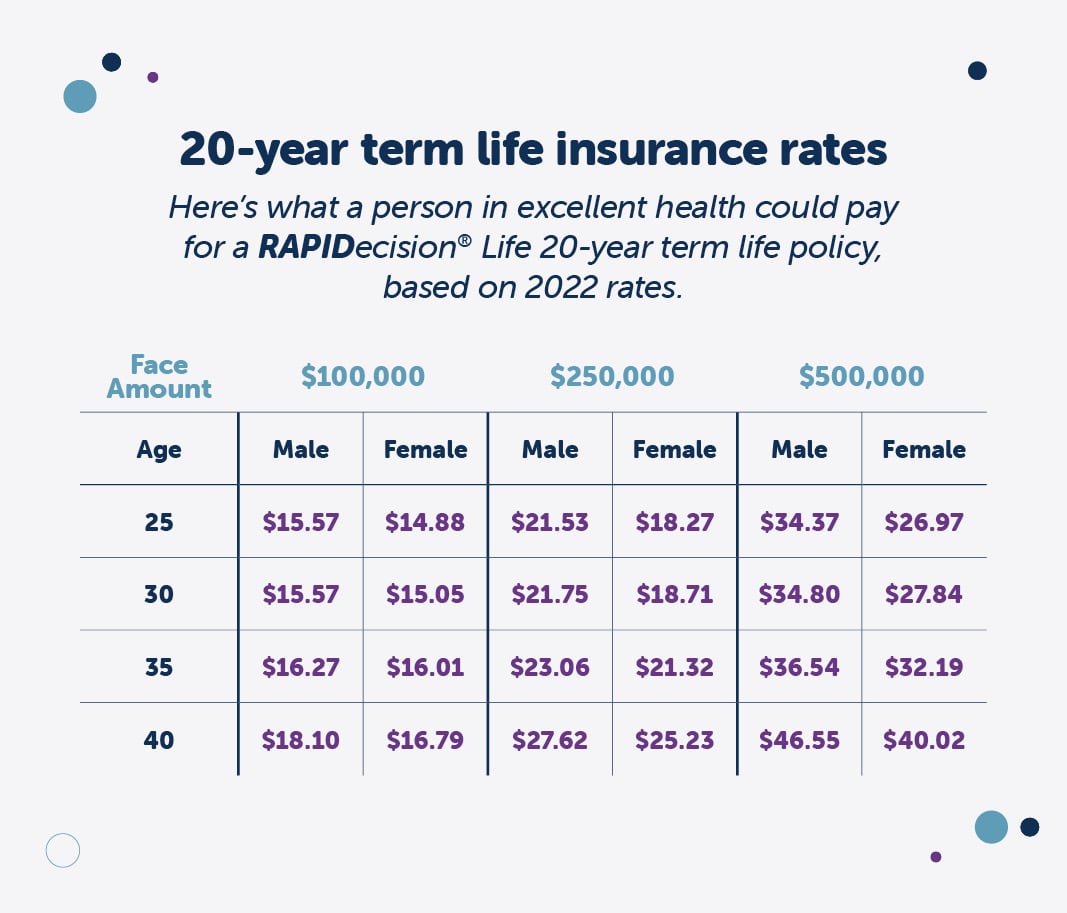

The cost of life insurance coverage for a 20-year term is influenced by several factors, including:

- Age: Premiums increase with age as the risk of death increases.

- Health: Pre-existing medical conditions or high-risk activities can result in higher premiums.

- Tobacco use: Smokers generally pay higher premiums due to increased health risks.

- Occupation: Hazardous occupations may also lead to higher premiums.

- Amount of coverage: The higher the death benefit, the higher the premiums.

By understanding the different coverage options and factors that influence cost, you can make an informed decision about the right life insurance policy for your needs.

Benefits of Life Insurance

Life insurance provides peace of mind and financial security for your loved ones in the event of your untimely death. It is a valuable tool that can help ensure your family’s financial well-being and future goals are met.

