Understanding Gap Insurance

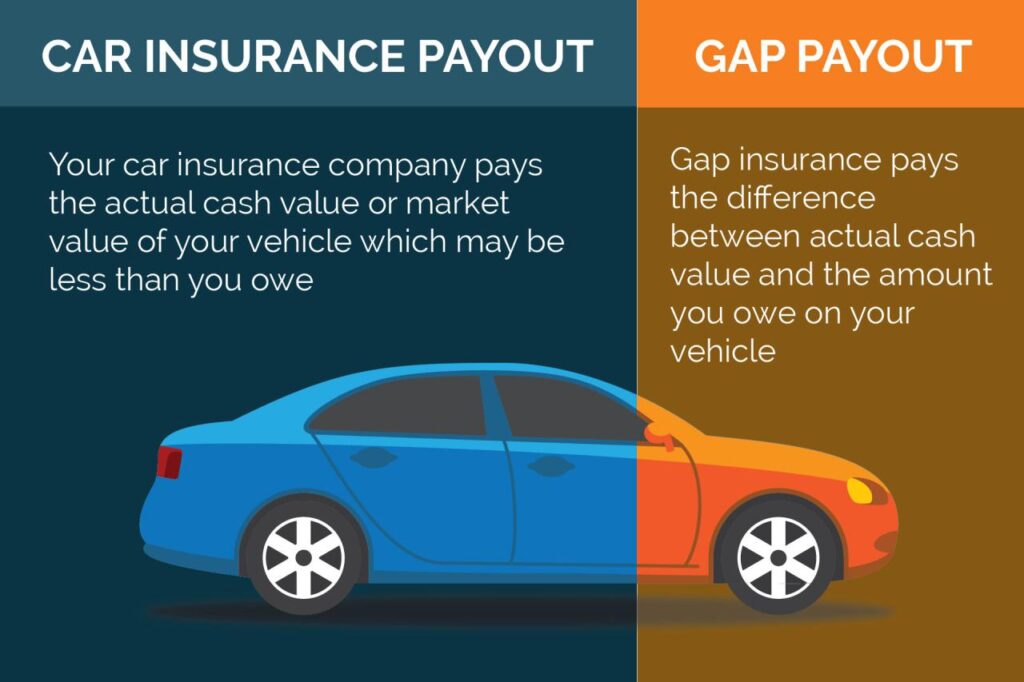

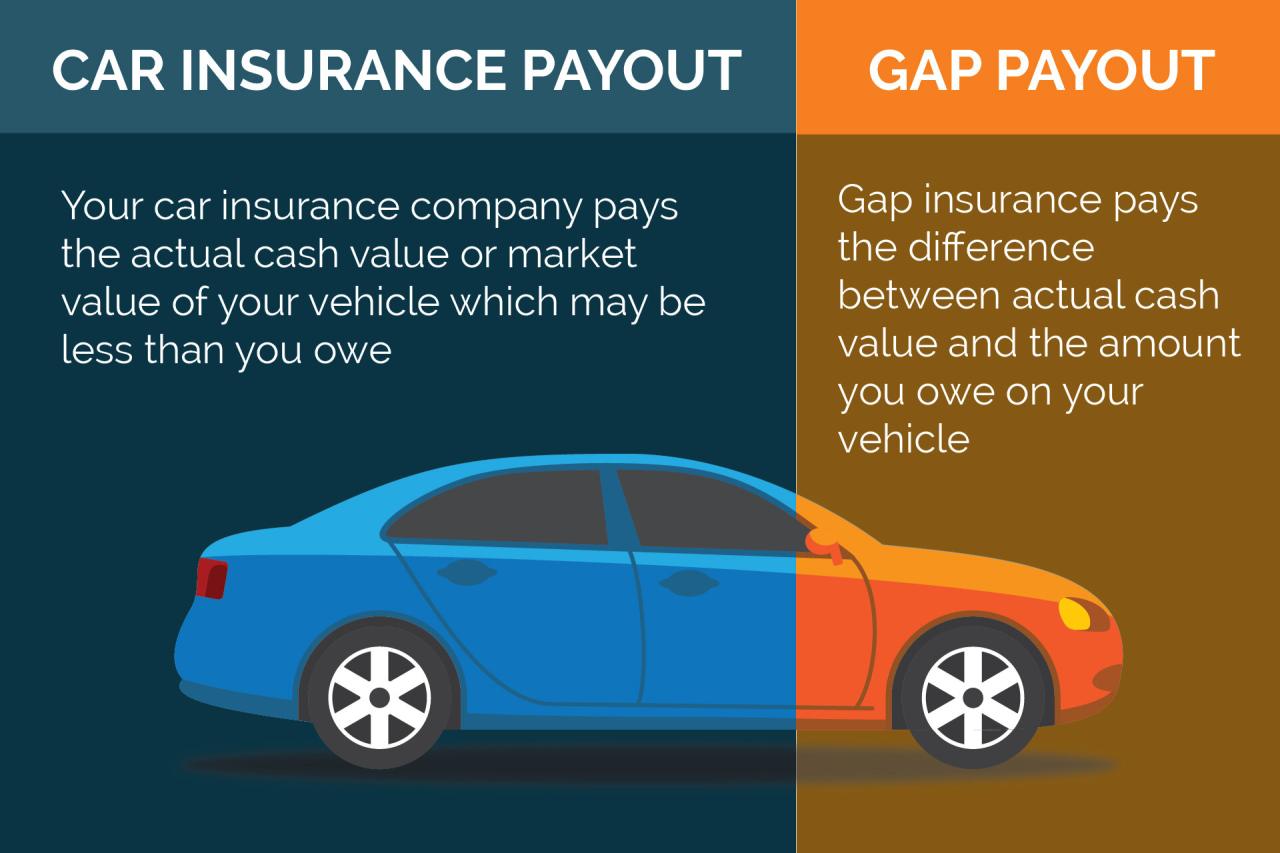

Gap insurance is an optional type of auto insurance that helps cover the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease. This can be important in situations where your vehicle is totaled or stolen, and the insurance payout is not enough to cover your remaining loan balance.

Gap insurance is typically sold through the same company that provides your auto insurance. The cost of gap insurance varies depending on the value of your vehicle, the amount of your loan or lease, and the length of the loan or lease term.

When Gap Insurance is Beneficial

Gap insurance can be beneficial in a number of situations, including:

- If you have a new car with a high loan-to-value ratio. This means that you owe more on your loan than the car is worth.

- If you have a leased car. Leases typically have higher monthly payments than loans, and the residual value of the car at the end of the lease term is often less than the amount you owe.

- If you live in an area with a high rate of car theft. If your car is stolen, gap insurance can help you cover the difference between the actual cash value of the car and the amount you owe on your loan.

Identifying Indicators of Gap Insurance Coverage

Determining whether you have gap insurance coverage can be done by examining various documents related to your vehicle and insurance.

Here are some indicators that may suggest the presence of gap insurance:

Loan Agreements

- Review your loan agreement for any mention of “gap insurance” or “loan/lease payoff insurance.”

- Check for an additional fee or premium listed in the agreement that may indicate the inclusion of gap insurance.

Insurance Policies

- Examine your auto insurance policy for a section or endorsement labeled “gap insurance” or “loan/lease gap coverage.”

- Look for a separate document or attachment that specifically Artikels gap insurance coverage.

Vehicle Purchase Contracts

- Inspect your vehicle purchase contract for any mention of gap insurance as an optional add-on or as part of a bundled package.

- Review the itemized list of fees or charges to see if there is a line item for gap insurance.

Contacting Financial Institutions and Insurance Providers

Understanding whether you have gap insurance is crucial for financial protection. One reliable method to confirm coverage is by contacting the financial institutions and insurance providers involved.

Reaching Out to Financial Institutions

