Industry Overview

The insurance industry is a vast and complex ecosystem that plays a crucial role in providing financial protection and risk management solutions to individuals and businesses. It comprises various segments, including life insurance, health insurance, property and casualty insurance, and specialty insurance.

The global insurance market is highly competitive, with a diverse range of players. Leading insurance companies include giants like Berkshire Hathaway, Allianz, AXA, and MetLife, along with numerous regional and national players.

Size and Growth of the Insurance Agency Market

The insurance agency market is a significant segment of the insurance industry, responsible for distributing insurance products to consumers and businesses. The size of the global insurance agency market is estimated to be over $1 trillion, with a projected annual growth rate of around 5% over the next five years.

The growth of the insurance agency market is driven by factors such as increasing demand for insurance coverage, rising awareness of risk management, and the expansion of insurance products into new markets.

Insurance Agency Owner Roles and Responsibilities

Insurance agency owners play a multifaceted role within their businesses, encompassing a wide range of responsibilities.

To thrive in this role, individuals must possess a comprehensive understanding of the insurance industry, along with strong leadership and management skills.

Essential Responsibilities

- Overseeing the agency’s overall operations, including sales, marketing, and customer service

- Developing and implementing business strategies to drive growth and profitability

- Managing a team of insurance agents and support staff

- Maintaining strong relationships with insurance carriers and other industry professionals

- Staying abreast of industry trends and regulations

Required Skills and Qualifications

- Bachelor’s degree in business, insurance, or a related field

- Several years of experience in the insurance industry, ideally in a leadership or management role

- Strong understanding of insurance products and services

- Excellent communication, interpersonal, and negotiation skills

- Ability to manage a team effectively and motivate staff

- Entrepreneurial spirit and a drive to succeed

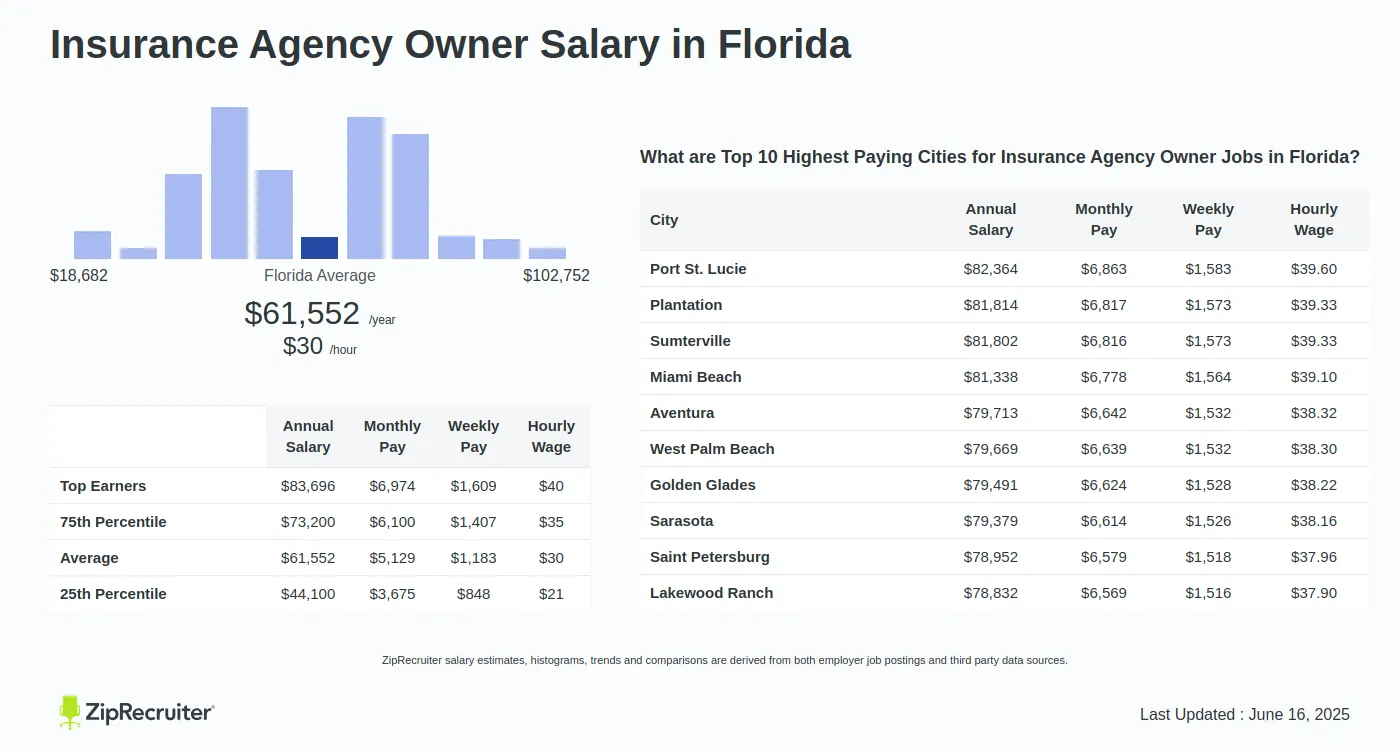

Factors Influencing Salary

The salary of an insurance agency owner is influenced by several key factors, including the size of the agency, its location, and the owner’s experience.

Larger agencies tend to generate more revenue and have higher expenses, resulting in higher potential earnings for the owner. Agencies located in urban areas with a higher cost of living typically have higher salaries than those in rural areas.