Financial Security for Loved Ones

Life insurance can provide a financial safety net for your family in the event of your death. The death benefit can be used to cover expenses such as funeral costs, outstanding debts, and mortgage payments. It can also help provide for your family’s ongoing living expenses, such as housing, food, and education.

Savings and Investment Tool

In addition to providing financial security, life insurance can also be used as a savings and investment tool. Some life insurance policies offer cash value components that grow over time. These cash value accounts can be used to save for retirement, education, or other financial goals.

Considerations for 20-Year Terms

When selecting a life insurance policy, the length of the term is a crucial factor to consider. A 20-year term life insurance policy offers both advantages and disadvantages that should be carefully evaluated.

The primary advantage of a 20-year term policy is its affordability. Compared to longer-term policies, such as whole life or universal life insurance, 20-year term policies typically have lower premiums. This can be particularly beneficial for younger individuals or those with a limited budget.

However, it’s important to note that the coverage period of a 20-year term policy is fixed. If the policyholder outlives the 20-year term, the policy will expire, and there will be no payout. This means that the policyholder may need to purchase a new policy or consider other options to ensure continued coverage.

Determining the Appropriate Coverage Amount

Determining the appropriate coverage amount for a 20-year term life insurance policy requires careful consideration of several factors. These include:

- Income: The policy should provide sufficient coverage to replace the policyholder’s income in the event of their death, ensuring that their family can maintain their standard of living.

- Debts: The policy should cover outstanding debts, such as mortgages, car loans, or credit card balances, to prevent financial hardship for the beneficiaries.

- Future expenses: The policy should consider future expenses, such as education costs for children or retirement planning, to ensure that these goals can still be met in the event of the policyholder’s death.

Finding the Right Policy

When comparing life insurance policies from different providers, it’s essential to consider the following tips:

- Understand your needs: Determine the amount of coverage you need based on your income, dependents, and financial obligations.

- Compare policy types: Choose between term life insurance (coverage for a specific period) and permanent life insurance (coverage for life).

- Get quotes from multiple providers: Obtain quotes from several insurers to compare premiums and benefits.

Before purchasing a policy, it’s crucial to thoroughly understand the terms and conditions:

- Policy length: Confirm the duration of the policy and any renewal options.

- Premiums: Determine the amount and frequency of premium payments.

- Exclusions and limitations: Be aware of any exclusions or limitations that may apply to the coverage.

- Beneficiaries: Designate beneficiaries who will receive the death benefit.

To find the right life insurance policy for your needs, follow these steps:

- Identify your coverage needs: Calculate the amount of coverage required based on your financial situation.

- Research different policies: Explore various policy types and providers to find the best fit.

- Compare quotes: Obtain quotes from multiple insurers to compare premiums and coverage.

- Review the terms and conditions: Carefully examine the policy details before making a decision.

- Make an informed decision: Choose the policy that aligns with your needs and provides the most comprehensive coverage at a reasonable cost.

Additional Considerations

Several factors influence life insurance premiums, including age, health, and lifestyle. Understanding these considerations can help you secure the best coverage at the most affordable rates.

Your age plays a significant role in determining premiums. Younger individuals typically pay lower premiums due to their lower mortality risk. As you age, your premiums may increase due to the increased likelihood of health issues.

Health and Lifestyle

Your overall health and lifestyle habits also affect your life insurance premiums. If you have a history of chronic health conditions or engage in risky behaviors, such as smoking or excessive alcohol consumption, you may pay higher premiums. Conversely, maintaining a healthy lifestyle, such as exercising regularly and eating a balanced diet, can lower your premiums.

Discounts and Preferred Rates

Many insurance companies offer discounts and preferred rates to individuals who meet certain criteria. These criteria may include:

- Non-smokers

- Individuals with healthy weight and BMI

- Individuals with no history of major health issues

Free or Low-Cost Quotes

There are several resources available to obtain free or low-cost life insurance quotes. Online comparison websites allow you to compare quotes from multiple insurers, while insurance agents can provide personalized recommendations based on your specific needs.