Your loan provider, typically a bank or credit union, can provide information about gap insurance coverage included in your loan agreement. You can contact their customer service line or visit a branch in person to inquire.

Contacting Insurance Companies

If you have purchased additional gap insurance through an insurance company, reach out to their customer service department. Provide them with your policy number or vehicle information to verify coverage details.

Utilizing Online Resources and Vehicle Information

Many online databases and manufacturer websites offer comprehensive vehicle information, including details about gap insurance coverage. To access these resources, you will typically need the vehicle’s VIN (Vehicle Identification Number). The VIN is a unique 17-character code that identifies your specific vehicle.

Accessing Online Databases

Numerous online databases provide access to vehicle information, including gap insurance coverage. These databases may require a subscription fee or offer limited information for free. Some popular online databases include:

- Carfax

- AutoCheck

- VINCheck

Using the Vehicle’s VIN

The VIN can be used to retrieve relevant data from various sources. Here’s how:

- Manufacturer’s Website: Visit the official website of the vehicle’s manufacturer and enter the VIN to access detailed information, including gap insurance coverage.

- Online Databases: Input the VIN into online databases mentioned earlier to retrieve a comprehensive report that may include gap insurance details.

- Insurance Provider: Contact your insurance provider and provide the VIN to inquire about gap insurance coverage.

By utilizing online resources and the vehicle’s VIN, you can effectively determine whether or not you have gap insurance coverage.

Additional Considerations

Consulting with Financial Advisors or Insurance Agents

Financial advisors and insurance agents possess expertise in insurance matters. They can provide valuable insights into your insurance coverage, including gap insurance. Consult with them to gain a comprehensive understanding of your insurance policies and identify any potential gaps.

Regular Policy Reviews

Insurance policies undergo changes over time due to various factors such as life events, vehicle upgrades, or changes in insurance regulations. It is crucial to review your insurance policies regularly to ensure that your coverage remains adequate and aligns with your current needs. This includes checking for the presence of gap insurance coverage and verifying its terms and conditions.