Level Funded Health Insurance Plans

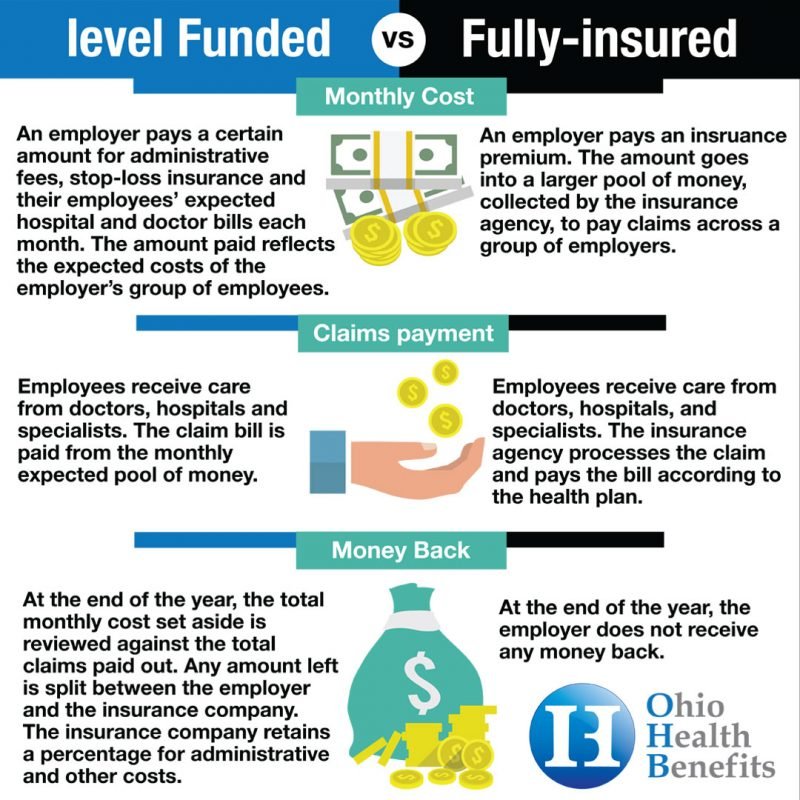

Level funded health insurance plans are a type of health insurance that is designed to provide employers with more predictable and stable health care costs. Unlike traditional insurance models, which pool risk across a large group of policyholders, level funded plans pool risk across a smaller group of employers. This allows employers to have more control over their health care costs and to avoid the large premium increases that can occur with traditional insurance plans.

Advantages of Level Funded Plans

There are several advantages to level funded health insurance plans, including:

- Predictable and stable costs: Level funded plans provide employers with more predictable and stable health care costs. This is because the premiums are based on the claims experience of the group of employers, rather than on the claims experience of the entire pool of policyholders.

- Lower costs: Level funded plans can be less expensive than traditional insurance plans. This is because the premiums are not subject to the same level of risk as traditional insurance plans.

- More control: Level funded plans give employers more control over their health care costs. This is because employers have a say in how the plan is designed and how the claims are processed.

Disadvantages of Level Funded Plans

There are also some disadvantages to level funded health insurance plans, including:

- Higher risk: Level funded plans are subject to more risk than traditional insurance plans. This is because the premiums are based on the claims experience of a smaller group of employers.

- Less flexibility: Level funded plans are less flexible than traditional insurance plans. This is because the premiums are based on the claims experience of the group of employers, and cannot be changed as easily as the premiums for traditional insurance plans.

- Limited coverage: Level funded plans may have more limited coverage than traditional insurance plans. This is because the premiums are based on the claims experience of the group of employers, and may not be sufficient to cover all of the health care costs of the employees.

Structure of Level Funded Plans

Level funded health insurance plans have a unique structure that sets them apart from traditional insurance models. They are self-funded plans, meaning that employers bear the financial risk of claims. To mitigate this risk, stop-loss insurance is typically purchased.

Key Components of a Level Funded Plan

The key components of a level funded health insurance plan include:

- Employer Funding: Employers contribute a fixed monthly amount to the plan, based on their estimated claims experience.

- Stop-Loss Insurance: This insurance provides coverage for claims that exceed a predetermined threshold, protecting employers from catastrophic financial losses.

- Claims Administration: A third-party administrator handles claims processing and manages the plan’s finances.

Role of Stop-Loss Insurance

Stop-loss insurance plays a crucial role in level funded plans by providing a safety net for employers. It covers claims that exceed a specified attachment point, which is typically a high dollar amount. This ensures that employers are not exposed to unlimited financial liability.

Determining the Appropriate Level of Funding

Determining the appropriate level of funding for a level funded plan is critical. Employers must consider their historical claims experience, expected utilization, and risk tolerance. Actuarial analysis is often used to assess these factors and calculate the optimal funding amount.

Funding and Administration

Level funded plans are funded by contributions from the employer and employees. Employers typically contribute a fixed amount each month, while employees may contribute a fixed amount or a percentage of their salary. The contributions are pooled and used to pay for the plan’s claims.

Level funded plans are typically administered by a third-party administrator (TPA). The TPA is responsible for managing the plan’s claims, providing customer service, and ensuring that the plan complies with all applicable laws and regulations.