Agency Size

- Larger agencies have more clients, which can lead to higher revenue and earnings.

- Owners of larger agencies may also have more employees, which can increase expenses and reduce profit margins.

Location

- Agencies in urban areas with a higher cost of living typically have higher salaries than those in rural areas.

- This is because the cost of living affects the expenses of running an agency, such as rent, utilities, and employee salaries.

Experience

- Owners with more experience typically have higher salaries than those with less experience.

- Experience can lead to increased knowledge and skills, which can make an owner more valuable to clients and increase their earning potential.

Compensation Structure

Insurance agency owners are typically compensated through a combination of commission, bonuses, and other incentives. The specific compensation structure can vary depending on the size and type of agency, as well as the owner’s experience and performance.

There are several common compensation models used for insurance agency owners:

Commission-based compensation

Under this model, the agency owner earns a commission on the policies they sell. The commission rate is typically a percentage of the premium paid by the policyholder. Commission-based compensation can be advantageous for agency owners who are able to generate a high volume of sales. However, it can also be risky, as the agency owner’s income can fluctuate depending on the number of policies they sell.

Salary-based compensation

Under this model, the agency owner receives a fixed salary from the agency. Salary-based compensation can provide a more stable income for agency owners, but it may not be as lucrative as commission-based compensation for those who are able to generate a high volume of sales.

Combination compensation

Under this model, the agency owner receives a combination of commission and salary. This can provide a balance between the stability of a salary and the potential for higher earnings through commissions.

Benefits and Perks

In addition to their salaries, insurance agency owners may receive a range of benefits and perks that can supplement their income and enhance their quality of life.

Health Insurance

Insurance agency owners typically receive comprehensive health insurance coverage for themselves and their families. This coverage may include medical, dental, vision, and prescription drug benefits.

Retirement Plans

Many insurance agency owners participate in retirement plans, such as 401(k) plans or IRAs. These plans allow them to save for their future and reduce their tax liability.

Paid Time Off

Insurance agency owners may receive paid time off for vacations, sick days, and personal business. This time off allows them to maintain a work-life balance and attend to personal matters.

Continuing Education

Some insurance agencies offer continuing education opportunities to their owners. This training can help them stay up-to-date on industry trends and improve their skills.

Other Perks

Insurance agency owners may also receive other perks, such as:

- Life insurance

- Disability insurance

- Vehicle allowances

- Expense accounts

- Bonuses

These benefits and perks can significantly supplement the salaries of insurance agency owners and contribute to their overall financial well-being.

Career Advancement

Insurance agency owners have various career advancement opportunities within the industry. They can expand their agency, acquire other agencies, or move into management roles.

By building a strong reputation and client base, agency owners can attract new clients and grow their revenue. They can also acquire other agencies to increase their market share and expand their service offerings.

Management Roles

Experienced agency owners may also transition into management roles within insurance companies or industry organizations. These roles typically involve overseeing multiple agencies or departments and developing and implementing strategies for growth and profitability.

Industry Trends

The insurance industry is constantly evolving, and these changes can have a significant impact on the salaries of insurance agency owners. Some of the most important trends to watch include:

Increased use of technology: Technology is playing an increasingly important role in the insurance industry, and this is likely to continue in the future. Insurance agency owners who are able to embrace new technologies will be well-positioned to succeed.

Digitalization and Automation

- Digitalization of insurance processes, such as policy issuance and claims processing, can increase efficiency and reduce costs.

- Automation of tasks, like underwriting and customer service, can free up agency owners to focus on higher-value activities.

- Use of data analytics can provide insights into customer behavior and risk, enabling personalized insurance products and services.

Changing customer expectations: Customers are becoming increasingly demanding, and they expect a high level of service from their insurance providers. Insurance agency owners who are able to meet these expectations will be more likely to succeed.

Evolving Customer Demands

- Customers seek convenience and personalized experiences, such as online policy management and tailored coverage options.

- Increased awareness of insurance products and services through digital channels has empowered customers to compare and negotiate policies.

- Demand for transparent and ethical insurance practices, including clear communication and fair claims handling.

Increased competition: The insurance industry is becoming increasingly competitive, and this is putting pressure on insurance agency owners to keep their costs down. Insurance agency owners who are able to find ways to reduce their costs will be more likely to succeed.

Market Dynamics and Competition

- Consolidation within the insurance industry is leading to larger players with greater market share.

- Online insurance marketplaces and direct-to-consumer insurers are challenging traditional agency distribution models.

- Increased competition forces agencies to differentiate their services and focus on niche markets or specialized products.

These are just a few of the trends that are likely to impact the salaries of insurance agency owners in the future. Insurance agency owners who are aware of these trends and are able to adapt to them will be more likely to succeed.

Comparison to Other Industries

Insurance agency owners typically earn higher salaries than professionals in other industries with similar experience and education. This is due to several factors, including the high level of responsibility and risk involved in running an insurance agency, as well as the potential for high commissions and bonuses.

Factors Contributing to Differences

* Level of Responsibility: Insurance agency owners are responsible for managing all aspects of their business, including sales, marketing, customer service, and finance. They must also ensure that their agency complies with all applicable laws and regulations.

* Risk: Insurance agency owners are exposed to a high level of risk. They are personally liable for any errors or omissions made by their employees, and they may also be held liable for claims made against their clients.

* Commissions and Bonuses: Insurance agency owners typically earn a commission on the policies they sell. They may also earn bonuses for meeting certain sales goals or achieving other performance targets.