Employers can manage the costs of a level funded plan by:

- Setting appropriate contribution rates.

- Managing claims effectively.

- Investing the plan’s assets wisely.

Eligibility and Coverage

Level funded health insurance plans typically have less stringent eligibility requirements compared to traditional fully insured plans.

Eligibility Requirements

To be eligible for a level funded plan, an employer must generally have a minimum number of employees, ranging from 2 to 50 or more, depending on the plan’s requirements. Employees must also meet the plan’s age and employment status criteria, which may vary depending on the plan.

Types of Coverage

Level funded plans offer a range of coverage options, including medical, dental, vision, and prescription drug coverage. Medical coverage typically includes services such as doctor visits, hospitalizations, and surgeries. Dental and vision coverage may include preventive care, such as cleanings and checkups, as well as more extensive procedures. Prescription drug coverage helps pay for the cost of prescription medications.

Enrollment and Access to Benefits

Enrolling in a level funded plan is typically a straightforward process. Employees can enroll during open enrollment periods or when they first become eligible for coverage. Once enrolled, employees can access benefits by using their insurance cards or by submitting claims to the plan administrator.

Claims Processing and Payment

Claims processing and payment under level funded health insurance plans follow a structured procedure to ensure timely and accurate reimbursement for covered medical expenses. The process involves multiple parties, including the plan administrator, the stop-loss insurer, and the healthcare providers.

When a covered individual incurs medical expenses, they submit a claim to the plan administrator. The administrator reviews the claim for eligibility and coverage, ensuring that the services rendered are covered under the plan and that the individual is eligible for reimbursement. Once the claim is approved, the administrator forwards it to the stop-loss insurer for further processing.

Role of the Stop-Loss Insurer

The stop-loss insurer plays a crucial role in claims processing by providing financial protection to the plan. The insurer assumes the risk of catastrophic claims that exceed a predetermined threshold, known as the attachment point. When a claim amount exceeds the attachment point, the stop-loss insurer becomes responsible for paying the excess amount.

Claims Adjudication and Payment

Once the claim is received by the stop-loss insurer, it undergoes a process of adjudication. The insurer verifies the validity of the claim, ensuring that the services provided were medically necessary and appropriate. The insurer also reviews the claim for any potential fraud or abuse.

If the claim is approved, the stop-loss insurer issues payment to the healthcare provider. The payment amount is determined based on the plan’s coverage and the individual’s deductible and coinsurance obligations. The plan administrator then disburses the payment to the provider on behalf of the covered individual.

Risk Management and Solvency

Level funded health insurance plans are subject to various risks, including:

- Underfunding: If the plan’s contributions are insufficient to cover claims, it may become insolvent.

- Investment risk: If the plan’s investments perform poorly, it may have difficulty meeting its obligations.

- Catastrophic claims: A single high-cost claim can deplete the plan’s funds.

To manage these risks, employers can:

- Conduct thorough actuarial analysis to determine appropriate funding levels.

- Diversify investments to reduce risk.

- Purchase stop-loss insurance to protect against catastrophic claims.

Solvency Maintenance

Level funded plans maintain solvency by:

- Setting aside reserves to cover potential losses.

- Monitoring claims experience and adjusting contributions as needed.

- Investing funds prudently to generate returns.

Regulatory and Compliance

Level funded health insurance plans are subject to various regulatory and compliance requirements. These requirements are designed to protect the interests of plan participants and ensure the financial stability of the plans.

The Employee Retirement Income Security Act (ERISA) is the primary federal law that regulates employee benefit plans, including level funded health insurance plans. ERISA sets forth minimum standards for plan design, funding, and administration. It also requires plan fiduciaries to act in the best interests of plan participants and beneficiaries.

Employers that sponsor level funded health insurance plans must comply with all applicable ERISA requirements. This includes filing an annual report with the Department of Labor (DOL) and providing participants with a summary plan description (SPD). Employers must also ensure that the plan is administered in accordance with ERISA’s fiduciary standards.

In addition to ERISA, level funded health insurance plans may also be subject to state insurance laws. These laws vary from state to state, but they generally require plans to be licensed and to meet certain minimum financial requirements.

Employers can ensure compliance with applicable laws and regulations by working with a qualified insurance broker or consultant. These professionals can help employers understand their obligations and develop a plan that meets all regulatory requirements.

Industry Trends and Innovations

The level funded health insurance market is constantly evolving, with new trends and innovations emerging all the time. These trends are being driven by a number of factors, including the rising cost of healthcare, the increasing popularity of consumer-driven health plans, and the growing use of technology.

One of the most significant trends in the level funded health insurance market is the use of technology to improve the efficiency and effectiveness of plans. For example, many insurers are now using data analytics to identify and manage high-cost claimants, and to develop more effective prevention and wellness programs. Insurers are also using technology to make it easier for employers and participants to access and manage their health insurance information.

New Products and Services

In addition to using technology to improve the efficiency and effectiveness of plans, insurers are also developing new products and services to meet the needs of employers and participants. For example, some insurers are now offering level funded plans that include stop-loss coverage, which provides protection against catastrophic claims. Other insurers are offering level funded plans that are designed to be integrated with other employee benefits, such as dental and vision insurance.